- United States

- /

- Capital Markets

- /

- NasdaqGS:TRIN

Did Trinity Capital’s (TRIN) Fintech Bet and New Life Sciences Leader Signal a Broader Growth Strategy?

Reviewed by Sasha Jovanovic

- Trinity Capital Inc. recently committed US$15 million in growth capital to Kard Financial, a commerce media network specializing in fintech rewards, and appointed Paul D'Agrosa as Managing Director of Life Sciences to drive national expansion efforts.

- This combination of significant fintech investment and new leadership in Life Sciences highlights Trinity's push to broaden its portfolio and deepen engagement in growth sectors.

- We'll explore how the appointment of a Life Sciences specialist shapes Trinity Capital's evolving investment narrative and sector diversification strategy.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Trinity Capital Investment Narrative Recap

To be a shareholder of Trinity Capital, you need to believe in its capacity to expand earnings and manage credit risk as it diversifies into growth sectors like fintech and life sciences. While the recent appointment of Paul D'Agrosa and the US$15 million investment into Kard Financial underline this diversification push, these moves are not expected to materially shift the short-term catalyst, which remains centered on levering scale and recurring fee income, nor do they immediately address the main risk of dividend sustainability should portfolio performance soften.

The announcement of a consistent US$0.51 per share quarterly dividend is highly relevant, as it underscores Trinity’s ongoing commitment to shareholder distributions, a key catalyst in maintaining investor interest, though it also heightens sensitivity to any signs of declining asset quality or shrinking earnings reserves.

By contrast, investors should be aware that Trinity’s high payout ratio and dividend policy hinge on continued robust portfolio performance, but if...

Read the full narrative on Trinity Capital (it's free!)

Trinity Capital's narrative projects $344.1 million in revenue and $159.5 million in earnings by 2028. This requires 10.5% yearly revenue growth and a $20.7 million earnings increase from $138.8 million today.

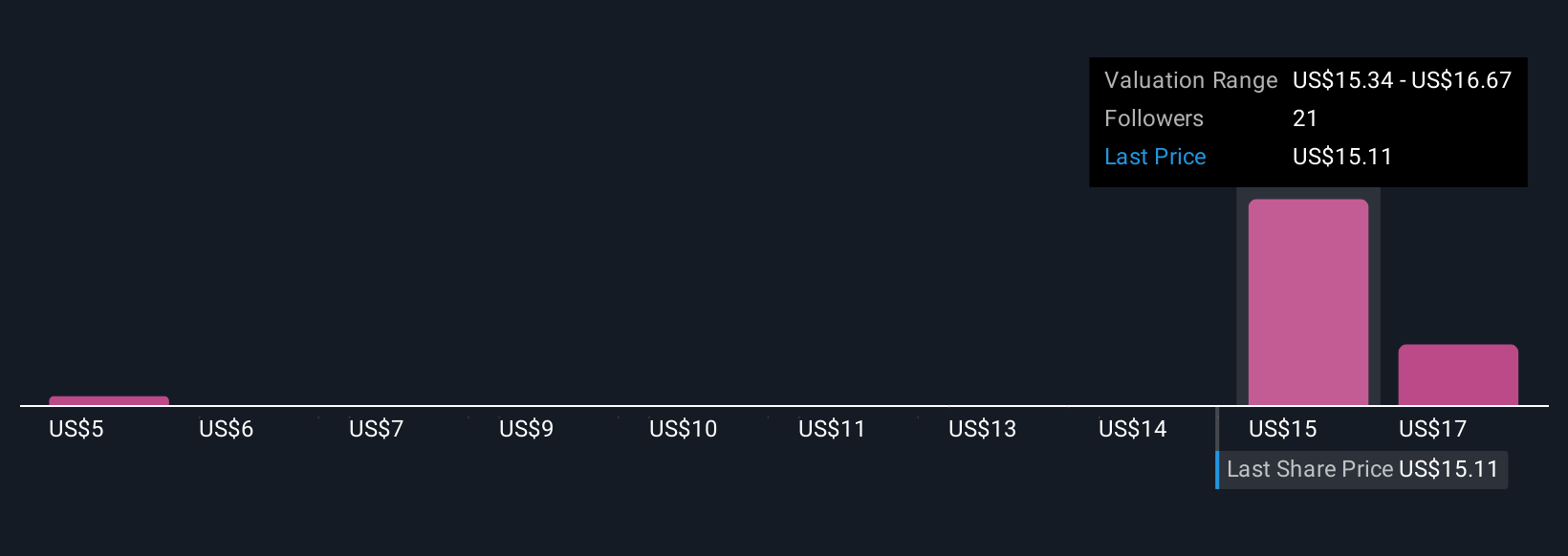

Uncover how Trinity Capital's forecasts yield a $16.44 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Eight private investors in the Simply Wall St Community set fair values for Trinity Capital between US$4.71 and US$18. Recent focus on recurring dividends continues to shape varied expectations for future stability. Your perspective matters, compare these with your views and explore more alternative takes.

Explore 8 other fair value estimates on Trinity Capital - why the stock might be worth less than half the current price!

Build Your Own Trinity Capital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trinity Capital research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Trinity Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trinity Capital's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trinity Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRIN

Trinity Capital

A business development company specializing in term loans, equipment financing, and private equity-related investments.

Good value with proven track record.

Market Insights

Community Narratives