- United States

- /

- Diversified Financial

- /

- NasdaqGS:RELY

Remitly Global (RELY): Evaluating Valuation Following Launch of Remitly One and Raised Financial Guidance

Reviewed by Kshitija Bhandaru

If you have been following Remitly Global (RELY), the launch of Remitly One might have caught your eye. This new all-in-one financial membership package is more than a routine product release. In addition to flexible funding and a digital wallet with cash rewards, Remitly One offers early-access debit cards and a range of future-focused benefits, such as stablecoin support and credit-building tools. It is a bold move that directly targets both customer needs and the broader shift toward digital banking. This comes right after strong Q2 numbers and elevated guidance for the rest of the year.

Looking at the bigger picture, Remitly's growth-oriented strategy seems to be getting noticed. The company has consistently introduced new features and services while expanding its value proposition, resulting in strong revenue and net income growth at 19% and 66% over the last year. Despite these advances and a healthy 21% total return over the year, shares have pulled back around 24% year-to-date, suggesting that the market is recalibrating expectations while keeping an eye on long-term gains. This pattern can sometimes signal that momentum is taking a breather, especially after high-growth periods.

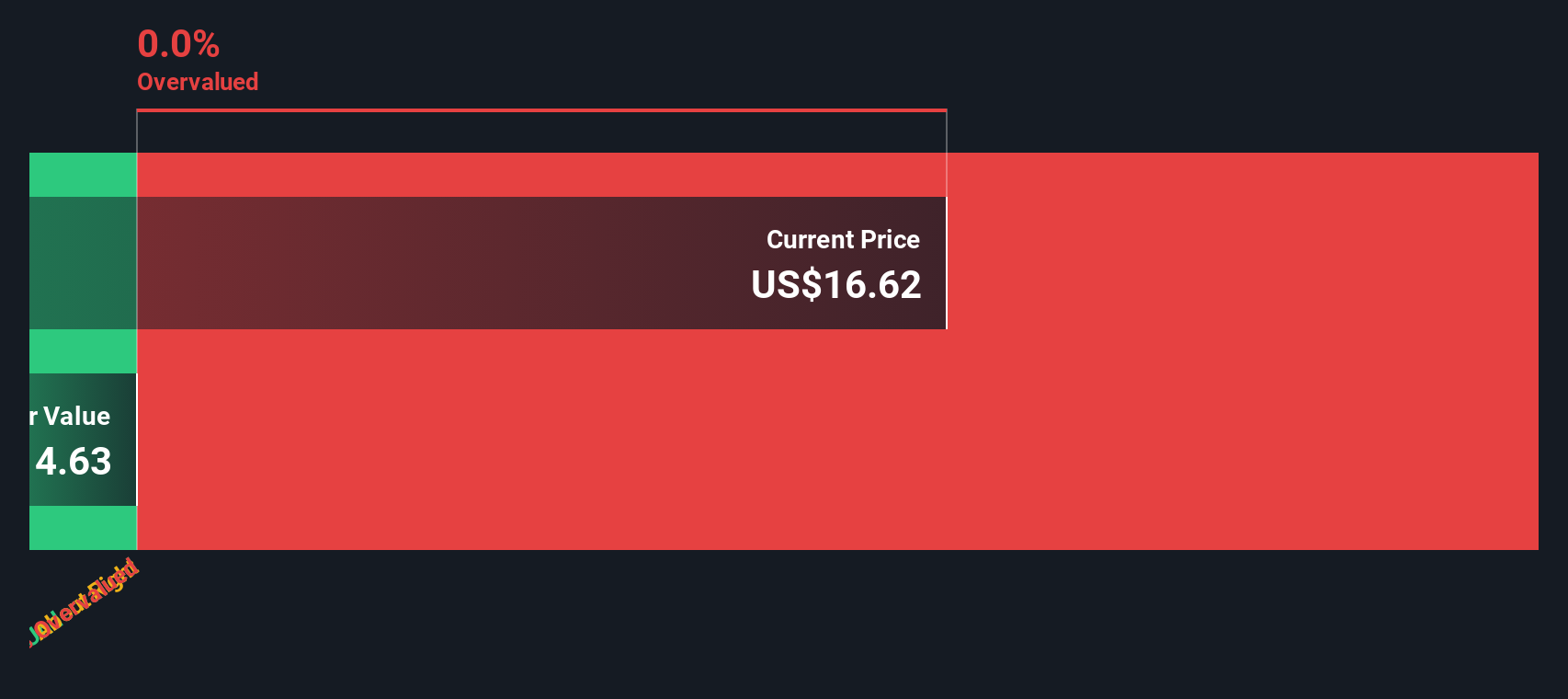

With the latest product launch and raised guidance, some may wonder whether Remitly Global is a bargain waiting to be discovered or if investors are already factoring in future potential. Here is a closer look at what the numbers really indicate.

Most Popular Narrative: 35.4% Undervalued

According to the most widely followed narrative, Remitly Global is seen as significantly undervalued based on its projected growth and profit trajectory.

"Significant expansion of the addressable market through Remitly Business and the Remitly One membership platform (including Wallet and Flex) directly taps into the ongoing global migration and the rise of cross-border economic activity. This is likely to support sustained, above-market revenue growth and increase ARPU over the long term.

The strategic launch of stablecoin functionality and multicurrency wallets positions Remitly to capitalize on the accelerating adoption of digital financial services and rising global smartphone penetration. This could drive higher customer acquisition, improve retention, and diversify revenue streams."

What is the real engine behind this bold valuation call? There is an unexpected mix of ambitious growth assumptions and a sky-high future profit multiple that rivals some of the market’s most optimistic stories. Wondering which specific forecasts give analysts the confidence to award such a premium? Peel back the layers to discover the precise factors pushing this narrative to its punchy fair value. Numbers and turning points could surprise you.

Result: Fair Value of $26.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent regulatory hurdles and fierce fintech competition remain key risks that could challenge Remitly's bold growth assumptions going forward.

Find out about the key risks to this Remitly Global narrative.Another View: SWS DCF Model Checks the Story

While the first valuation leans heavily on projected growth and profit multiples, our SWS DCF model paints a slightly different picture. This approach weighs the company's future cash flows and can sometimes reveal a more conservative side of the story. Could this model challenge the optimism in the market, or will it ultimately support the view that Remitly is still a bargain?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Remitly Global for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Remitly Global Narrative

If you see things differently or would rather dig into the data on your own terms, creating your own Remitly Global narrative is quick and user-friendly. The process often takes less than three minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Remitly Global.

Looking for More Smart Investment Ideas?

Don’t limit your portfolio to one perspective. Uncover unique opportunities by targeting top-performing companies from exciting sectors and themes with the help of Simply Wall Street’s powerful screeners. Miss this opportunity and you could be overlooking tomorrow’s breakout winners.

- Spot early-stage growth by seeking out penny stocks with strong financials, which are building a reputation for strong balance sheets and financial resilience.

- Supercharge your returns with dividend stocks with yields > 3%, known for consistently delivering high-yield payouts for steady income.

- Ride the next wave of transformative medicine by checking out healthcare AI stocks, leading the charge in AI-powered healthcare solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RELY

Remitly Global

Engages in the provision of digital financial services in the United States, Canada, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives