- United States

- /

- Diversified Financial

- /

- NasdaqGS:PYPL

Does PayPal’s (PYPL) Move Into AI Shopping Assistants Signal a Shift in Its Competitive Edge?

Reviewed by Sasha Jovanovic

- In recent days, Ashley and Newegg Commerce, Inc. each announced the integration of PayPal's payment technology into AI-driven shopping environments, enabling seamless end-to-end purchases within conversational platforms like Perplexity.

- This development highlights PayPal's move to embed its services directly into emerging AI-powered retail channels, expanding its reach and relevance in next-generation commerce.

- We'll explore how PayPal's integration into AI-powered shopping assistants could reshape its investment narrative and future growth outlook.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

PayPal Holdings Investment Narrative Recap

Owning shares in PayPal Holdings requires confidence in its evolution from a pure payments provider to a commerce platform that leverages innovative technologies to drive transaction growth and expand merchant relationships. The recent integration of PayPal’s payment services into AI-powered shopping platforms by Ashley and Newegg signals a push into next-generation channels, but it does not materially alter PayPal’s primary short-term catalyst, delivering higher-margin transaction volume, nor does it significantly shift the biggest risk, which remains macroeconomic uncertainty affecting consumer spending and payment flows.

The announcement of PayPal’s new agentic commerce solutions being adopted by Newegg is closely linked to this news, as it reinforces PayPal’s strategy to embed payment capabilities into AI-driven retail experiences. This advancement aligns with broader catalysts, such as deepening merchant relationships and tapping into higher margin, value-added services that support improved profitability.

However, in contrast, investors should be mindful that any slowdown in consumer spending due to global economic pressures could still...

Read the full narrative on PayPal Holdings (it's free!)

PayPal Holdings' outlook anticipates $38.1 billion in revenue and $5.4 billion in earnings by 2028. This scenario implies a yearly revenue growth rate of 5.6% and an increase of $0.7 billion in earnings from the current level of $4.7 billion.

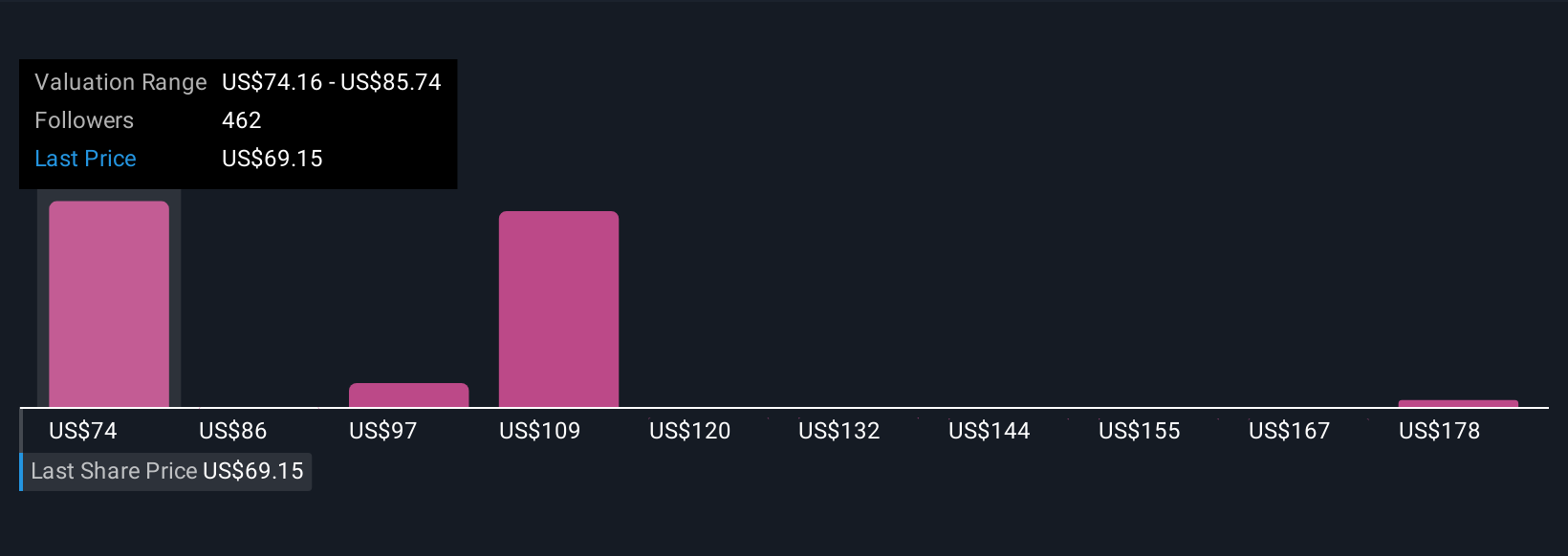

Uncover how PayPal Holdings' forecasts yield a $82.22 fair value, a 33% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s 44 fair value estimates for PayPal range from US$75.52 to US$119.89 per share. While opinions widely differ, many participants see opportunity as PayPal pushes further into AI-driven commerce, yet macroeconomic risks remain front of mind for the company’s prospects.

Explore 44 other fair value estimates on PayPal Holdings - why the stock might be worth as much as 94% more than the current price!

Build Your Own PayPal Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PayPal Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PayPal Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PayPal Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PYPL

PayPal Holdings

Operates a technology platform that enables digital payments for merchants and consumers worldwide.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.