- United States

- /

- Capital Markets

- /

- NasdaqGS:STEP

Why We're Not Concerned About StepStone Group LP's (NASDAQ:STEP) Share Price

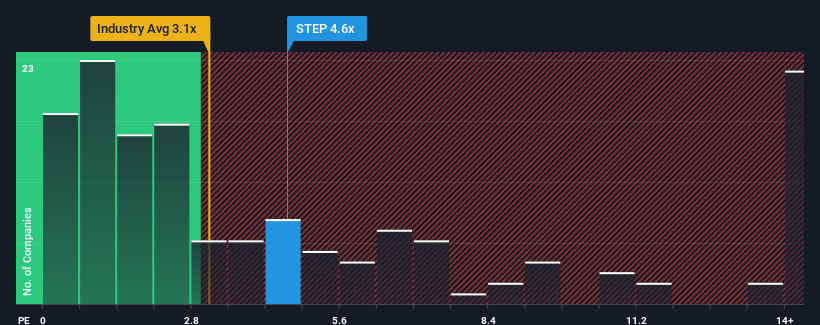

When close to half the companies in the Capital Markets industry in the United States have price-to-sales ratios (or "P/S") below 3.1x, you may consider StepStone Group LP (NASDAQ:STEP) as a stock to potentially avoid with its 4.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for StepStone Group

What Does StepStone Group's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, StepStone Group has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on StepStone Group.Is There Enough Revenue Growth Forecasted For StepStone Group?

In order to justify its P/S ratio, StepStone Group would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. Still, revenue has fallen 7.9% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Turning to the outlook, the next year should generate growth of 42% as estimated by the five analysts watching the company. With the industry only predicted to deliver 12%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why StepStone Group's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From StepStone Group's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that StepStone Group maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Capital Markets industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

And what about other risks? Every company has them, and we've spotted 3 warning signs for StepStone Group (of which 1 doesn't sit too well with us!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:STEP

StepStone Group

A private equity and venture capital firm specializing in direct, fund of funds, secondary direct, and secondary indirect investments.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives