- United States

- /

- Banks

- /

- NasdaqGM:BWFG

US Market's Undiscovered Gems Featuring Three Promising Small Caps

Reviewed by Simply Wall St

In the current U.S. market landscape, major indices have experienced fluctuations with recent gains following strong earnings reports from tech giants like Nvidia and retail leaders such as Walmart. Amid this backdrop, small-cap stocks in the S&P 600 are drawing attention as investors seek opportunities beyond the high-profile names dominating headlines. Identifying promising small-cap stocks involves looking for companies with solid fundamentals and growth potential that can thrive even when broader market conditions are volatile or uncertain.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Value Line (VALU)

Simply Wall St Value Rating: ★★★★★★

Overview: Value Line, Inc. is involved in producing and selling investment periodicals and related publications, with a market cap of $342.07 million.

Operations: The company's primary revenue stream is from its publishing segment, generating $34.80 million. The net profit margin reflects the company's profitability in relation to its total revenue.

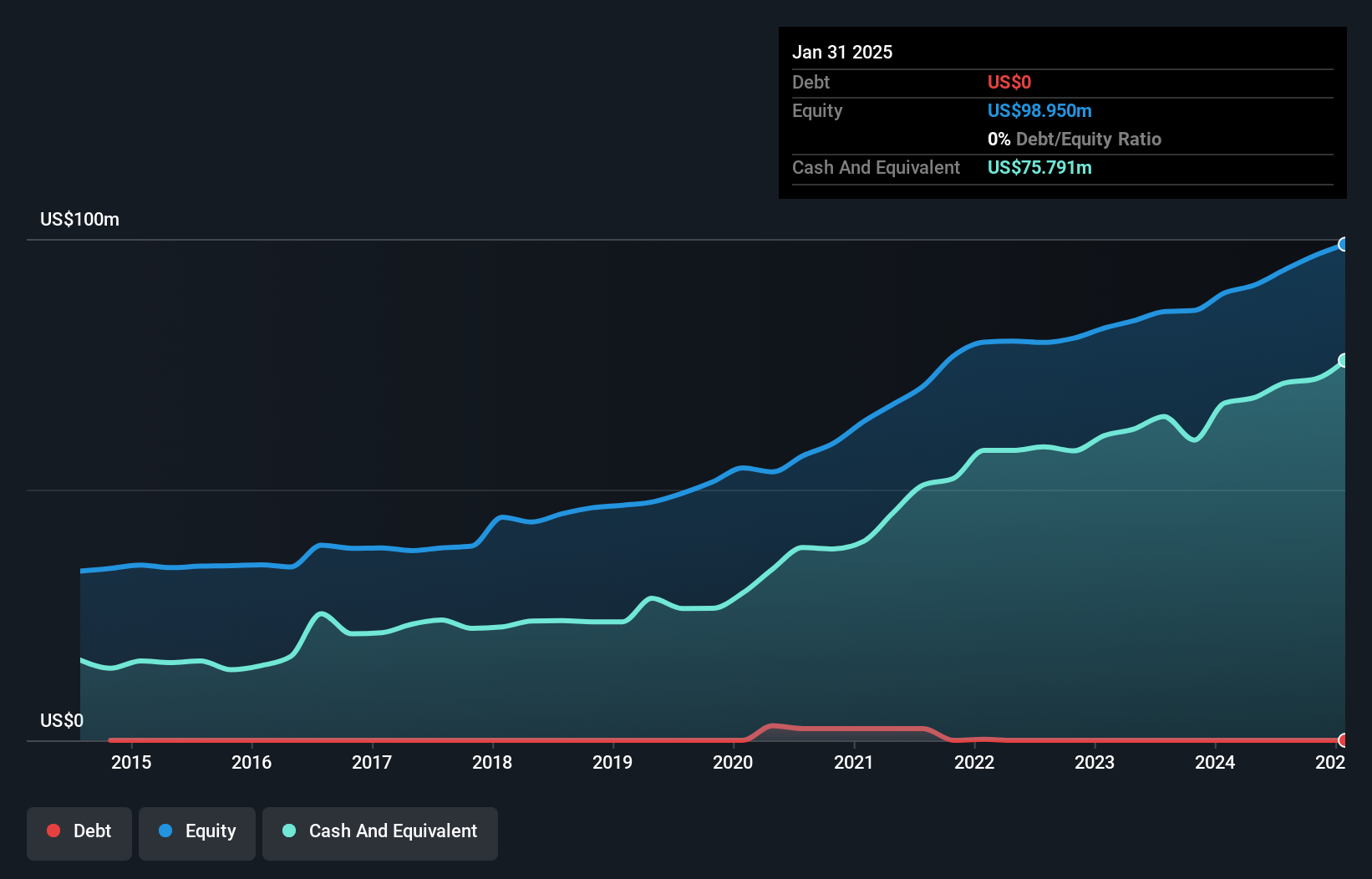

Value Line, a nimble player in the financial services sector, showcases a debt-free balance sheet with its debt to equity ratio dropping from 4.1% five years ago to zero today. The company’s earnings growth of 6.1% last year lagged behind the Capital Markets industry's 15.8%, yet it boasts high-quality earnings and a solid price-to-earnings ratio of 16.1x, undercutting the broader US market's average of 18x. Recently announcing plans to repurchase up to $2 million worth of shares without an expiration date, Value Line also declared a quarterly dividend of $0.325 per share payable in November 2025.

- Click here to discover the nuances of Value Line with our detailed analytical health report.

Evaluate Value Line's historical performance by accessing our past performance report.

Bankwell Financial Group (BWFG)

Simply Wall St Value Rating: ★★★★★★

Overview: Bankwell Financial Group, Inc. is the bank holding company for Bankwell Bank, offering a range of banking services to individual and commercial clients, with a market cap of $337.50 million.

Operations: Bankwell Financial Group generates revenue primarily through its banking services, totaling $94.28 million. The company's market capitalization is approximately $337.50 million.

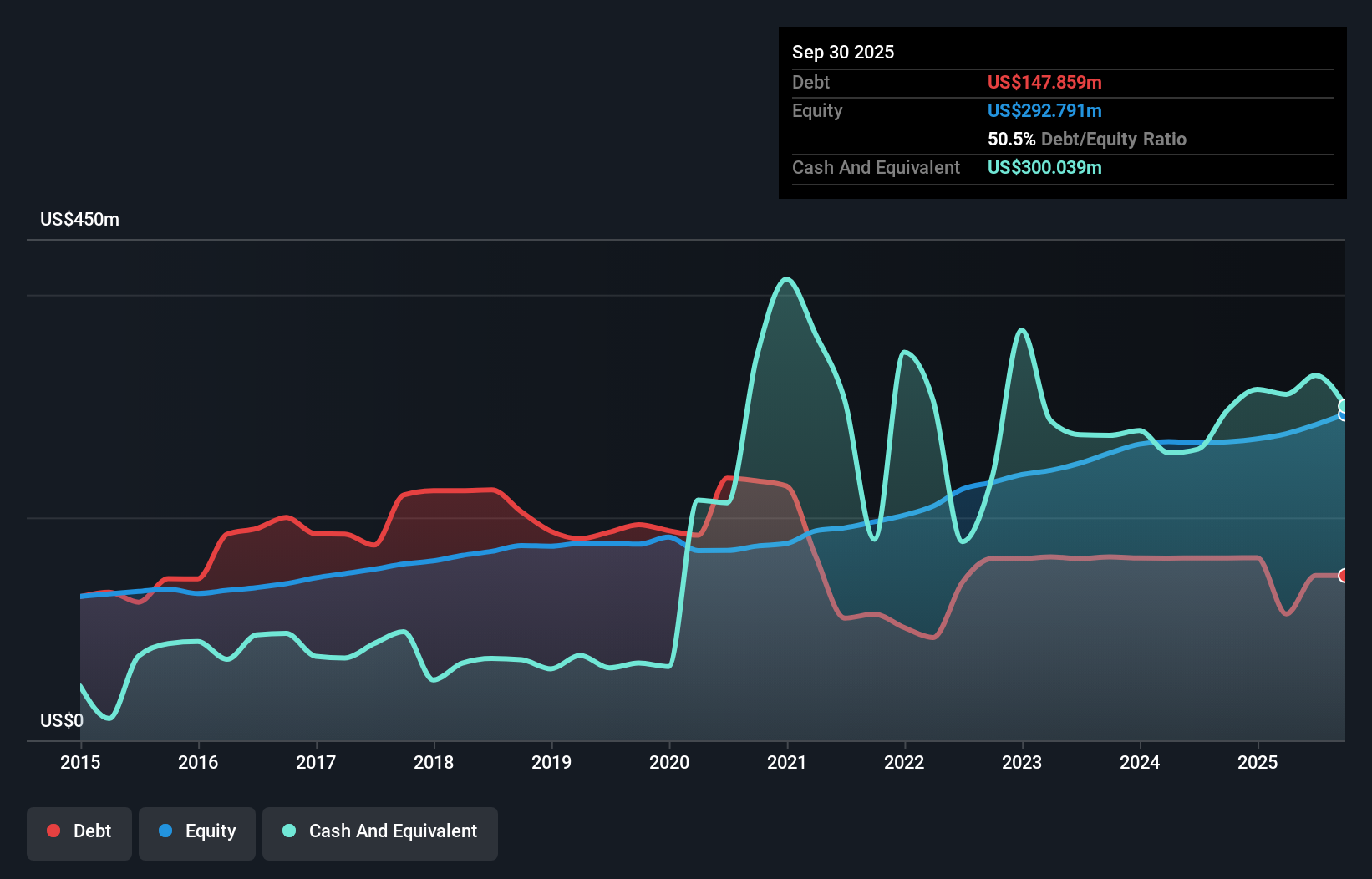

Bankwell Financial Group, with total assets of US$3.2 billion and equity of US$292.8 million, shows promise as a smaller financial entity. Its earnings surged by 91.7% over the past year, outpacing the industry average of 18.2%, while trading at 52% below estimated fair value suggests potential upside. The bank maintains an appropriate level of bad loans at 0.6%, supported by a sufficient allowance for bad loans at 177%. With deposits totaling US$2.8 billion and loans at US$2.7 billion, Bankwell's focus on low-risk funding sources and high-quality earnings positions it well for future growth amidst competitive pressures and regulatory challenges.

Ennis (EBF)

Simply Wall St Value Rating: ★★★★★★

Overview: Ennis, Inc. is a company that produces and sells business forms and other printed products in the United States with a market capitalization of approximately $426.22 million.

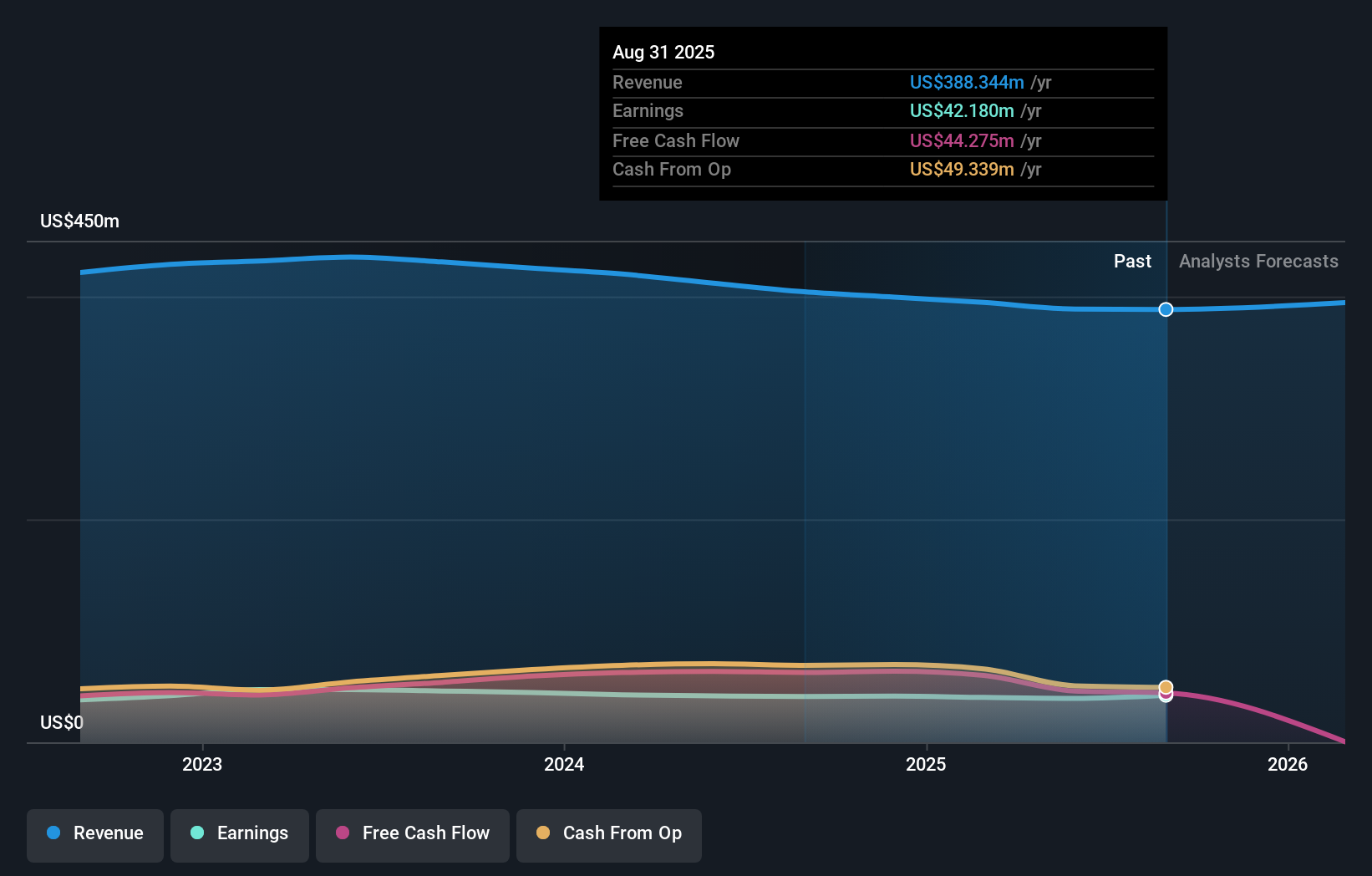

Operations: Ennis generates revenue primarily from its print segment, which amounts to $388.34 million. The company's market capitalization stands at approximately $426.22 million.

Ennis, a smaller player in the commercial services space, has shown resilience with earnings growth of 2.8% over the past year, outpacing its industry peers' 2.4%. The company operates debt-free, which likely contributes to its solid financial footing and allows it to focus on shareholder returns like dividends and share buybacks. Ennis recently repurchased 196,111 shares for US$3.64 million and declared a quarterly dividend of US$0.25 per share. With a price-to-earnings ratio of 10.1x compared to the broader market's 18x, Ennis presents an attractive valuation for investors seeking stable performance amidst market fluctuations.

- Delve into the full analysis health report here for a deeper understanding of Ennis.

Understand Ennis' track record by examining our Past report.

Turning Ideas Into Actions

- Gain an insight into the universe of 293 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bankwell Financial Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:BWFG

Bankwell Financial Group

Operates as the bank holding company for Bankwell Bank that provides various banking services for individual and commercial customers.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives