- United States

- /

- Capital Markets

- /

- NasdaqGS:STEP

Should Investors Reassess StepStone After Strong 11% Rally and Growing Private Markets Interest in 2025?

Reviewed by Bailey Pemberton

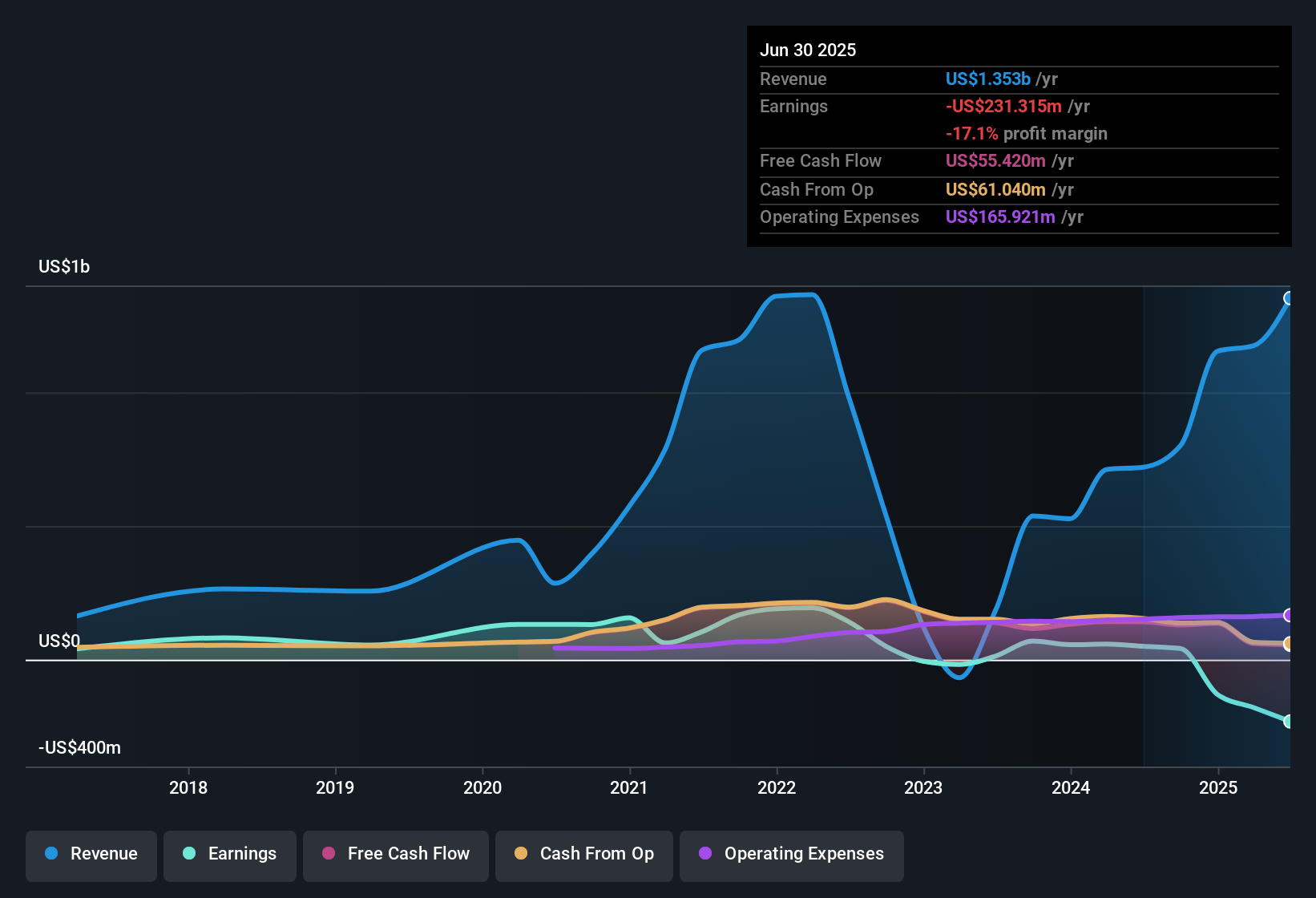

If you have been watching StepStone Group’s stock, you have seen more than a few interesting signals lately. Whether you are weighing a new investment or considering holding your current shares, this is a moment worth some attention. Within the past five years, StepStone's stock has delivered an impressive 191.4% gain, handily outpacing many peers and even showing persistence: up 189.9% over three years and 15.3% in the most recent twelve months. More recently, the price jumped 11.4% over the past month and 1.8% in the last seven days, riding a wave of positive sentiment as private-markets investment platforms like StepStone attract fresh investor interest. Some of these moves are also tied to broader market optimism for alternative asset managers, as investors recalibrate risk and growth expectations across sectors.

Of course, those headline returns only tell part of the story. Valuation is the perennial question for anyone looking at a stock with a big run behind it: is it still reasonably priced today, or are we chasing momentum? By our metrics, StepStone scores a 2 on a six-point undervaluation scale, meaning it looks undervalued in 2 out of 6 key valuation checks. That leaves room for debate, and for opportunity, depending on how you weigh the methods behind the numbers.

Let’s break down those valuation approaches to see how StepStone really stacks up. Stay tuned, because at the end of this article we will share an even more effective way to understand what the numbers say about value.

StepStone Group scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: StepStone Group Excess Returns Analysis

The Excess Returns valuation model examines how much profit a company generates above its cost of equity capital. In other words, it evaluates whether StepStone Group is producing enough returns on its book value to justify investing in its shares after accounting for the cost required to compensate shareholders for risk.

For StepStone, the key figures are as follows:

- Book Value: $1.96 per share

- Stable EPS: $0.99 per share

(Source: Median Return on Equity from the past 5 years.) - Cost of Equity: $1.17 per share

- Excess Return: $-0.18 per share

- Average Return on Equity: 8.33%

- Stable Book Value: $11.89 per share

(Source: Median Book Value from the past 5 years.)

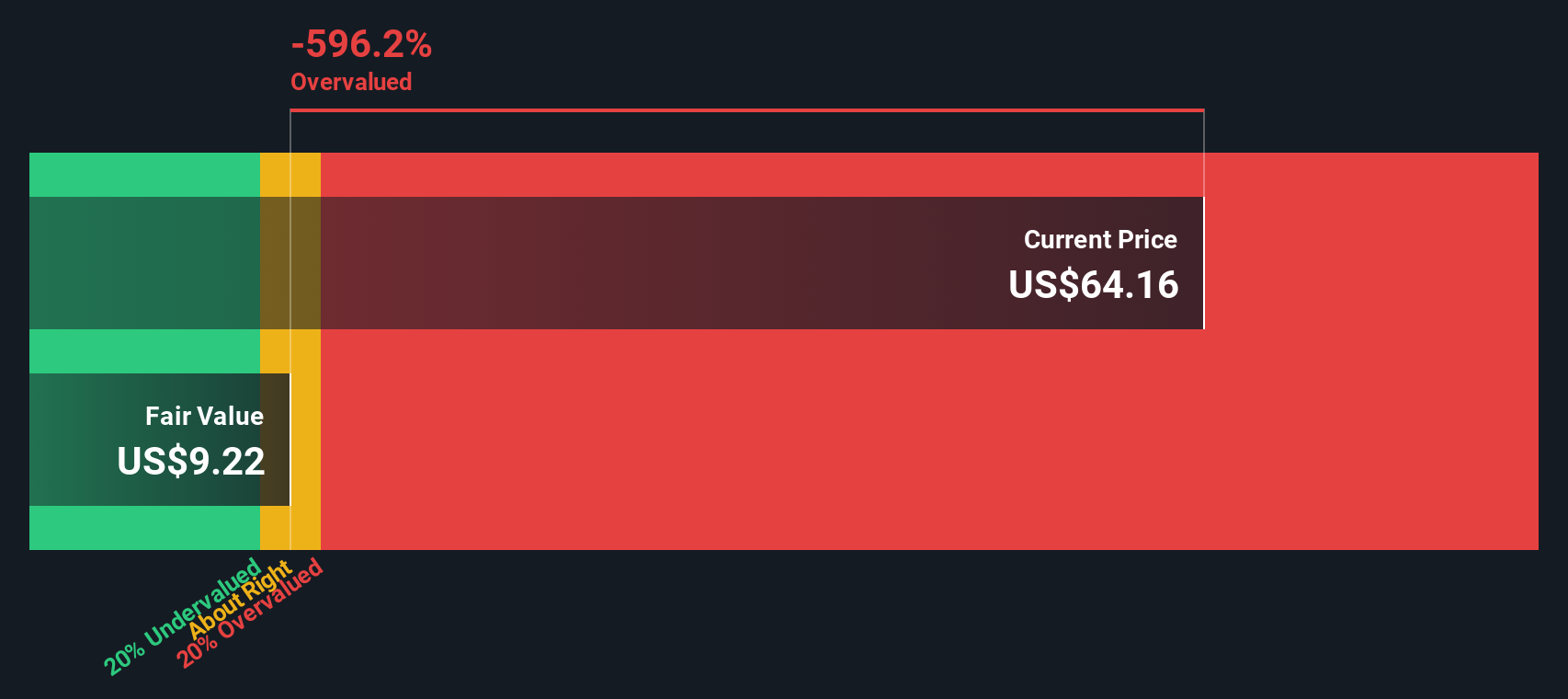

According to this model, StepStone’s returns have not consistently exceeded the cost of shareholder capital. The estimated intrinsic value is $9.26 per share. With the current market price much higher, this suggests StepStone Group is trading at a 632.5% premium to its excess returns value, which indicates it is significantly overvalued by this approach.

Result: OVERVALUED

Our Excess Returns analysis suggests StepStone Group may be overvalued by 632.5%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: StepStone Group Price vs Sales

For companies with steady revenues but potentially inconsistent profits, the Price-to-Sales (P/S) ratio can offer a clear perspective on valuation. This multiple is useful for firms in the capital markets industry like StepStone Group because it focuses on the top line and smooths out volatility at the net income level.

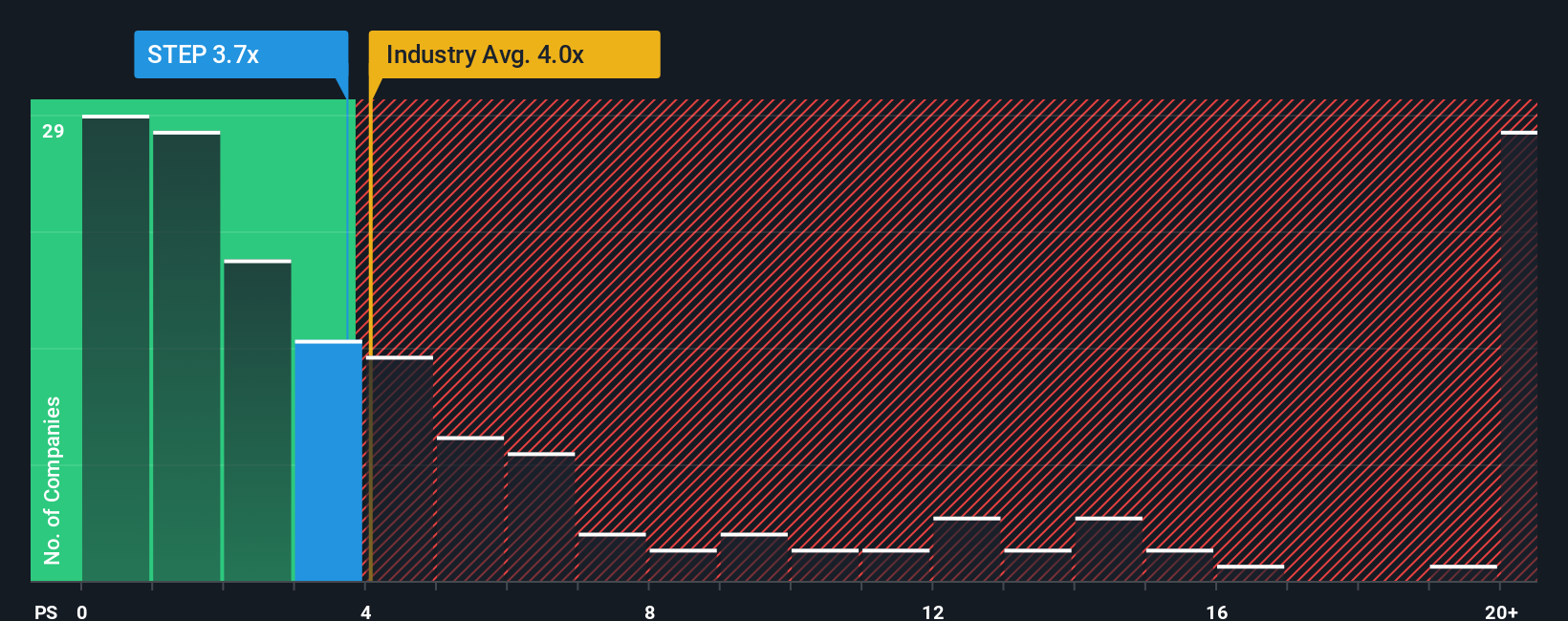

Growth expectations and perceived risk play a major role in where a “normal” P/S multiple lands. Fast-growing, highly profitable businesses often command higher multiples, while slower or riskier companies typically trade closer to or below the industry average. StepStone Group currently trades at a P/S ratio of 3.94x. For context, the industry average is 4.11x and the average among direct peers is even higher at 5.70x. This suggests StepStone’s valuation by this measure is slightly below both benchmarks.

However, rather than relying solely on industry or peer averages, Simply Wall St uses a proprietary "Fair Ratio" for a more tailored valuation. This metric considers StepStone’s own growth outlook, profit margins, market capitalization, risk profile, and its position within the industry. The Fair Ratio for StepStone Group is 1.59x, meaning in theory, a P/S ratio near that level would reflect a fair valuation based on the company’s fundamentals.

Comparing the actual 3.94x multiple to the Fair Ratio of 1.59x shows that, while StepStone may appear attractively priced versus its industry and peers, it is trading at a sizable premium to its fair value when accounting for its unique characteristics and risks.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose Your StepStone Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple yet powerful way to express your own story behind a company’s numbers. It connects your assumptions about fair value, future revenue, earnings, and profit margins to the bigger picture of what you believe about a business.

Think of a Narrative as your personalized forecast and valuation that links the company’s strategy and context to its expected financial outcomes. This approach turns forecasts into a dynamic, living story. Narratives are easy to use and available on Simply Wall St’s Community page, where millions of investors share and update their views.

By comparing your Narrative fair value estimate to StepStone Group’s current share price, you can decide if now is the right time to make a decision. Narratives automatically update whenever fresh data or news arrives, so your outlook stays current.

For example, on StepStone Group, one investor’s Narrative might reflect high optimism with a fair value of $52 per share, while another’s could be more cautious at $21. This shows how different perspectives shape investing decisions.

Do you think there's more to the story for StepStone Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STEP

StepStone Group

A private equity and venture capital firm specializing in primary, direct, fund of funds, secondary direct, and secondary indirect investments.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives