- United States

- /

- Capital Markets

- /

- NasdaqGS:PWP

Investors Still Aren't Entirely Convinced By Perella Weinberg Partners' (NASDAQ:PWP) Revenues Despite 25% Price Jump

Perella Weinberg Partners (NASDAQ:PWP) shares have had a really impressive month, gaining 25% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 81%.

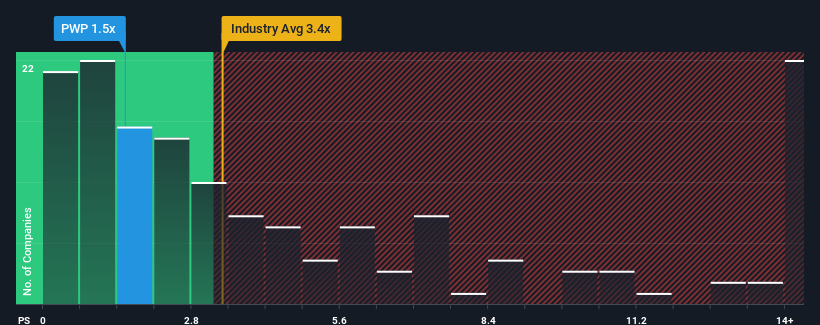

Although its price has surged higher, Perella Weinberg Partners' price-to-sales (or "P/S") ratio of 1.5x might still make it look like a buy right now compared to the Capital Markets industry in the United States, where around half of the companies have P/S ratios above 3.4x and even P/S above 8x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Perella Weinberg Partners

What Does Perella Weinberg Partners' P/S Mean For Shareholders?

Perella Weinberg Partners could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Perella Weinberg Partners' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Perella Weinberg Partners' to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Regardless, revenue has managed to lift by a handy 6.6% in aggregate from three years ago, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 26% during the coming year according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 8.2%, which is noticeably less attractive.

With this information, we find it odd that Perella Weinberg Partners is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Perella Weinberg Partners' P/S

Despite Perella Weinberg Partners' share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Perella Weinberg Partners' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for Perella Weinberg Partners you should be aware of, and 1 of them makes us a bit uncomfortable.

If these risks are making you reconsider your opinion on Perella Weinberg Partners, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PWP

Perella Weinberg Partners

An independent advisory firm, provides strategic and financial advice services in the United States and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives