- United States

- /

- Consumer Finance

- /

- NasdaqGS:UPST

Could Upstart (UPST) Partnerships Signal a Sustainable Edge in AI-Driven Lending Innovation?

Reviewed by Sasha Jovanovic

- Peak Credit Union recently announced a partnership with Upstart Holdings to extend personal loans to a broader pool of consumers through the Upstart Referral Network, enabling tailored loan offers and a seamless, branded digital application process for qualified applicants.

- This collaboration not only broadens Upstart’s lending network but also signals growing adoption of AI-driven lending solutions among credit unions seeking to modernize their offerings.

- We'll explore how the expanded Peak Credit Union partnership could shape Upstart's outlook by driving lending volume through its AI-powered platform.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Upstart Holdings Investment Narrative Recap

To be a shareholder in Upstart Holdings, you need to believe that AI-powered lending will drive mainstream credit decisions for banks and credit unions, unlocking sustained growth for digital platforms like Upstart. The recent Peak Credit Union partnership strengthens Upstart's AI lending ecosystem and may support near-term lending volumes, but does not materially shift the key catalyst: consistently improving model accuracy, nor does it significantly change the biggest risk, managing credit performance in unpredictable economic cycles.

Among recent announcements, the October 2025 partnership expansion with Corporate America Family Credit Union stands out for its breadth, including HELOCs and auto refinance loans. This move is closely related to the catalysts highlighted earlier, as it reflects Upstart's focus on growing loan products and deepening relationships with credit unions to scale origination volumes while enhancing underwriting models.

However, while partnerships are expanding, investors should also be aware of the risk posed if default rates climb faster than Upstart’s models anticipate and...

Read the full narrative on Upstart Holdings (it's free!)

Upstart Holdings' narrative projects $1.8 billion in revenue and $337.2 million in earnings by 2028. This requires 27.2% yearly revenue growth and a $343.6 million increase in earnings from the current $-6.4 million.

Uncover how Upstart Holdings' forecasts yield a $74.69 fair value, a 57% upside to its current price.

Exploring Other Perspectives

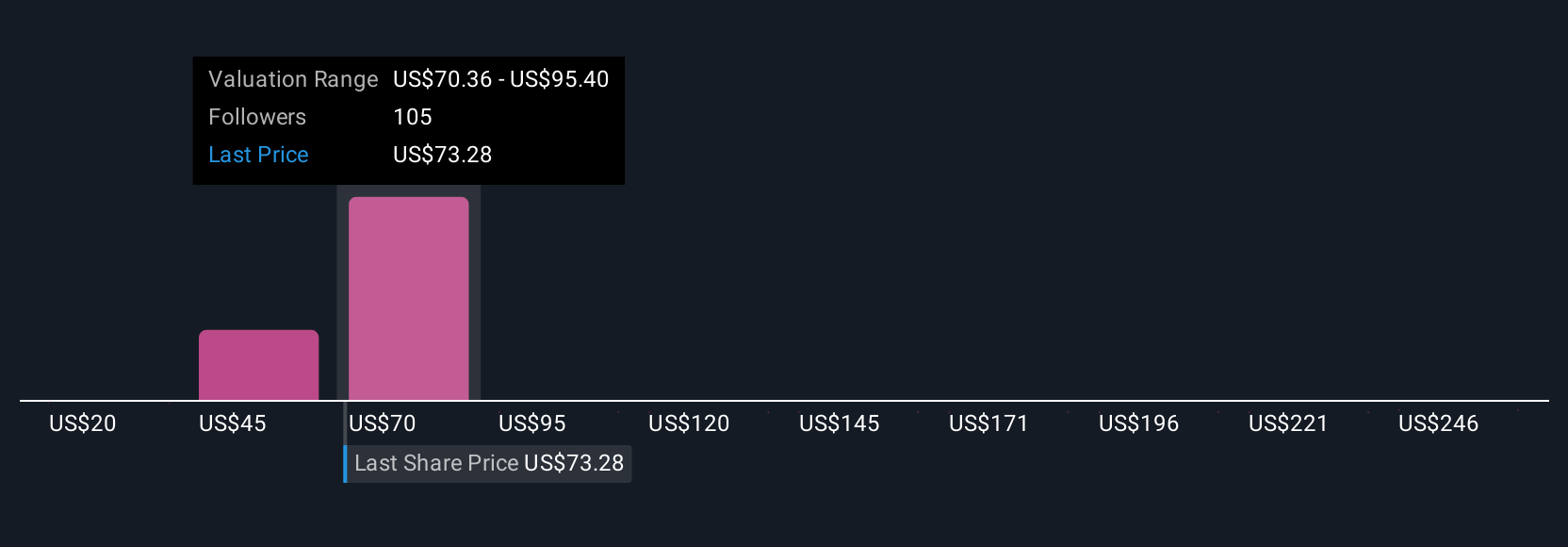

Sixteen private investors in the Simply Wall St Community estimate Upstart Holdings' fair value ranges from US$21.91 to US$85 per share. As model accuracy and economic volatility remain central to Upstart's future, see how others interpret these wide differences and compare your own view.

Explore 16 other fair value estimates on Upstart Holdings - why the stock might be worth less than half the current price!

Build Your Own Upstart Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Upstart Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Upstart Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Upstart Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UPST

Upstart Holdings

Operates a cloud-based artificial intelligence (AI) lending platform in the United States.

Exceptional growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives