- United States

- /

- Capital Markets

- /

- NasdaqGS:SNEX

How Investors Are Reacting To StoneX Group (SNEX) Appearance at Egypt Mining Forum

Reviewed by Simply Wall St

- StoneX Group Inc. is scheduled to present at the Egypt Mining Forum on July 15, 2025, with Rhona O’Connell, Head of Market Analysis for EMEA & Asia, representing the company at The Nile Ritz-Carlton in Cairo.

- The company’s participation at a significant regional industry gathering highlights its engagement with emerging markets and potential exploration of new mining-related opportunities.

- We’ll examine how the company’s upcoming presence at a key mining forum shapes StoneX Group’s broader investment narrative.

Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

What Is StoneX Group's Investment Narrative?

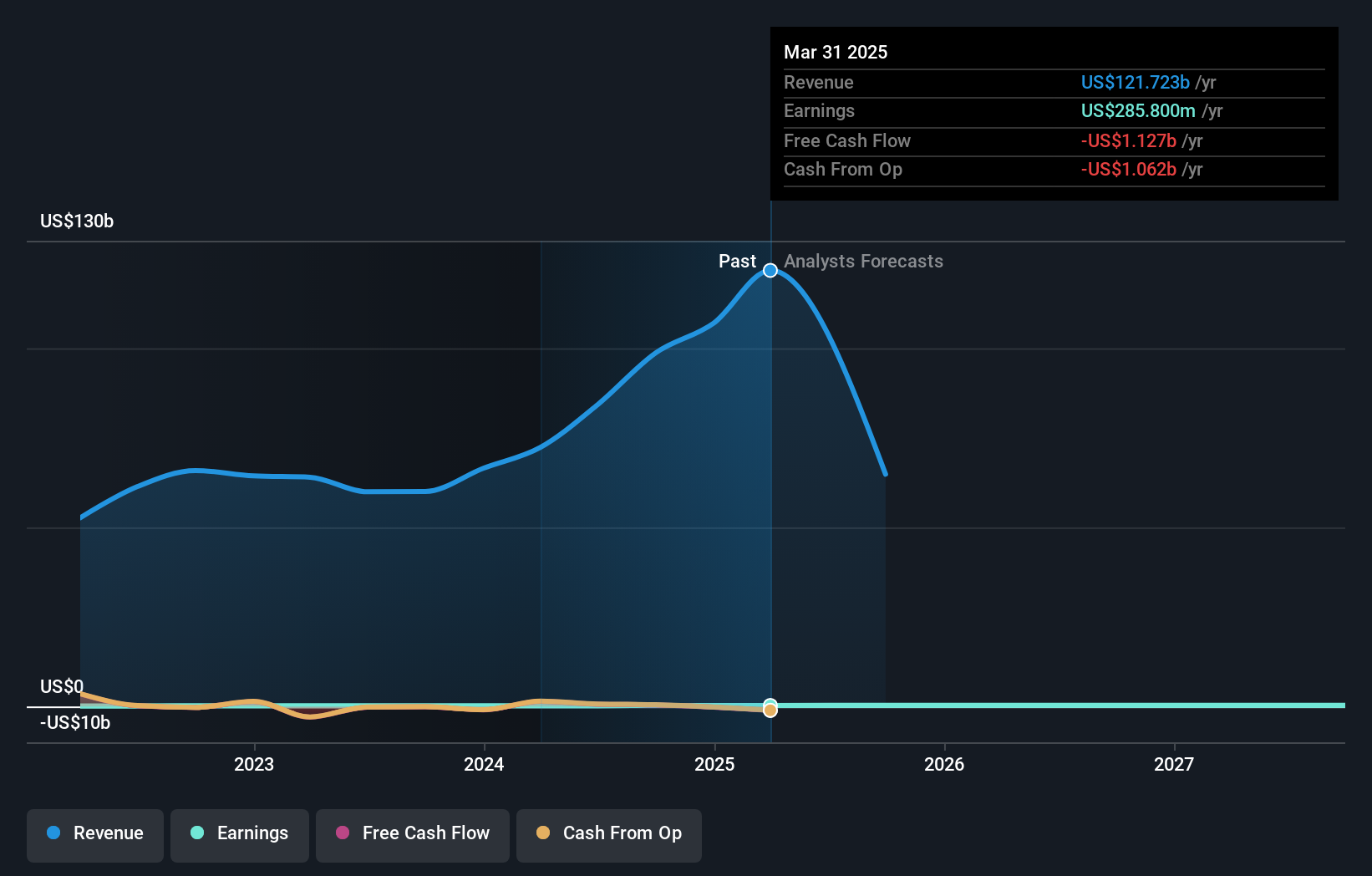

For me, the core belief supporting a decision to hold StoneX Group shares revolves around its ability to expand into new markets and diversify its revenue. The company’s scheduled presentation at the Egypt Mining Forum might offer fresh insight into growth in emerging economies, but the immediate impact on the most important short-term catalysts, such as ongoing debt financing, executive reshuffles, and index removals, appears marginal for now. While the stock saw a modest increase on the news, major risks like leadership changes and higher debt from the new $625 million bond offering are still on investors’ minds, especially following an absence of recent share buybacks and some insider selling. In short, the Cairo forum may hint at new directions, but for now, the big catalysts and risks remain closely tied to financing, management, and capital allocation rather than one event.

However, executive shakeups and higher debt remain material risks investors should watch closely.

StoneX Group's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Build Your Own StoneX Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your StoneX Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free StoneX Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate StoneX Group's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNEX

StoneX Group

Operates as a global financial services network that connects companies, organizations, traders, and investors to market ecosystem in the United States, Europe, South America, the Middle East, Asia, and internationally.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives