- United States

- /

- Capital Markets

- /

- NasdaqGS:STEP

Is StepStone Group’s (STEP) Leadership Succession Strategy Reinforcing or Recasting Its Private Equity Identity?

Reviewed by Sasha Jovanovic

- StepStone Group has announced that longtime Partner Lindsay Creedon, currently Co-Head of Private Equity Co-Investments and a Global Executive Committee member, will become Head of Private Equity effective January 1, 2026, while CEO Scott Hart remains on the Private Equity Investment Committee.

- This appointment highlights StepStone’s emphasis on leadership continuity and culture, as Creedon will retain her committee roles and stewardship of major client relationships.

- Next, we’ll examine how Creedon’s expanded leadership in private equity shapes StepStone Group’s broader investment narrative and long-term positioning.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is StepStone Group's Investment Narrative?

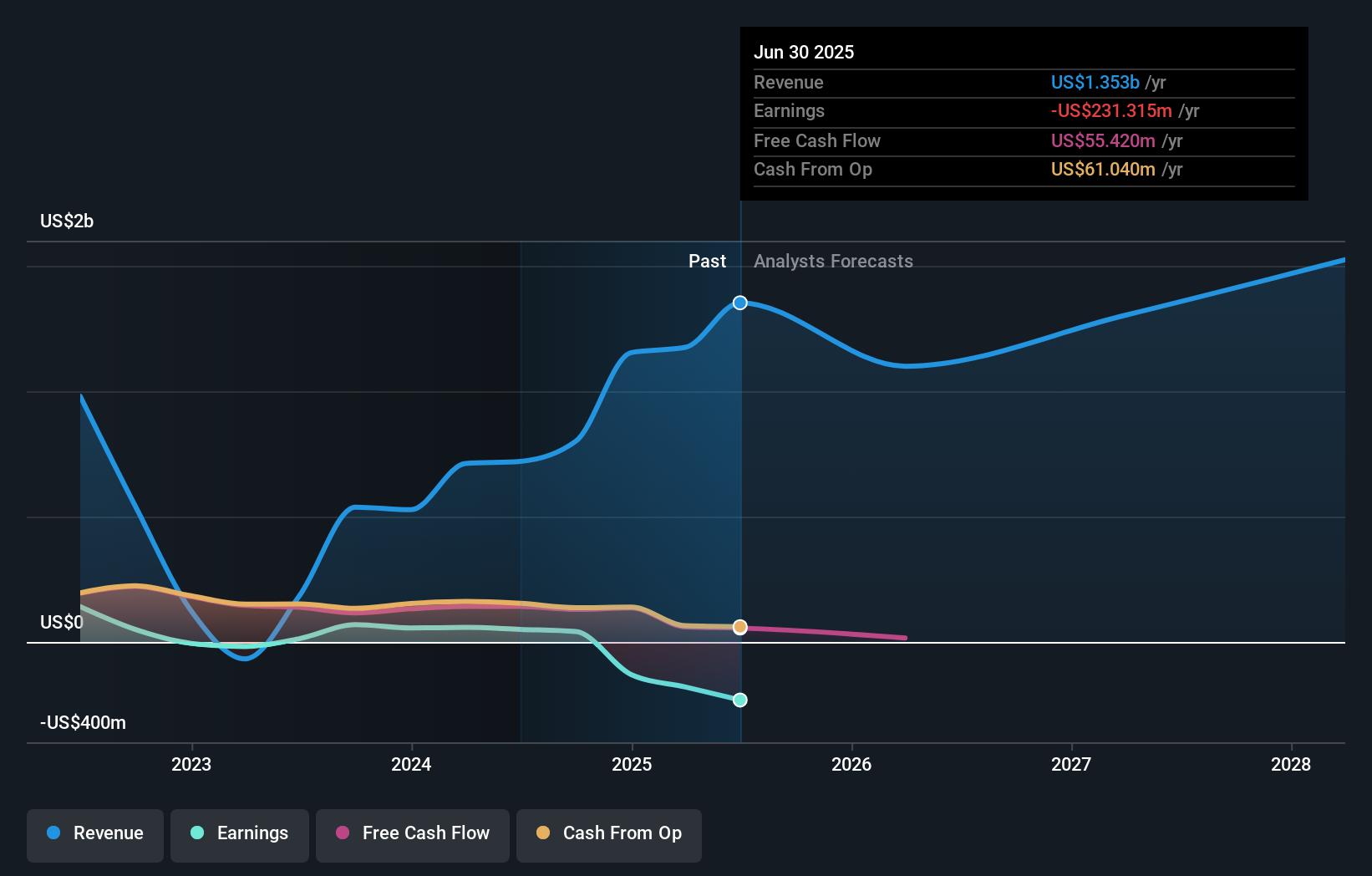

To own StepStone Group, you need to believe in its role as a scaled, diversified gatekeeper to private markets, even as the firm works through recent losses and a dividend that is not covered by earnings. The big near term swing factors still look tied to fundraising momentum, performance fees and uptake of newer vehicles like the STPEX interval fund, rather than to this week’s leadership news. Lindsay Creedon’s appointment as future Head of Private Equity reads as continuity more than disruption, reinforcing the culture and investment process that already support those catalysts. The core risks remain: a rich price-to-sales multiple for an unprofitable business, relatively weak recent share returns and governance questions around board independence and CEO pay while losses have increased.

However, governance and profit trends are issues investors should keep front of mind. According our valuation report, there's an indication that StepStone Group's share price might be on the cheaper side.Exploring Other Perspectives

Explore another fair value estimate on StepStone Group - why the stock might be worth less than half the current price!

Build Your Own StepStone Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your StepStone Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free StepStone Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate StepStone Group's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STEP

StepStone Group

A private equity and venture capital firm specializing in primary, direct, fund of funds, secondary direct, and secondary indirect investments.

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026