- United States

- /

- Capital Markets

- /

- NasdaqGS:PWP

Will PWP’s New Sector Leaders in London and New York Elevate Its Specialization Strategy?

Reviewed by Sasha Jovanovic

- Perella Weinberg Partners recently announced that Hanadi Al Hamoui and Barry Blake have joined the Firm as Partners, heading the Consumer & Retail business in London and the Healthcare business in New York, respectively.

- The addition of these seasoned executives from Bank of America and Leerink Partners highlights the firm’s intent to broaden its expertise and reach in two major industry sectors across EMEA and North America.

- Let’s examine how these high-profile leadership hires may reshape Perella Weinberg’s investment narrative by deepening sector specialization.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Perella Weinberg Partners' Investment Narrative?

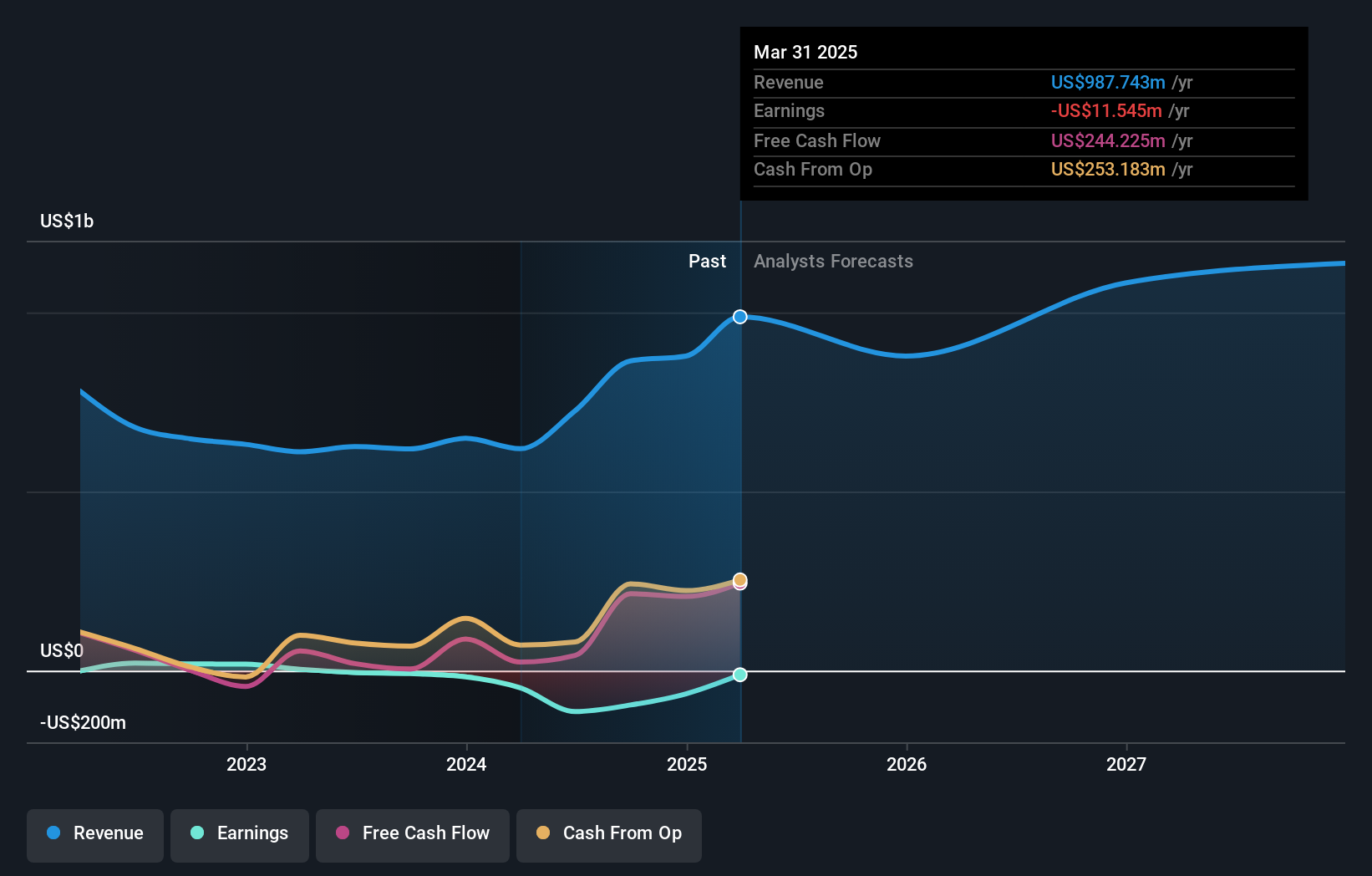

For anyone considering Perella Weinberg Partners, the investment story often centers on whether its push for sector specialization and recent string of high-level hires can translate into sustainable revenue growth and improved profitability. The company’s new appointments in Healthcare and Consumer & Retail, Barry Blake and Hanadi Al Hamoui, signal a deliberate effort to shore up expertise in two sizable fee-generating verticals, which could influence short-term deal activity and client wins. While these hires expand the firm’s talent bench, it’s important to keep in mind that such leadership changes typically take time to filter through to earnings. With a still inexperienced management team by industry standards and mixed recent price action, the biggest short-term catalysts, like deal pipelines or M&A volumes, may see some incremental benefit, but risks remain, especially given recent index removals and historic underperformance versus peers. Ultimately, the immediate impact of these hires may be moderate, but they have the potential to reshape sector risk exposure as integration matures.

However, the relative inexperience of the management team remains a factor investors should be aware of.

The analysis detailed in our Perella Weinberg Partners valuation report hints at an inflated share price compared to its estimated value.Exploring Other Perspectives

Explore another fair value estimate on Perella Weinberg Partners - why the stock might be worth as much as 22% more than the current price!

Build Your Own Perella Weinberg Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Perella Weinberg Partners research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Perella Weinberg Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Perella Weinberg Partners' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PWP

Perella Weinberg Partners

An independent advisory firm, provides strategic and financial advice services in the United States and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives