- United States

- /

- Capital Markets

- /

- NasdaqGS:VCTR

If EPS Growth Is Important To You, Victory Capital Holdings (NASDAQ:VCTR) Presents An Opportunity

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Victory Capital Holdings (NASDAQ:VCTR). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Victory Capital Holdings with the means to add long-term value to shareholders.

View our latest analysis for Victory Capital Holdings

How Fast Is Victory Capital Holdings Growing Its Earnings Per Share?

Over the last three years, Victory Capital Holdings has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Victory Capital Holdings' EPS shot up from US$3.26 to US$4.15; a result that's bound to keep shareholders happy. That's a impressive gain of 27%.

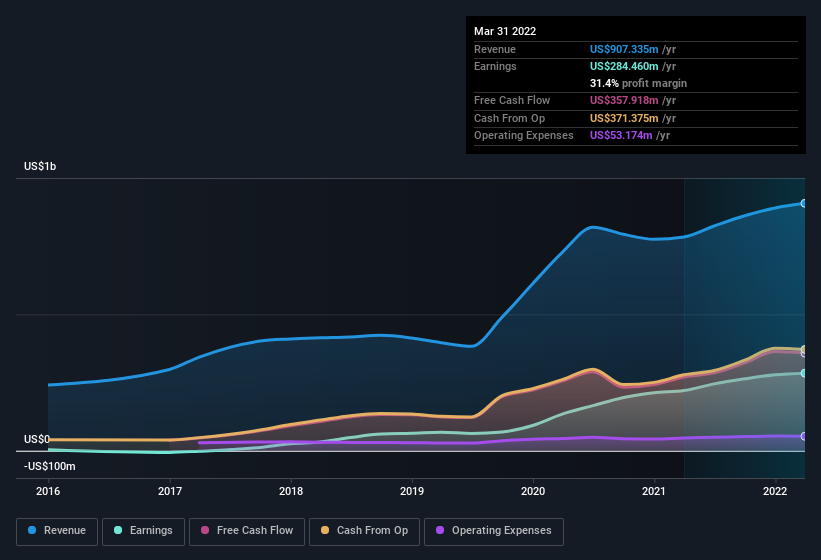

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Victory Capital Holdings remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 16% to US$907m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Victory Capital Holdings' future EPS 100% free.

Are Victory Capital Holdings Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news is that Victory Capital Holdings insiders spent a whopping US$2.7m on stock in just one year, without so much as a single sale. Knowing this, Victory Capital Holdings will have have all eyes on them in anticipation for the what could happen in the near future. It is also worth noting that it was Chairman of the Board of Directors & CEO David Brown who made the biggest single purchase, worth US$1.0m, paying US$34.62 per share.

On top of the insider buying, it's good to see that Victory Capital Holdings insiders have a valuable investment in the business. Notably, they have an enviable stake in the company, worth US$181m. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

Is Victory Capital Holdings Worth Keeping An Eye On?

For growth investors, Victory Capital Holdings' raw rate of earnings growth is a beacon in the night. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. Astute investors will want to keep this stock on watch. Even so, be aware that Victory Capital Holdings is showing 2 warning signs in our investment analysis , you should know about...

Keen growth investors love to see insider buying. Thankfully, Victory Capital Holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:VCTR

Victory Capital Holdings

Operates as an asset management company in the United States and internationally.

Exceptional growth potential with outstanding track record.