- United States

- /

- Diversified Financial

- /

- NasdaqCM:SEZL

The Bull Case For Sezzle (SEZL) Could Change Following Surge in Analyst Optimism and Upgraded Forecasts

Reviewed by Simply Wall St

- In recent days, analysts have shown strong agreement that Sezzle will report earnings surpassing previous estimates and have upgraded its ranking to reflect this optimism.

- This surge in analyst confidence highlights a growing belief in Sezzle's near-term financial outlook among investment professionals.

- We'll now explore what rising analyst optimism and stronger earnings expectations might mean for Sezzle's broader investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Sezzle Investment Narrative Recap

To be a shareholder in Sezzle, you typically need to believe that expanding digital payment solutions like Buy Now Pay Later will keep winning over younger consumers, and that Sezzle's strong revenue growth can be converted into sustainable profits. The surge in analyst confidence, reflected in upward earnings revisions and a higher consensus price target, directly impacts Sezzle’s main near-term catalyst: continued outperformance on earnings. However, it doesn't eliminate the key risk that aggressive marketing spend may outpace returns if user growth shifts or competitive pressures intensify.

Of Sezzle’s recent announcements, the completed share buyback in August 2025 stands out alongside improving earnings forecasts. A sizable repurchase often signals management’s confidence in future cash flow, and when combined with stronger analyst projections, it reinforces the view that near-term earnings delivery is a central focus. Whether such support for the share price can offset structural profitability risks remains an open question for investors assessing both upside and sustainability.

Yet, that optimism should be balanced by the possibility that, if marketing investments do not yield expected payback or higher-margin user migration stalls...

Read the full narrative on Sezzle (it's free!)

Sezzle's narrative projects $885.4 million revenue and $232.2 million earnings by 2028. This requires 33.5% yearly revenue growth and a $127.6 million earnings increase from $104.6 million currently.

Uncover how Sezzle's forecasts yield a $131.67 fair value, a 48% upside to its current price.

Exploring Other Perspectives

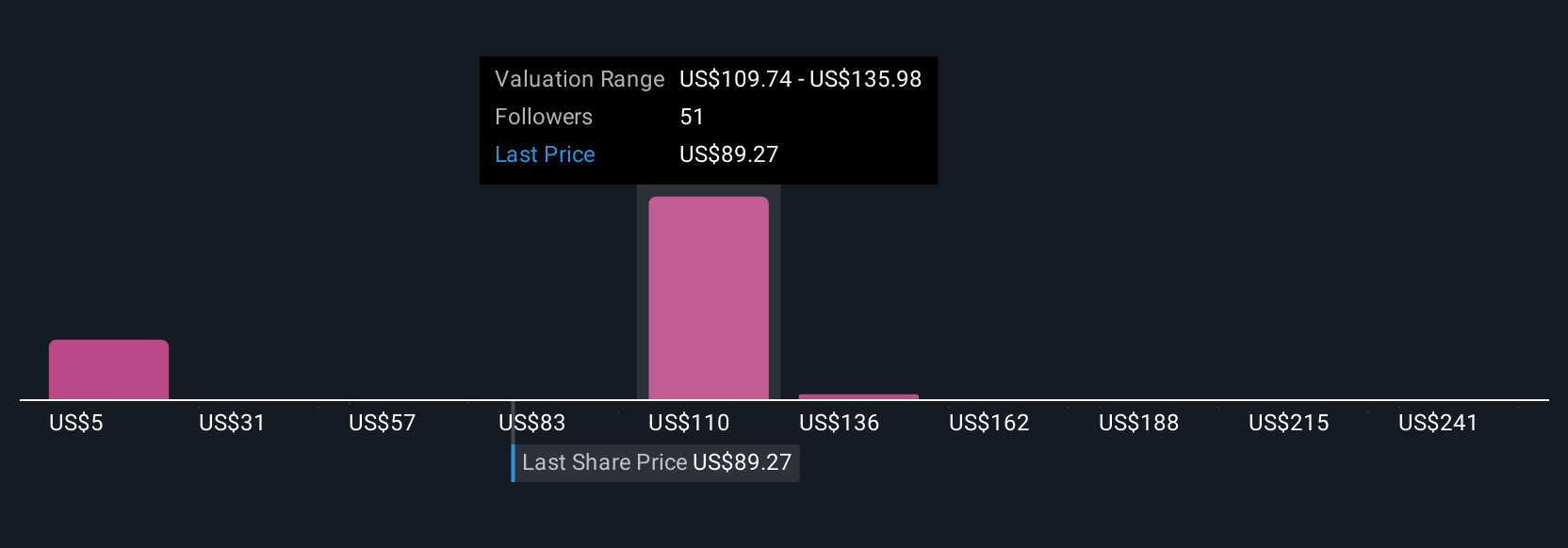

Thirteen members of the Simply Wall St Community have offered fair value estimates for Sezzle, spanning from as low as US$4.74 to as high as US$346.57 per share. Investor opinions clearly vary, and with analysts citing earnings momentum as the key near-term driver, it’s worth considering what these different perspectives could mean for future performance.

Explore 13 other fair value estimates on Sezzle - why the stock might be worth less than half the current price!

Build Your Own Sezzle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sezzle research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sezzle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sezzle's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SEZL

Sezzle

Operates as a technology-enabled payments company primarily in the United States and Canada.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives