- United States

- /

- Diversified Financial

- /

- NasdaqGS:PYPL

While shareholders of PayPal Holdings (NASDAQ:PYPL) are in the red over the last three years, underlying earnings have actually grown

PayPal Holdings, Inc. (NASDAQ:PYPL) shareholders should be happy to see the share price up 22% in the last quarter. But that doesn't change the fact that the returns over the last three years have been stomach churning. In that time the share price has melted like a snowball in the desert, down 73%. So it's about time shareholders saw some gains. Of course the real question is whether the business can sustain a turnaround.

While the stock has risen 5.4% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for PayPal Holdings

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate three years of share price decline, PayPal Holdings actually saw its earnings per share (EPS) improve by 1.5% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

After considering the numbers, we'd posit that the the market had higher expectations of EPS growth, three years back. But it's possible a look at other metrics will be enlightening.

We note that, in three years, revenue has actually grown at a 8.4% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating PayPal Holdings further; while we may be missing something on this analysis, there might also be an opportunity.

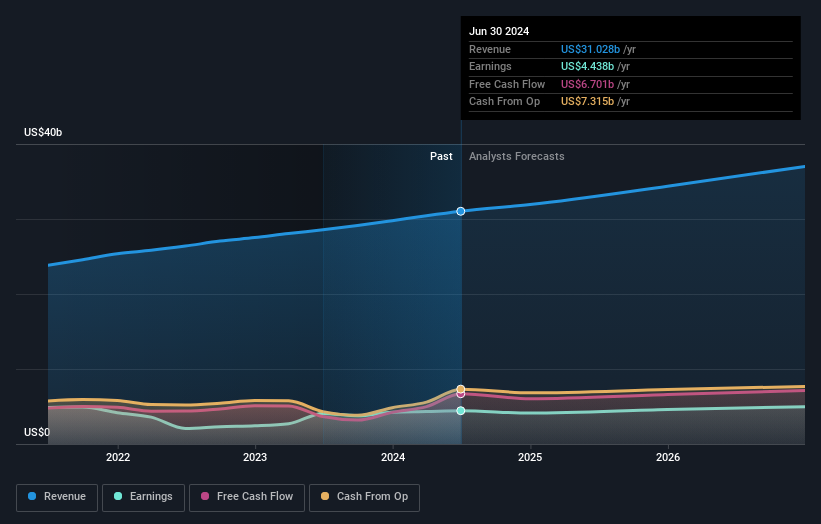

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

PayPal Holdings is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling PayPal Holdings stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

PayPal Holdings shareholders are up 20% for the year. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 5% per year, over five years. So this might be a sign the business has turned its fortunes around. Before spending more time on PayPal Holdings it might be wise to click here to see if insiders have been buying or selling shares.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PYPL

PayPal Holdings

Operates a technology platform that enables digital payments on behalf of merchants and consumers worldwide.

Outstanding track record with excellent balance sheet.