- United States

- /

- Diversified Financial

- /

- NasdaqCM:RPAY

Repay Holdings Corporation (NASDAQ:RPAY) Surges 27% Yet Its Low P/S Is No Reason For Excitement

Those holding Repay Holdings Corporation (NASDAQ:RPAY) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 51% share price drop in the last twelve months.

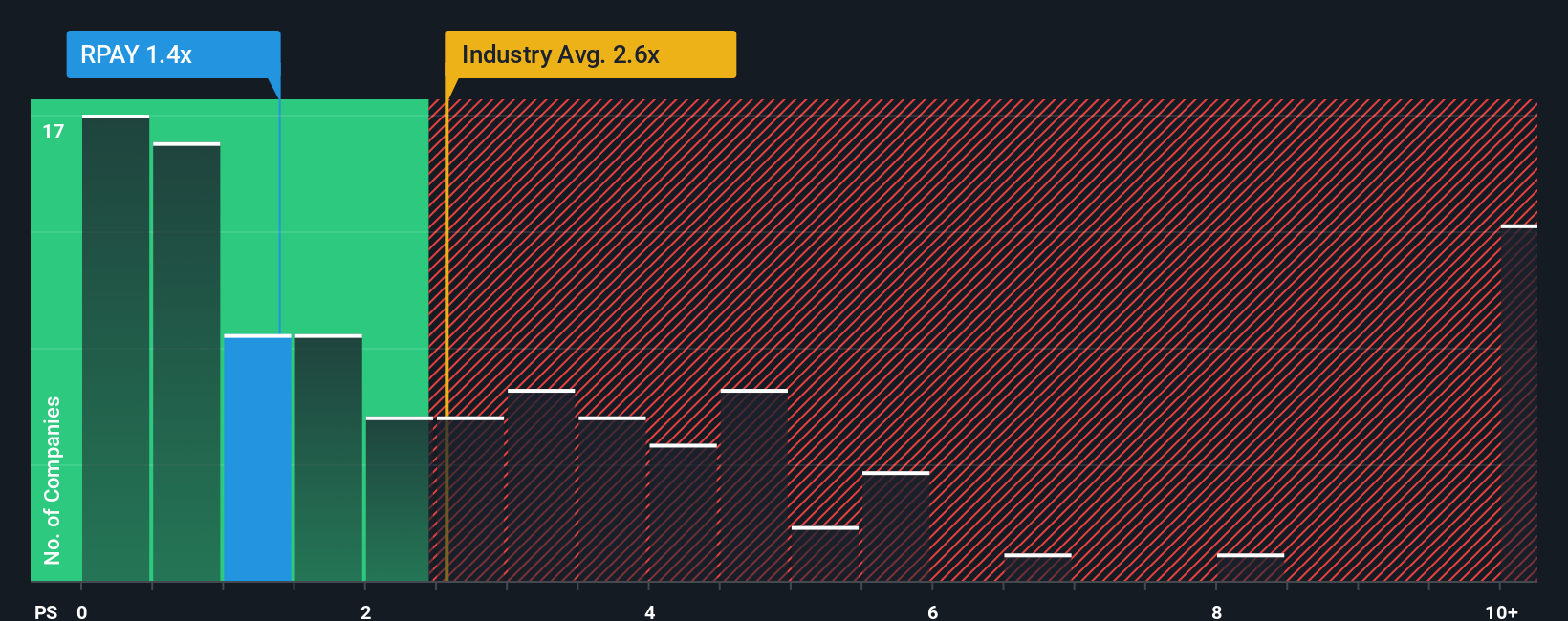

Although its price has surged higher, Repay Holdings may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.4x, considering almost half of all companies in the Diversified Financial industry in the United States have P/S ratios greater than 2.6x and even P/S higher than 5x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Repay Holdings

How Repay Holdings Has Been Performing

Recent times haven't been great for Repay Holdings as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Repay Holdings.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Repay Holdings' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Still, the latest three year period was better as it's delivered a decent 29% overall rise in revenue. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 0.7% over the next year. Meanwhile, the rest of the industry is forecast to expand by 5.1%, which is noticeably more attractive.

In light of this, it's understandable that Repay Holdings' P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Repay Holdings' P/S

The latest share price surge wasn't enough to lift Repay Holdings' P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Repay Holdings' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Repay Holdings that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RPAY

Repay Holdings

A payments technology company, provides integrated payment processing solutions that enables consumers and businesses to make payments using electronic payment methods in the United States.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives