- United States

- /

- Capital Markets

- /

- NasdaqGS:SEIC

Assessing SEI Investments (SEIC) Valuation After Recent Share Price Softness

Reviewed by Simply Wall St

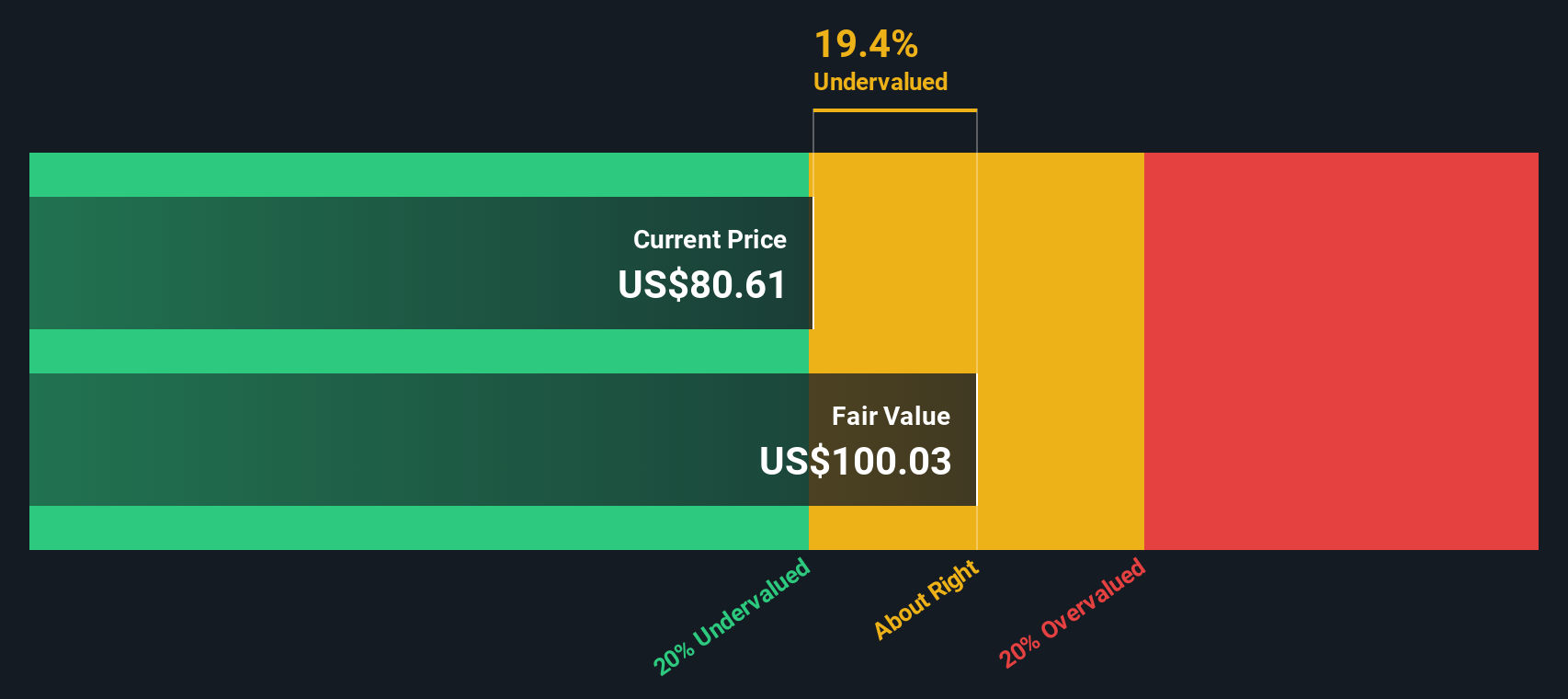

SEI Investments (SEIC) has quietly slipped about 2% over the past month and roughly 7% in the past 3 months, despite steady mid single digit revenue and net income growth.

See our latest analysis for SEI Investments.

At around $80.90, SEI Investments’ recent 30 day and quarter share price weakness sits in contrast to its solid multi year total shareholder returns. This suggests momentum has cooled even as the longer term wealth creation story remains intact.

If this more measured setup at SEI has you thinking about where else steady compounding might be hiding, it could be worth exploring fast growing stocks with high insider ownership.

With shares lagging even as revenues and profits keep grinding higher, investors are left with a familiar puzzle: is SEI Investments quietly undervalued here, or is the market already pricing in the next leg of earnings growth?

Most Popular Narrative: 15% Undervalued

With SEI Investments last closing at $80.90 versus a narrative fair value of $95.17, the storyline leans toward meaningful upside grounded in recurring growth.

The strategic partnership and investment in Stratos gives SEI deeper access to the fast-growing independent advisory channel, expanding its total addressable market and enabling cross-selling of asset management and technology solutions, which is expected to accelerate revenue and earnings growth over time.

Curious how modest growth forecasts, steady margins, and a richer future earnings multiple combine into that upside case? The narrative stitches these together in a way that might surprise you. Want to see exactly which assumptions have to click for that valuation to hold?

Result: Fair Value of $95.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy investment needs and rising competition could keep margins under pressure, which may delay the earnings growth and multiple expansion implied by that upside case.

Find out about the key risks to this SEI Investments narrative.

Another Lens On Valuation

Our DCF model paints a cooler picture, putting fair value closer to $68.51, which is below today’s $80.90 price. On this view, SEI looks slightly overvalued, not cheap, raising the question of whether the market is already paying up for that narrative upside.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SEI Investments for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SEI Investments Narrative

If you would rather probe the numbers yourself and challenge these assumptions, you can build a personalized SEI story in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding SEI Investments.

Looking for more investment ideas?

Before you move on, lock in a few fresh opportunities by running the Simply Wall St Screener, so you are never stuck with a single storyline.

- Target steady cash generators and potential bargains with these 908 undervalued stocks based on cash flows that could quietly reshape your long term returns.

- Ride the next wave of innovation by tapping into these 27 AI penny stocks powering smarter software, automation, and real world AI adoption.

- Strengthen your income stream through these 15 dividend stocks with yields > 3% that aim to balance yield with resilience and long term stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SEIC

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026