- United States

- /

- Consumer Finance

- /

- NasdaqGS:WRLD

World Acceptance (WRLD) Profit Margin Beat Challenges Consensus on Sustainability

Reviewed by Simply Wall St

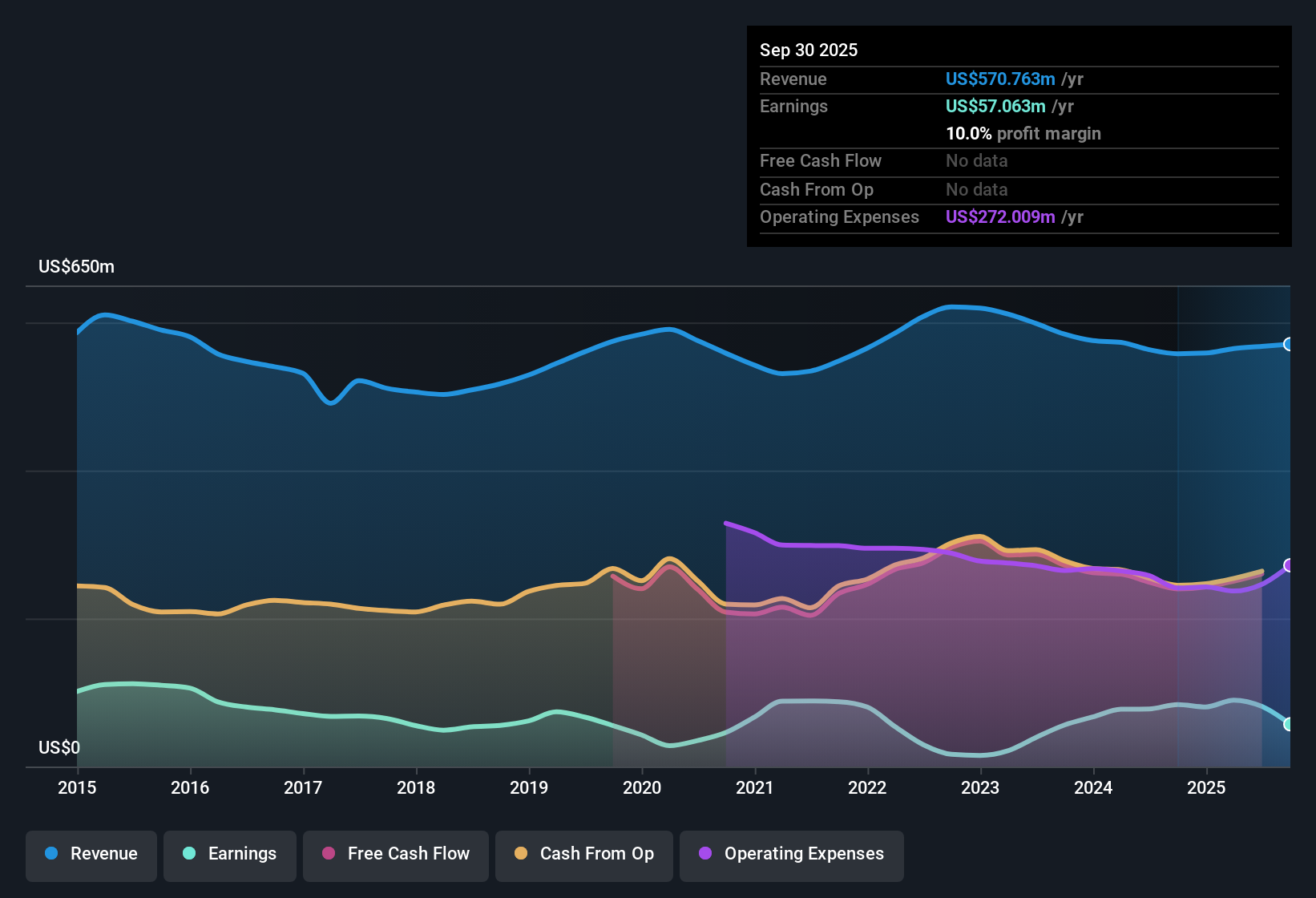

World Acceptance (WRLD) posted net profit margins of 14.3%, edging out last year's 13.8%, while annual earnings grew 4.4% and have averaged 5% growth per year over the last five years. Looking forward, analysts see earnings rising 15.98% per year, which slightly outpaces the projected 15.5% annual growth rate for the US market. However, revenue growth is expected to lag at 6.1% per year compared to the broader market’s 10% rate. With margins holding strong and a solid track record of profit growth, investors are likely to see the company’s risk and reward profile as attractive in the current Consumer Finance landscape.

See our full analysis for World Acceptance.Next, we will see how these results compare to the market’s narrative and the prevailing community views. Sometimes they line up, and other times they shake up the consensus.

See what the community is saying about World Acceptance

Margins May Face Compression Despite Recent Highs

- Analysts expect profit margins to contract from 14.3% today to 8.5% over the next three years, a drop of nearly six percentage points even though current margins are historically strong.

- According to the analysts' consensus view, persistent operating costs from branch-heavy infrastructure and only modest new loan growth support the projection for shrinking margins in coming years.

- The consensus narrative notes that even after gross yields rose 230 basis points recently, management guidance and loan mix point to stabilization, not continued expansion, of margins.

- The branch-based cost structure is seen as limiting net margin improvement despite recent profitability highs, which could act as a headwind relative to digital-only competitors.

- The relatively short-lived margin improvement creates tension with the bullish expectation for sustained profit growth, leaving upside dependent on diversification or efficiency.

Share Repurchases Could Lift Future EPS

- Analysts project that the number of shares outstanding will decline by 3.39% annually over the next three years, with substantial capacity for stock repurchases supported by a new credit agreement and recent bond redemptions.

- The consensus narrative contends that aggressive buybacks could offset slower topline growth, boosting earnings per share even as total profits are expected to decrease.

- Projected earnings per share for 2028 stand at $13.06 despite expected lower total earnings; this reflects the anticipated benefit from reduced share count.

- Market participants are closely watching whether World Acceptance continues to execute these repurchases at favorable valuations, as this may shape medium-term returns.

Trading Below DCF Fair Value, Premium to Peers

- World Acceptance stock currently trades at $155.00 per share, which is below its DCF fair value estimate of $170.60 and analyst price target of $157.50, but above peer group valuation with a Price-To-Earnings Ratio of 9.9x versus 6.5x for similar companies.

- The analysts' consensus narrative highlights the nuanced valuation case. While shares may look attractive on a discounted cash flow basis, the stock’s premium to peers and the relatively low 1.6% gap to the $157.50 analyst price target suggest the market agrees with moderate growth expectations.

- A more optimistic view would require believing in either a higher terminal growth rate or significantly improving margins, neither of which is currently supported by explicit company guidance.

- The DCF fair value offers some downside protection, but slower revenue trends and industry regulatory risks may explain the muted premium.

Skeptical or optimistic, analysts believe the stock price today tightly tracks underlying fundamentals, so investors weighing a move might want to see what the full range of community perspectives say next. 📊 Read the full World Acceptance Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for World Acceptance on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a different angle on the figures? Share your insights and shape the story in just a few minutes, then Do it your way

A great starting point for your World Acceptance research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite recent profit highs, World Acceptance faces contracting margins and slowing revenue growth. This casts doubt on the durability of its earnings momentum.

If you want more consistent growth and less margin pressure, check out stable growth stocks screener (2089 results) to discover companies delivering reliable performance through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if World Acceptance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WRLD

World Acceptance

Engages in consumer finance business in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives