- United States

- /

- Consumer Finance

- /

- NasdaqGS:UPST

Upstart (UPST) Margin Turnaround Timeline Reinforces Bull Narratives Despite Premium Valuation Concerns

Reviewed by Simply Wall St

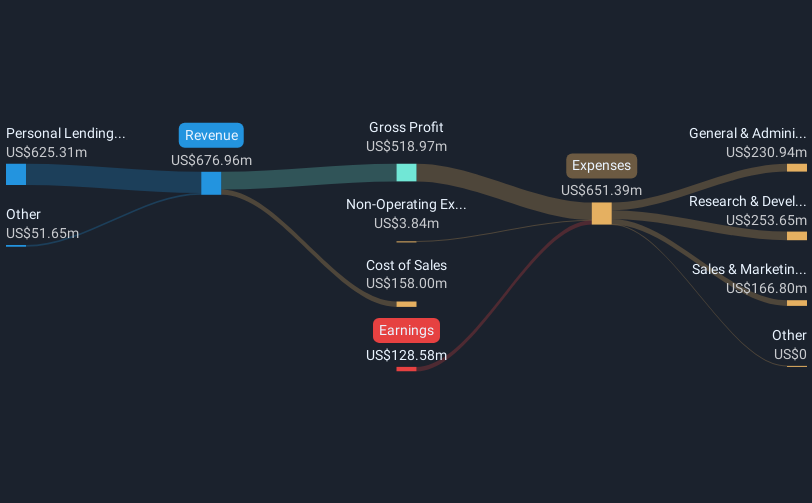

Upstart Holdings (UPST) is forecast to grow earnings by 56.05% per year and increase revenue at an annual rate of 18.8%, outpacing the broader US market’s 10.5% growth projection. Despite the strong outlook, the company remains unprofitable, with losses having accelerated at 43.8% annually over the past five years. Investors will note the current Price-to-Sales ratio of 4.6x sits above industry and peer averages. With shares trading at $41.75, below analysts’ fair value estimate of $47.40, there are signs of potential upside as the company is expected to achieve profitability within three years.

See our full analysis for Upstart Holdings.Next up, we’ll see how these headline results compare against the most widely followed narratives on Simply Wall St. We will highlight where the numbers reinforce expectations and where they cast doubt.

See what the community is saying about Upstart Holdings

Model 19 Delivers Underwriting Edge

- The implementation of Model 19, featuring the Payment Transition Model (PTM), has improved loan approval rates and lowered default risks, directly benefiting revenue and net margin potential as outlined in the EDGAR summary.

- Analysts' consensus view highlights that

- Upstart’s Model 19 and automation enhancements are credited for expanding the borrower base and cutting origination costs. These factors are expected to drive medium-term margin improvement even as challenges such as industry default rates persist.

- The consensus narrative notes that strategic HELOC growth and broader bank partnerships are positioned to support earnings expansion, backed by analysts’ projections of a 27.2% average annual revenue increase over three years.

Sense check how the new underwriting model shapes Upstart’s consensus narrative in the full story:

📊 Read the full Upstart Holdings Consensus Narrative.Profit Margin Inflection Projected by Year Three

- Profit margins are forecast to move from -0.7% today to 18.5% in three years, according to the latest analyst estimates in the filing summary. This represents an ambitious turnaround compared to Upstart’s recent history of accelerating losses.

- Analysts' consensus view notes

- Operational efficiencies, such as increased automation in loan servicing, are expected to cut costs and enhance borrower outcomes, helping to achieve the projected shift in margins.

- Nevertheless, analysts caution that rising macroeconomic volatility and high default rates could interfere with these improvements, making margin progress increasingly sensitive to accurate risk modeling.

Premium Valuation Despite Sector Discount

- Upstart currently trades at a Price-to-Sales multiple of 4.6x, higher than the US Consumer Finance industry average of 1.4x and peers at 3.3x. Its share price of $41.75 is below both the DCF fair value ($47.40) and consensus price target ($59.92).

- Analysts' consensus view stresses

- While the premium multiple versus industry raises caution, the gap between current trading price and consensus target suggests that expectations for strong margin and revenue growth are already factored in, but not yet reflected in the share price.

- Following these projections would require assuming Upstart can reach $337.2 million in earnings and sustain a future PE ratio of 34.1x, notably above the sector’s current 10.6x average. This provides a focal point for debate over risk and reward at these levels.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Upstart Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Want to interpret the results your own way? Build your take on Upstart’s story in just a few minutes, and Do it your way

A great starting point for your Upstart Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Upstart’s reliance on high growth projections and premium valuation means its future depends on achieving ambitious profitability and margin targets, despite recent losses.

If you want more reliable results, check out stable growth stocks screener (2073 results) to discover companies with proven, steady progress through every stage of the cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UPST

Upstart Holdings

Operates a cloud-based artificial intelligence (AI) lending platform in the United States.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives