- United States

- /

- Specialty Stores

- /

- NasdaqGS:ULTA

US Stock Market Today: S&P 500 Futures Edge Higher amid Fed Rate Cut Hopes

Reviewed by Sasha Jovanovic

The Morning Bull - US Market Morning Update Monday, Dec, 8 2025

US stock futures are edging higher this morning, with a key benchmark for the S&P 500 up about 0.2 percent as investors weigh steady but not yet tame inflation against a looming Federal Reserve decision. The Fed’s preferred inflation scorecard, the PCE index, is running at 2.8 percent year over year, which means the cost of living is easing but still above the central bank’s comfort zone. At the same time, personal spending rose 0.3 percent in September, showing households are still opening their wallets. The big question is whether this mix keeps rate cut hopes alive and what it means for rate sensitive sectors like banks, utilities and smaller US companies.

Shield your portfolio from rate shock by zeroing in on dividend stocks with yields > 3% before yields compress further.

Top Movers

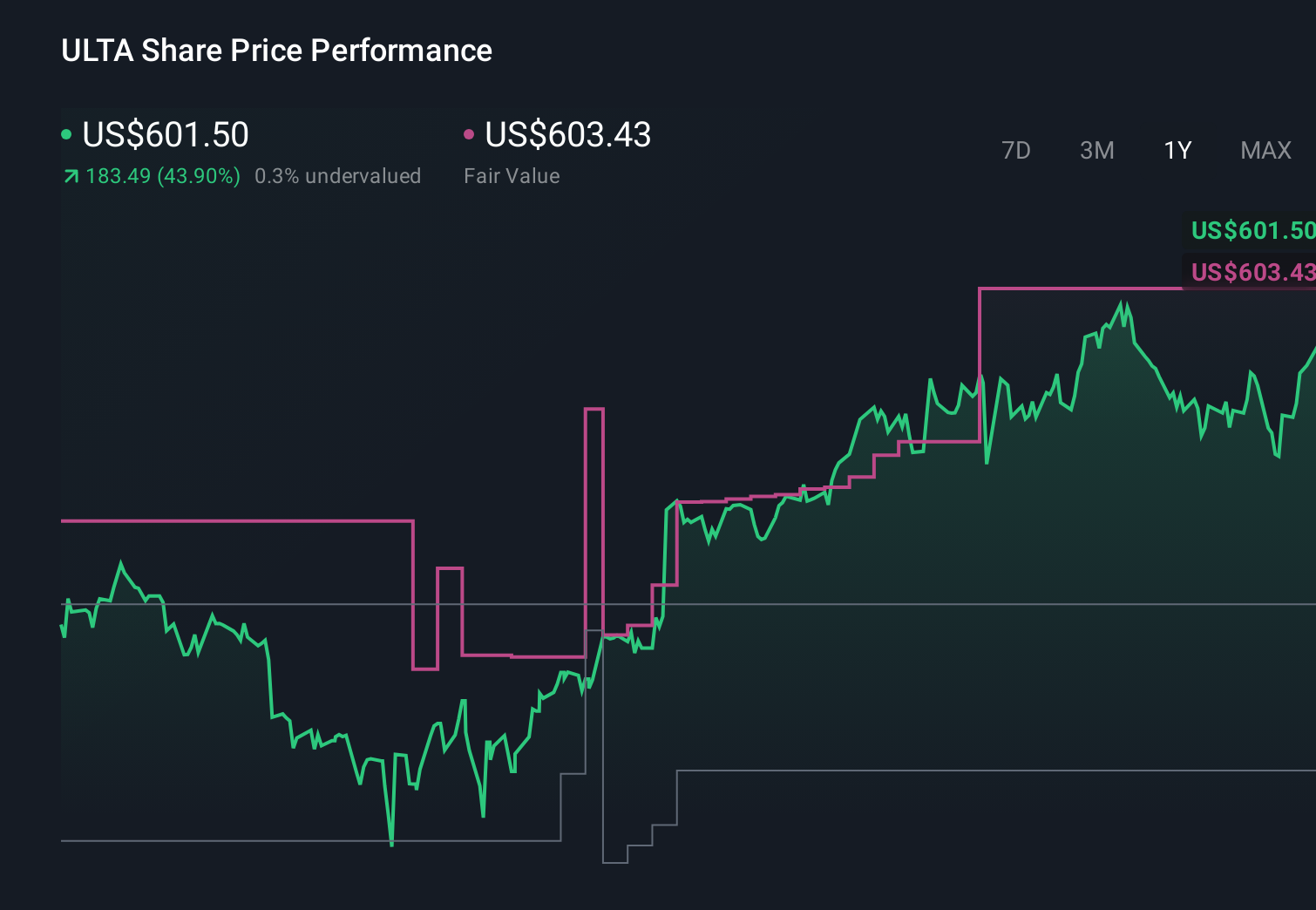

- Ulta Beauty (ULTA) jumped 12.65 percent after strong sales, raised full year guidance and buyback progress.

- Samsara (IOT) climbed 11.08 percent as earnings turned profitable and management guided to robust revenue growth.

- EchoStar (SATS) surged 10.07 percent.

Is Ulta Beauty still a smart investment or just hype? Read our most popular narrative and get all the answers you need.

Top Losers

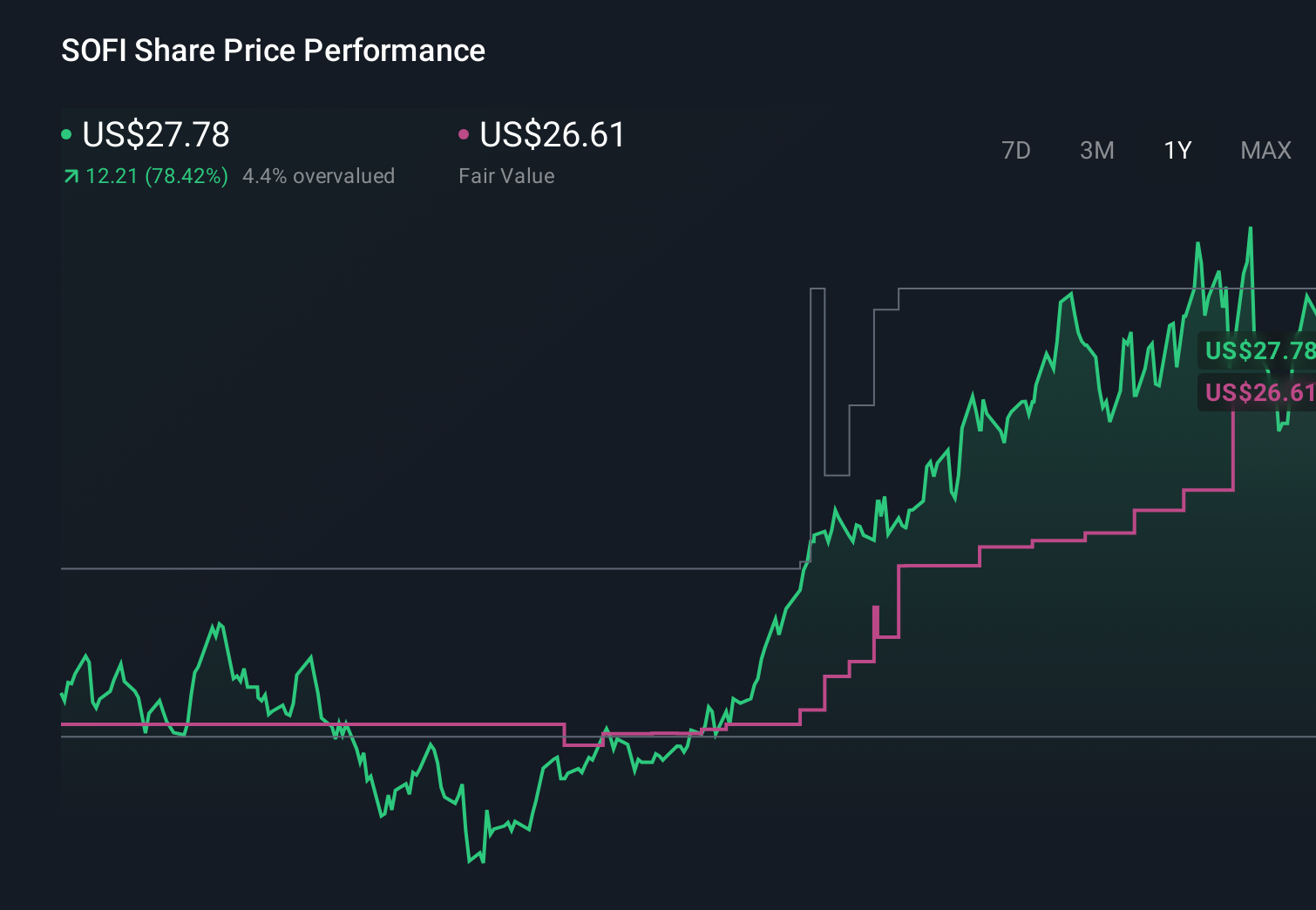

- SoFi Technologies (SOFI) fell 6.15 percent after completing a $1.5 billion follow on equity offering.

- W. R. Berkley (WRB) slipped 5.86 percent despite announcing an additional $1.00 per share special dividend.

- Nu Holdings (NU) declined 5.38 percent.

Look past the noise - uncover the top narrative that explains what truly matters for Nu Holdings' long-term success.

On The Radar

Software and specialty retail earnings will steer stock specific moves as traders brace for the Fed decision next week.

- AutoZone (AZO) posts Q1 2026 results before the market opens on Tuesday, spotlighting DIY demand, commercial growth and margin resilience.

- Ferguson Enterprises (FERG) reports Q1 2026 early Tuesday, updating on construction exposure, pricing power and cash returns.

- Adobe (ADBE) reports Q4 2025 after the close on Wednesday, with focus on Digital Media growth and GenAI monetization.

- Oracle (ORCL) delivers Q2 2026 earnings Wednesday after hours, gauging cloud infrastructure momentum and AI workload wins.

- Synopsys (SNPS) posts Q4 2025 on Wednesday afternoon, offering a read on chip design demand and licensing growth.

Use our Portfolio or Watchlist features to track market-moving events like these and get alerts for the companies you own, free!

How To Find Stocks That Fit Your Strategy

Look past the headline moves and focus where smart money is quietly positioning before the next Fed pivot. These windows do not stay open for long, and our research on undervalued stocks based on cash flows reveals a select group of mispriced cash generators that combine resilient balance sheets with catalysts that could unlock value sooner than most investors expect.

Ready to take control of your next move? Use our stock screener to run custom searches that fit your unique style and set timely alerts so you never miss a promising new opportunity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ULTA

Ulta Beauty

Operates as a specialty beauty retailer in the United States, Mexico, and Kuwait.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026