- United States

- /

- Capital Markets

- /

- NasdaqGS:NDAQ

Assessing Nasdaq’s Lofty Valuation After Strong Multi Year Share Price Surge

Reviewed by Bailey Pemberton

- If you are wondering whether Nasdaq is still a buy after such a strong multi year run, you are not alone. This is exactly the kind of stock where valuation really matters.

- Despite a recent 1.8% dip over the last week, the shares are still up 2.9% over the past month, 14.1% year to date and 126.2% over five years. That naturally raises questions about how much upside is really left.

- Recent headlines have focused on Nasdaq leaning further into its role as a technology and data platform for global markets, including continued expansion of its anti financial crime and trading technology businesses. At the same time, investors are watching how its evolving mix of recurring revenues and market sensitive activities could reshape both growth prospects and risk perceptions.

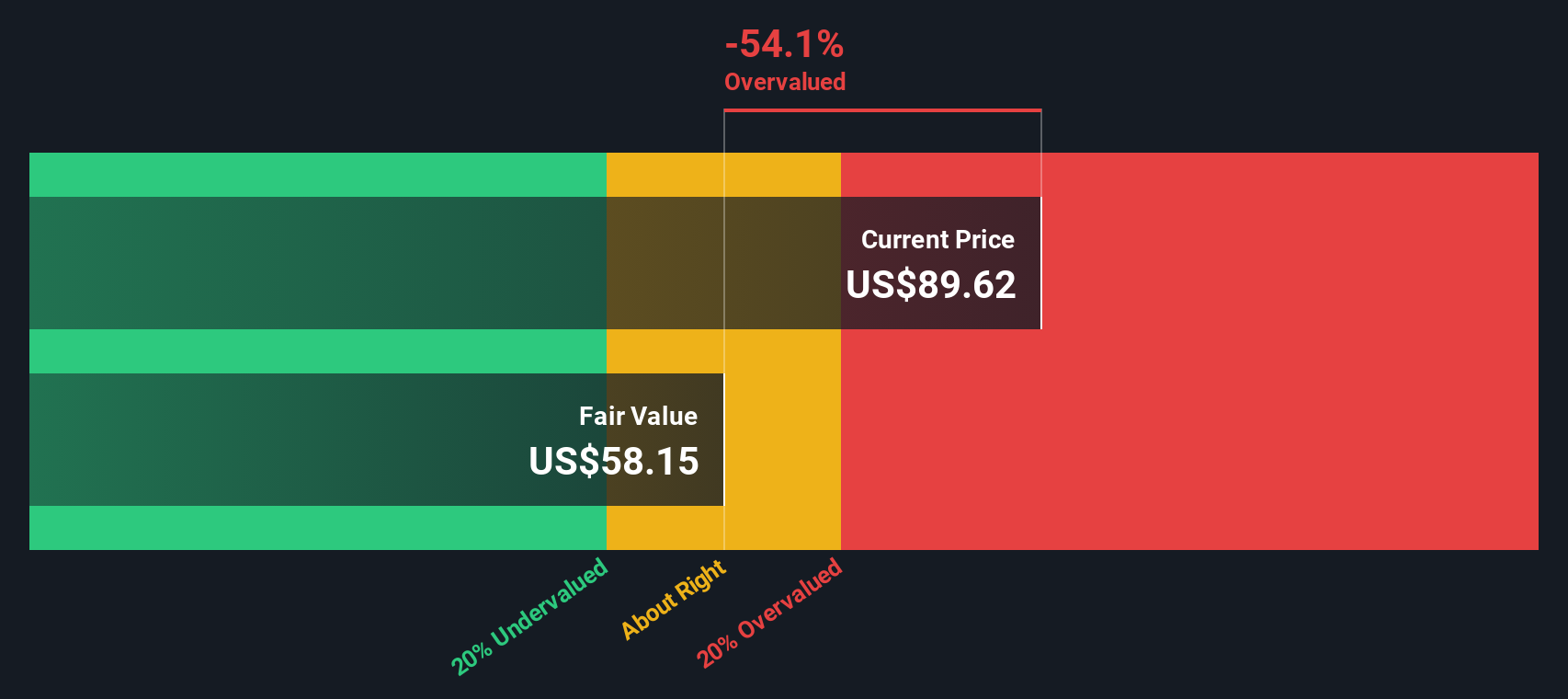

- Right now Nasdaq scores just 1 out of 6 on our valuation checks, which suggests the stock does not look like a bargain on most traditional metrics. The real story emerges when we compare different valuation approaches and, later in this article, look at a more complete way to judge what the shares are truly worth.

Nasdaq scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Nasdaq Excess Returns Analysis

The Excess Returns model looks at how much profit a company can generate above the minimum return investors require on its equity, then capitalizes those extra profits into an estimated intrinsic value per share.

For Nasdaq, the model starts with a Book Value of $20.99 per share and a Stable EPS of $4.08 per share, based on weighted future Return on Equity estimates from 4 analysts. With an Average Return on Equity of 17.64% and a Cost of Equity of $1.99 per share, the company is expected to generate an Excess Return of $2.09 per share. Analysts also expect Stable Book Value to rise to $23.15 per share, based on estimates from 3 analysts, suggesting ongoing reinvestment at attractive rates.

When these excess returns are projected forward and discounted, the model points to an intrinsic value of about $62.27 per share. With the Excess Returns valuation implying the stock is 41.8% overvalued relative to the current market price, Nasdaq appears richly priced on this metric.

Result: OVERVALUED

Our Excess Returns analysis suggests Nasdaq may be overvalued by 41.8%. Discover 917 undervalued stocks or create your own screener to find better value opportunities.

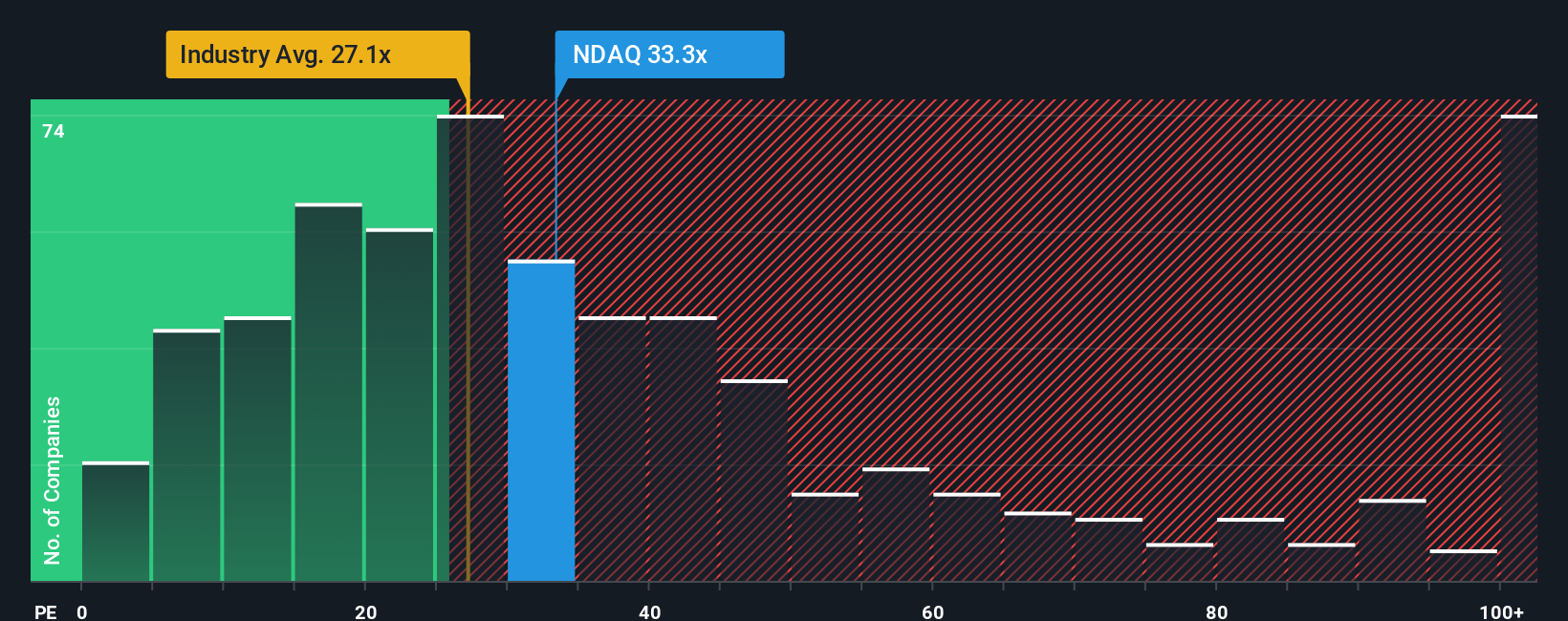

Approach 2: Nasdaq Price vs Earnings

For a consistently profitable business like Nasdaq, the price to earnings, or PE, ratio is a useful yardstick because it directly links what investors pay today to the company’s current earnings power. In general, faster earnings growth and lower perceived risk justify a higher PE, while slower growth or higher uncertainty should pull that multiple down.

Nasdaq currently trades at about 31.0x earnings, a touch below the 31.9x average of its closest peers but well above the wider Capital Markets industry average of 23.9x. At first glance, that suggests investors already pay a premium for Nasdaq’s earnings compared to the typical industry player, even if it is broadly in line with similar high quality peers.

To refine that view, Simply Wall St’s Fair Ratio framework estimates what a more tailored PE should be, after factoring in Nasdaq’s specific earnings growth outlook, profitability, risk profile, industry and market cap. For Nasdaq, this Fair Ratio is 16.0x. Based on these fundamentals, investors might reasonably expect to pay closer to mid teens earnings, not above 30x. Since the actual PE of 31.0x sits well above this Fair Ratio, the stock screens as materially overvalued on this approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Nasdaq Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Nasdaq’s story with a concrete forecast and Fair Value, all inside the Community page on Simply Wall St’s platform that is used by millions of investors. A Narrative lets you spell out why you think revenues, earnings and margins will move a certain way, turns that story into a set of numbers, and then into a Fair Value you can compare directly with today’s share price to help inform an investment decision. Because these Narratives update dynamically as new news, earnings or guidance comes in, your Fair Value view can evolve with the facts instead of staying frozen in time. For example, one Nasdaq Narrative might lean bullish, assuming its solutions and cloud partnerships drive stronger growth and justify something closer to the high analyst target of around $115. A more cautious Narrative might focus on regulatory and macro risks and land nearer the low target around $74. Seeing where your own view sits between those can help you act with more conviction.

Do you think there's more to the story for Nasdaq? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nasdaq might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NDAQ

Nasdaq

Operates as a technology company that serves capital markets and other industries worldwide.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026