- United States

- /

- Capital Markets

- /

- NasdaqGS:SNEX

Insufficient Growth At StoneX Group Inc. (NASDAQ:SNEX) Hampers Share Price

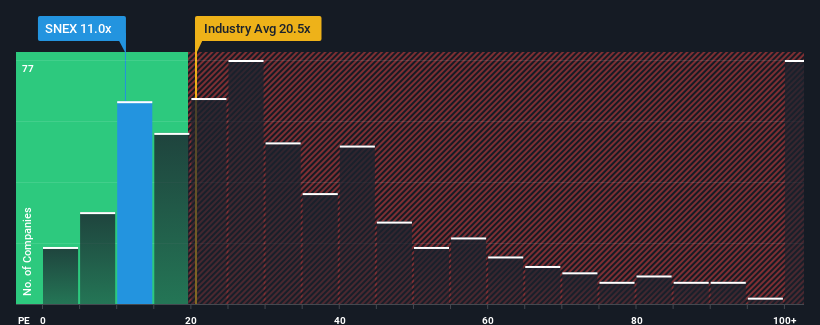

With a price-to-earnings (or "P/E") ratio of 11x StoneX Group Inc. (NASDAQ:SNEX) may be sending bullish signals at the moment, given that almost half of all companies in the United States have P/E ratios greater than 18x and even P/E's higher than 34x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With its earnings growth in positive territory compared to the declining earnings of most other companies, StoneX Group has been doing quite well of late. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for StoneX Group

How Is StoneX Group's Growth Trending?

In order to justify its P/E ratio, StoneX Group would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a decent 7.9% gain to the company's bottom line. EPS has also lifted 14% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 0.9% per year as estimated by the one analyst watching the company. With the market predicted to deliver 10% growth per year, that's a disappointing outcome.

With this information, we are not surprised that StoneX Group is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that StoneX Group maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for StoneX Group that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNEX

StoneX Group

Operates as a global financial services network that connects companies, organizations, traders, and investors to market ecosystem in the United States, Europe, South America, the Middle East, Asia, and internationally.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives