- United States

- /

- Consumer Finance

- /

- NasdaqGS:UPST

Upstart Holdings (UPST): Exploring Valuation After Recent Tight Trading Range and Volatile Share Moves

Reviewed by Simply Wall St

Upstart Holdings (UPST) has been trading in a tight range recently, with its stock price experiencing smaller daily moves and little in terms of major announcements. Investors have been watching for fresh developments or changes in trends that might influence the company’s prospects.

See our latest analysis for Upstart Holdings.

With Upstart Holdings’ share price closing at $47.52, the stock has seen short-term volatility, including a sharp 5.69% gain in the last day, but is still down 21.84% year-to-date and off 42.48% over the past quarter. Despite these fluctuations, the 1-year total shareholder return is essentially flat, while the 3-year total return remains impressive at over 150%. Momentum has faded, but longer-term holders have still come out ahead.

If you’re looking to expand your opportunity set beyond the usual names, it’s a great moment to discover fast growing stocks with high insider ownership

With Upstart now trading well below many analyst targets, and following a period of rapid growth and recent volatility, the key question is whether the stock is undervalued with room to run or if the market has already priced in future gains.

Most Popular Narrative: 36.4% Undervalued

The consensus narrative suggests Upstart Holdings could be trading far below its fair value, with analysts projecting significantly higher levels than the last close of $47.52. This wide gap in valuation highlights a potential opportunity or a notable mismatch in expectations.

The implementation of Model 19, featuring the Payment Transition Model (PTM), has improved underwriting accuracy, which is likely to enhance loan approval rates and reduce default risks, positively impacting revenue and net margins.

Curious how this upbeat valuation comes together? The narrative is based on bold financial forecasts and an aggressive earnings trajectory that rivals top-tier tech firms. Ready to see the headline-making projections driving this fair value? The key details might surprise you.

Result: Fair Value of $74.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, as high default rates and unpredictable macroeconomic shifts could undermine future revenue growth and challenge the optimistic narrative.

Find out about the key risks to this Upstart Holdings narrative.

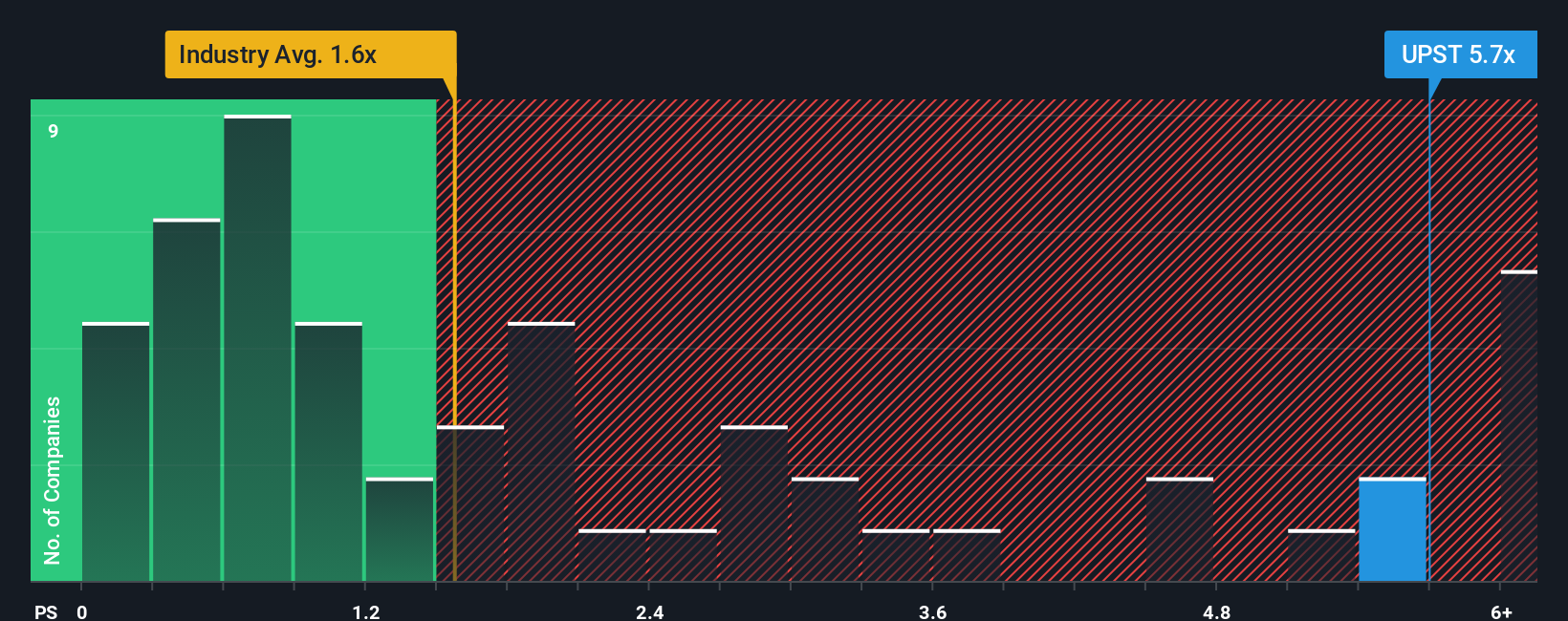

Another View: Multiples Tell a Different Story

While the narrative points to Upstart Holdings trading below analyst fair value, the current price-to-sales ratio of 5.2x stands out as expensive compared to industry and peer averages of 1.4x and 3.3x, respectively, and remains well above the fair ratio of 4.3x. Does this gap signal caution or a market still pricing in future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Upstart Holdings Narrative

If you'd rather dive into the data, challenge the consensus, or build a narrative that fits your own view of Upstart Holdings, you can create your own in just a few minutes. Do it your way

A great starting point for your Upstart Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let tomorrow’s market leaders pass you by. Give yourself the edge by finding investments with strong upside, game-changing tech, or steady returns before everyone else does.

- Tap into powerful megatrends and uncover breakout opportunities with these 27 AI penny stocks poised to transform industries and fuel tomorrow’s innovation.

- Boost your income stream by exploring these 20 dividend stocks with yields > 3% offering reliable yields that can help strengthen your portfolio for the long haul.

- Catch the next big thing in digital finance by checking out these 81 cryptocurrency and blockchain stocks and spot businesses pioneering decentralized technology and blockchain solutions before they hit the mainstream.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UPST

Upstart Holdings

Operates a cloud-based artificial intelligence (AI) lending platform in the United States.

Exceptional growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives