- United States

- /

- Diversified Financial

- /

- NasdaqGM:NMIH

Did Rising Analyst Optimism and Institutional Buying Just Shift NMI Holdings’ (NMIH) Investment Narrative?

Reviewed by Simply Wall St

- In recent months, NMI Holdings has attracted increased interest from institutional investors, including new stakes acquired by Strs Ohio and Acadian Asset Management, while analysts have raised their earnings estimates and maintained a “Moderate Buy” consensus rating.

- This combination of upward estimate revisions and active institutional engagement points to growing confidence in the company’s underlying outlook, despite some insider selling and mixed analyst ratings.

- We'll examine how improved analyst sentiment and institutional buying may influence NMI Holdings’ investment narrative and future performance expectations.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

NMI Holdings Investment Narrative Recap

To be a shareholder in NMI Holdings, you generally need to believe that steady growth in homeownership, effective risk management, and ongoing investment in technology will continue to drive strong insurance portfolio performance and earnings consistency. The recent increase in institutional investment and upward earnings estimate revisions reinforce broader market confidence, but these developments do not meaningfully change near-term exposure to housing market shifts, the primary short-term catalyst, or the risk of localized downturns, which remains the most significant threat to earnings predictability.

Among recent company developments, continued robust share repurchase activity stands out, with NMI Holdings buying back more than US$49 million in stock over the most recent two quarters. While this supports capital returns and may enhance per-share value, it does not directly address vulnerabilities tied to geographic concentration and potential housing supply-demand resets, which are still key areas for investors to monitor closely.

Yet, despite recent institutional optimism, investors should be aware of how regional housing market corrections could...

Read the full narrative on NMI Holdings (it's free!)

NMI Holdings' narrative projects $812.2 million revenue and $410.6 million earnings by 2028. This requires 6.1% yearly revenue growth and a $32.9 million earnings increase from $377.7 million.

Uncover how NMI Holdings' forecasts yield a $44.14 fair value, a 12% upside to its current price.

Exploring Other Perspectives

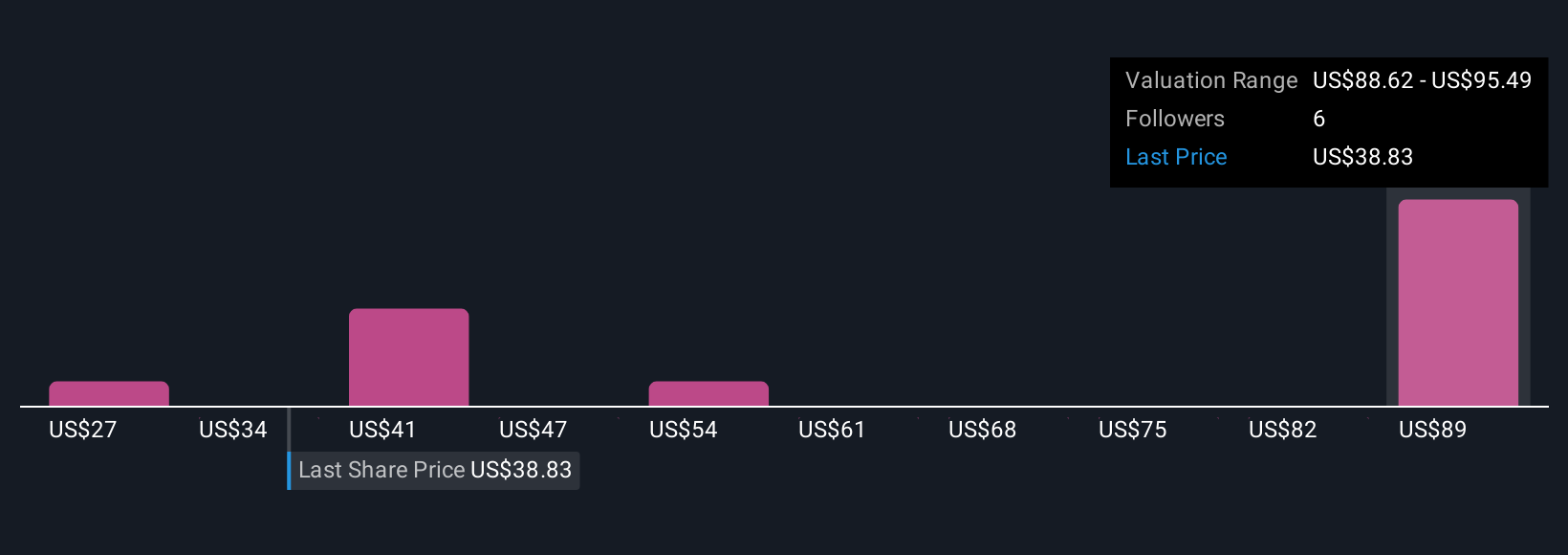

Four different Simply Wall St Community fair value estimates for NMI Holdings range from US$26.80 to US$95.49 per share. With analyst consensus highlighting geographic risk as a key concern, these opinions show just how much views on future company performance can differ, reviewing several perspectives can provide useful context.

Explore 4 other fair value estimates on NMI Holdings - why the stock might be worth 32% less than the current price!

Build Your Own NMI Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NMI Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NMI Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NMI Holdings' overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 31 stocks are leading the charge.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NMI Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NMIH

NMI Holdings

Provides private mortgage guaranty insurance services in the United States.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives