- United States

- /

- Diversified Financial

- /

- NasdaqGS:PYPL

PayPal Holdings (NasdaqGS:PYPL) Joins Forces With Checkbook For Seamless Payments Via PayPal And Venmo

Reviewed by Simply Wall St

PayPal Holdings (NasdaqGS:PYPL) experienced a 1% price increase last week, a move that coincided with Checkbook's launch of new payment rails. This integration, which allows businesses to use PayPal and Venmo APIs for seamless fund transfers, highlights the company's ongoing efforts to enhance user convenience and broaden financial inclusion. This positive development for PayPal came amidst a favorable broader market scenario, with major indices like the Dow and Nasdaq posting gains and tech stocks showing recovery, excluding Intel's decline. These market movements followed investor anticipation of the Federal Reserve's policy meeting and the Fed's decision not to adjust interest rates further, contributing to improving market sentiment. Consequently, in the context of evolving market conditions and PayPal's strategic enhancements to its service offerings, the company's stock performance appeared consistent with broader trends, reflecting investor confidence in its ability to innovate and adapt to the digital financial ecosystem.

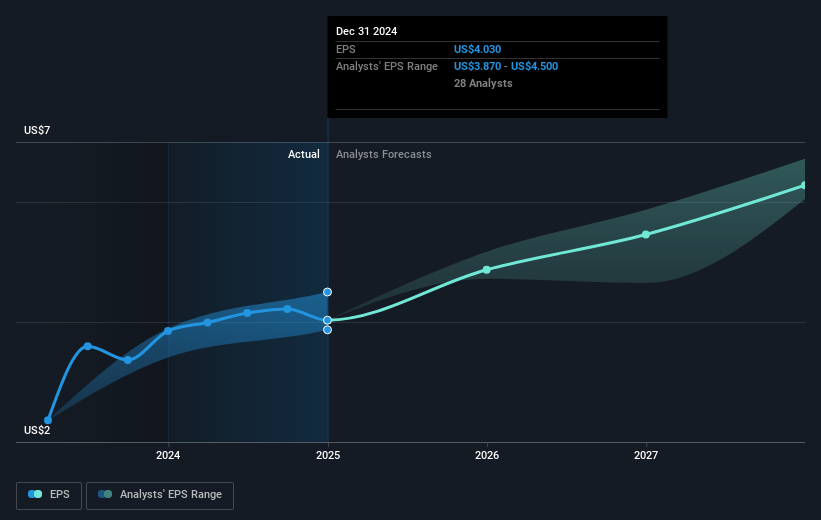

Over the past year, PayPal Holdings delivered a total return of 9.32%, slightly exceeding the US market's return. However, it underperformed the US Diversified Financial industry. Several developments likely influenced this performance. PayPal’s integration with Checkbook, announced in March 2025, facilitated direct transfers to customers' digital wallets, enhancing convenience and promoting financial inclusion. The February 2025 appointment of Jamie Miller as Chief Financial and Operating Officer brought new leadership insights at a critical juncture. Furthermore, in early February 2025, a robust share buyback program totaling up to US$15 billion was announced, potentially contributing to share price support.

On the financial front, PayPal's full-year 2024 sales reached US$31.80 billion, reported in February 2025. However, its current net profit margins indicated a decline from the previous year, reflecting challenges in maintaining profitability. Additionally, PayPal issued US$1.5 billion in senior notes in March 2025 to bolster financial flexibility, indicating prudent fiscal management amidst evolving market dynamics.

Assess PayPal Holdings' previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PYPL

PayPal Holdings

Operates a technology platform that enables digital payments for merchants and consumers worldwide.

Undervalued with excellent balance sheet.