- United States

- /

- Diversified Financial

- /

- NasdaqGS:PYPL

PayPal Holdings (NasdaqGS:PYPL) Expands Global Payments Capabilities And Partners With Perplexity

Reviewed by Simply Wall St

PayPal Holdings (NasdaqGS:PYPL) launched "PayPal Complete Payments" for businesses across Singapore, facilitating payments in over 200 markets. This introduction coincided with a 16.72% rise in the company's share price over the past month. Additionally, the new partnership with Perplexity to enable agentic commerce could have contributed positively. Market trends, notably in the tech-heavy Nasdaq Composite, showed an overall bullish sentiment. PayPal’s financial performance, highlighted by increased earnings and strategic client partnerships, potentially added positive weight to the broader market gains, which increased by 11% over the last year.

The launch of "PayPal Complete Payments" in Singapore and partnership with Perplexity are significant developments in PayPal's evolution into a commerce platform, potentially expanding revenue streams through increased transaction volume and merchant engagement. These initiatives align with PayPal's focus on broadening its service offerings and could drive future earnings as the company leverages its new smart wallet and expands services like Venmo.

Over the past year, PayPal reported a total shareholder return of 13.74%. However, its performance relative to the US Diversified Financial industry was less favorable, with PayPal underperforming the industry's 20.2% annual return. This variance underscores the competitive pressures and market challenges PayPal faces in maintaining growth trajectories.

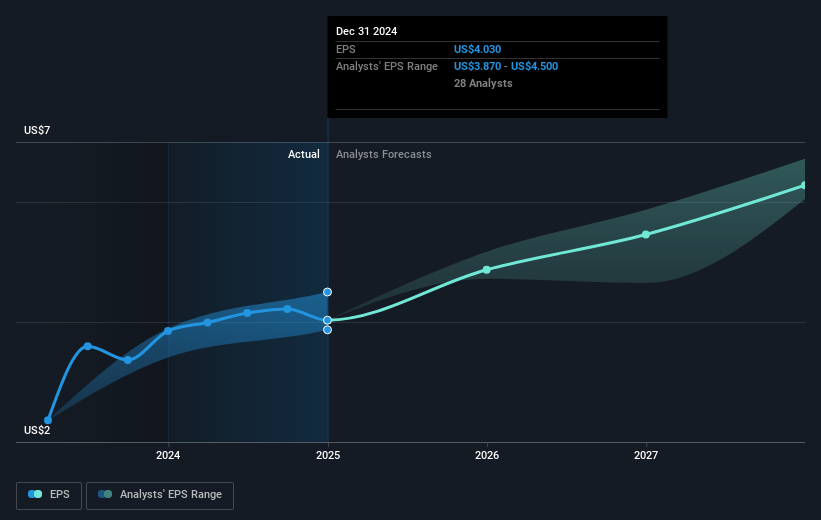

Incorporating recent developments, analysts expect revenue growth driven by the rollout of new services such as Buy Now, Pay Later (BNPL), despite macroeconomic and competitive challenges. Earnings are projected to grow from US$4.55 billion today to US$5.5 billion by 2028, as PayPal capitalizes on increased consumer engagement and transaction margins.

In terms of valuation, the recent share price increase to US$68.05 is roughly 17.3% lower than the consensus price target of US$82.32. This discount suggests potential upside if PayPal can achieve projected earnings and maintain its strategic momentum. However, competition and regulatory shifts remain key risks to watch in the coming years as PayPal navigates its transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade PayPal Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PYPL

PayPal Holdings

Operates a technology platform that enables digital payments for merchants and consumers worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives