- United States

- /

- Banks

- /

- NasdaqCM:CZFS

Discovering US Undiscovered Gems In November 2025

Reviewed by Simply Wall St

As the U.S. market navigates a landscape marked by fluctuating indices and heightened investor focus on AI-driven valuations, small-cap stocks present unique opportunities amid broader economic uncertainties. In this context, identifying promising stocks involves assessing their potential for growth and resilience in the face of market volatility, making them intriguing prospects for investors seeking undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 1.99% | 2.14% | 1.63% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

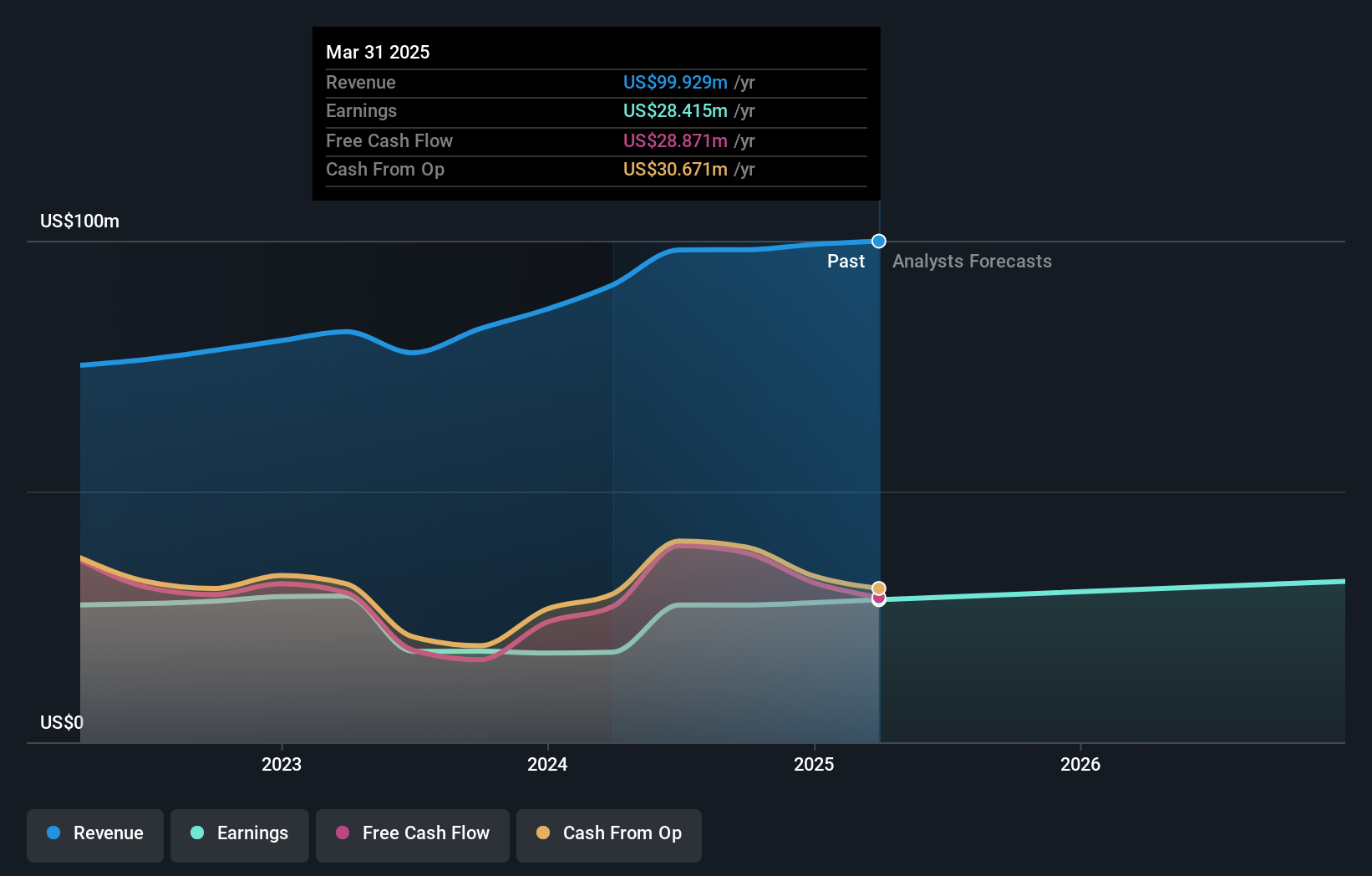

Citizens Financial Services (CZFS)

Simply Wall St Value Rating: ★★★★★★

Overview: Citizens Financial Services, Inc. is a bank holding company that offers a range of banking products and services to individual, business, governmental, and institutional clients with a market cap of $264.16 million.

Operations: With a revenue of $107.40 million from its community banking segment, Citizens Financial Services has a market cap of $264.16 million.

Citizens Financial Services, a nimble player with total assets of US$3.1 billion and equity of US$327.7 million, operates with 88% of its liabilities funded through low-risk customer deposits. The bank's non-performing loans are well-managed at 0.9%, supported by a robust bad loan allowance at 109%. Earnings grew by 24.5% over the past year, outpacing industry growth, while trading at an attractive discount of 36.2% below estimated fair value suggests potential upside for investors seeking value plays in financials. Despite recent insider selling, the company's fundamentals remain solid with high-quality earnings and positive free cash flow.

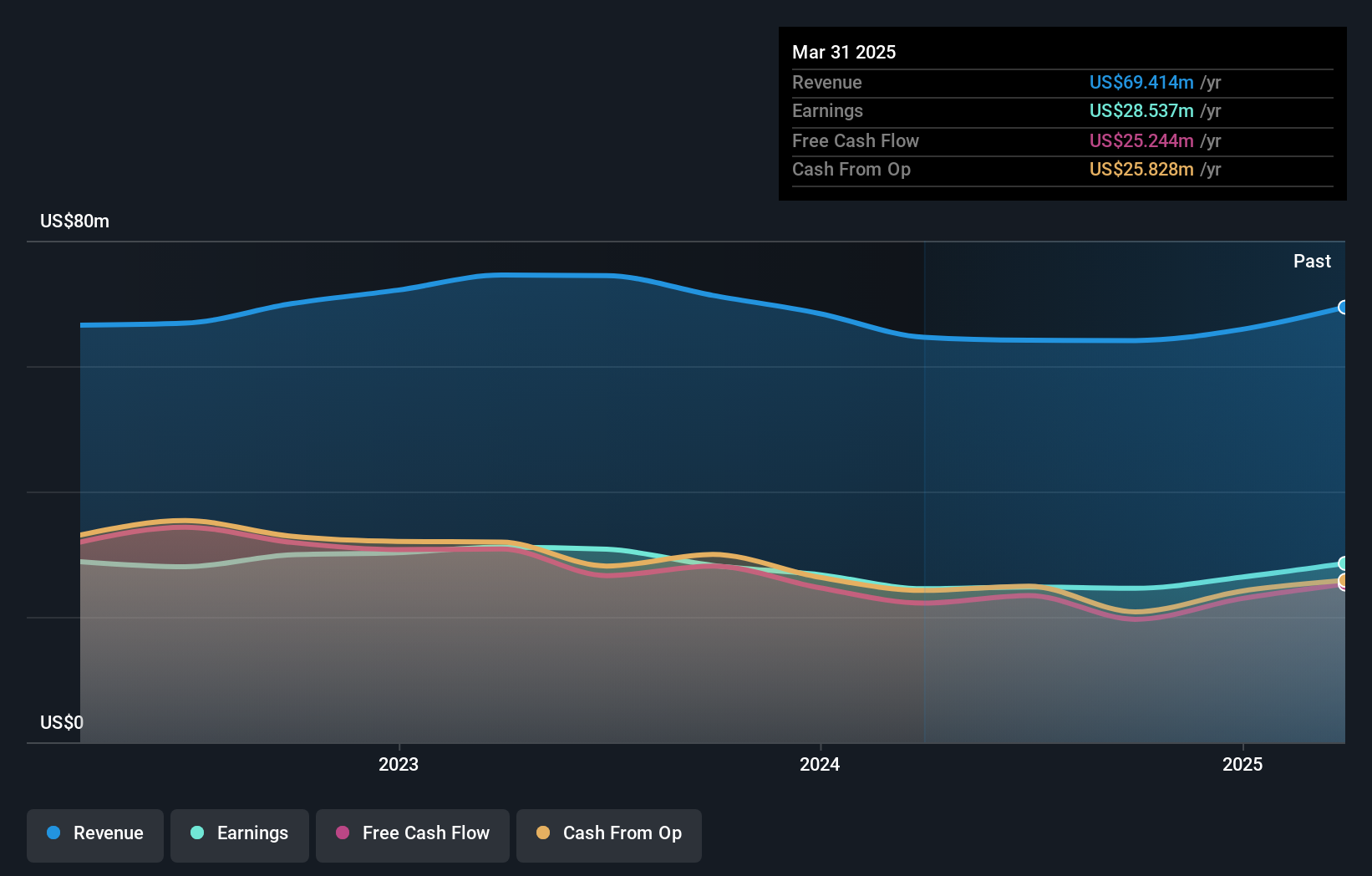

Greene County Bancorp (GCBC)

Simply Wall St Value Rating: ★★★★★★

Overview: Greene County Bancorp, Inc. is a holding company for The Bank of Greene County, offering a range of financial services in the United States with a market cap of $373.74 million.

Operations: The primary revenue stream for Greene County Bancorp comes from its banking operations, generating $78.05 million. The company's financial performance is reflected in its net profit margin, which stands at 37.45%.

Greene County Bancorp, with total assets of US$3.1 billion and equity of US$248.2 million, operates with a strong foundation primarily supported by customer deposits, accounting for 97% of its liabilities. The bank's earnings growth over the past year was an impressive 37.4%, outpacing the industry average of 18.2%. It maintains a sufficient allowance for bad loans at just 0.2% of total loans, reflecting prudent risk management practices. Recent board changes include John Brust's appointment as director for three years, and the company has continued its steady dividend payout at US$0.10 per share quarterly.

- Take a closer look at Greene County Bancorp's potential here in our health report.

Understand Greene County Bancorp's track record by examining our Past report.

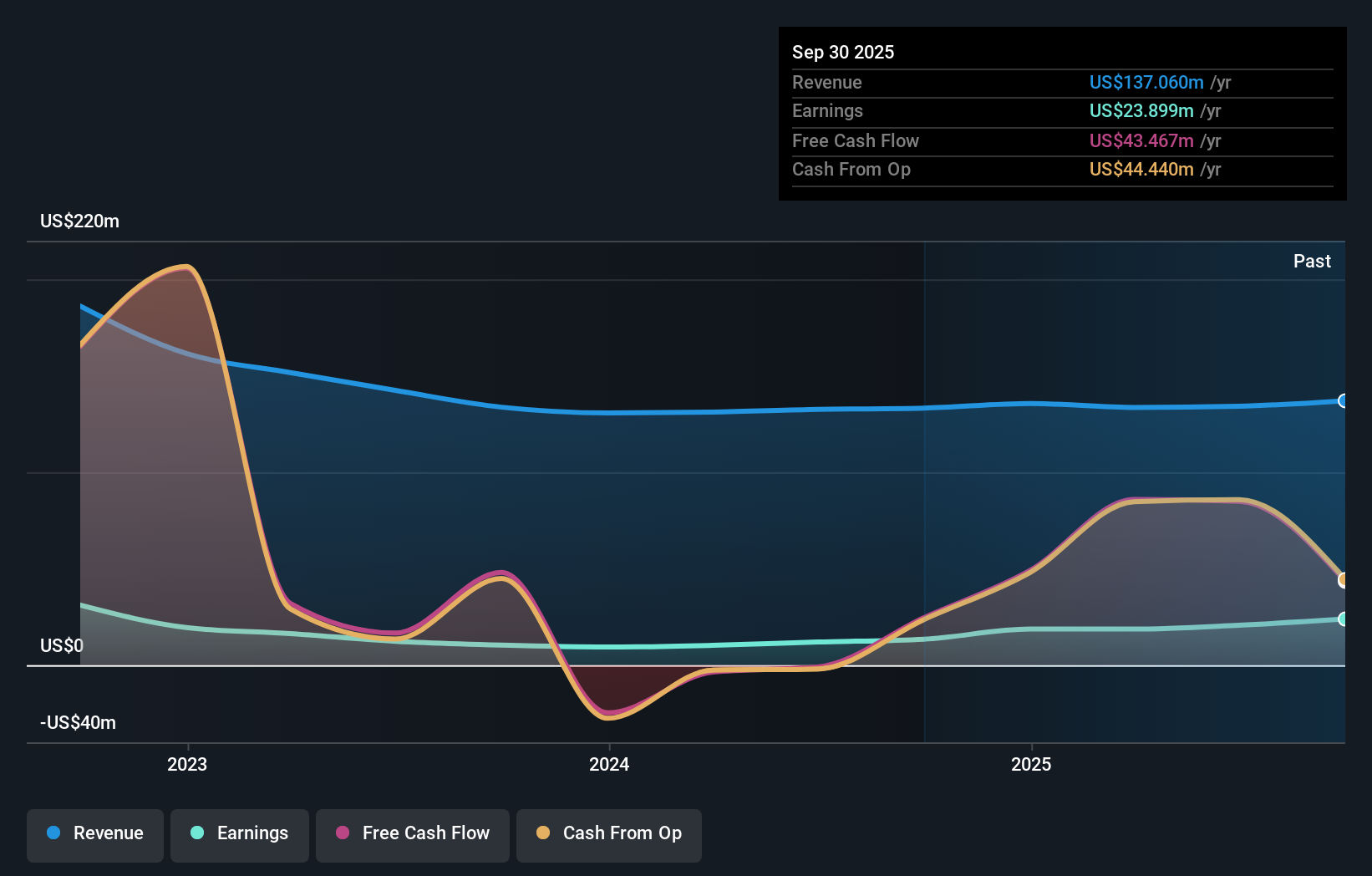

Waterstone Financial (WSBF)

Simply Wall St Value Rating: ★★★★★★

Overview: Waterstone Financial, Inc. is a bank holding company for WaterStone Bank SSB, offering a range of financial services in southeastern Wisconsin with a market cap of $285.17 million.

Operations: The company generates revenue primarily from mortgage banking ($77.02 million) and community banking ($60.02 million).

Waterstone Financial, a financial entity with assets totaling $2.3 billion and equity of $345.5 million, showcases strong fundamentals. Its total deposits stand at $1.4 billion against loans of $1.7 billion, coupled with an adequate bad loan allowance at 0.3% of total loans and a net interest margin of 2.2%. The company has demonstrated impressive earnings growth over the past year at 77.8%, surpassing industry averages significantly, despite a five-year earnings decline by 42% annually. Recently, it repurchased shares worth US$3.8 million from July to September 2025 and declared dividends affirming shareholder returns amidst these strategic moves.

Key Takeaways

- Unlock more gems! Our US Undiscovered Gems With Strong Fundamentals screener has unearthed 290 more companies for you to explore.Click here to unveil our expertly curated list of 293 US Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CZFS

Citizens Financial Services

A bank holding company, provides various banking products and services for individual, business, governmental, and institutional customers.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives