- United States

- /

- Capital Markets

- /

- NasdaqGS:MRX

Marex Group (NasdaqGS:MRX) Valuation in Focus After Short Seller Report and Legal Investigation

Reviewed by Kshitija Bhandaru

Marex Group (NasdaqGS:MRX) has landed in the spotlight after a dramatic turn of events. On August 5, 2025, a prominent short seller released a report accusing the company of a multi-year accounting scheme involving opaque off-balance sheet entities and misleading disclosures. The situation escalated as the shareholders' rights law firm Hagens Berman announced an investigation into whether Marex violated securities laws. This has raised tough questions about the company’s risk exposure and profit reporting. For investors weighing their next move, this kind of headline can be hard to ignore.

These allegations sent Marex Group's share price tumbling in recent trading. Despite this, the stock remains up roughly 44% over the past year, even though momentum has waned in the past 3 months. Annual revenue growth has been negative while net income improved, creating a mixed picture that further complicates the story. With the market focused on risk, the stakes for Marex’s future valuation appear especially high right now.

After a year marked by impressive gains but now overshadowed by fresh controversy, some investors may be asking whether Marex Group is trading at a discount compared to its true worth, or if the market is bracing for tougher times ahead.

Most Popular Narrative: Narrative: 35.5% Undervalued

Based on the most widely followed view, Marex Group is trading well below its estimated fair value. This suggests room for upside should its business performance align with current projections.

Ongoing M&A activity, particularly the transformative Winterflood acquisition and a robust pipeline of smaller deals, is expected to drive both revenue and margin synergies through product and geographic diversification, cross-selling, and operational scale. These factors could positively impact topline and earnings stability.

Want to know what’s really behind this bold undervaluation? The Street's favorite narrative points to notable profit expansion, margin upgrades, and a valuation multiple that might defy expectations. Interested in uncovering which ambitious forecasts and strategic moves could increase Marex’s value? The full story reveals the hard numbers and hidden levers that support this outlook.

Result: Fair Value of $50.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising regulatory scrutiny and integration challenges from ongoing acquisitions could threaten Marex’s margin expansion and earnings stability in the years ahead.

Find out about the key risks to this Marex Group narrative.Another View: Testing Value with a Different Lens

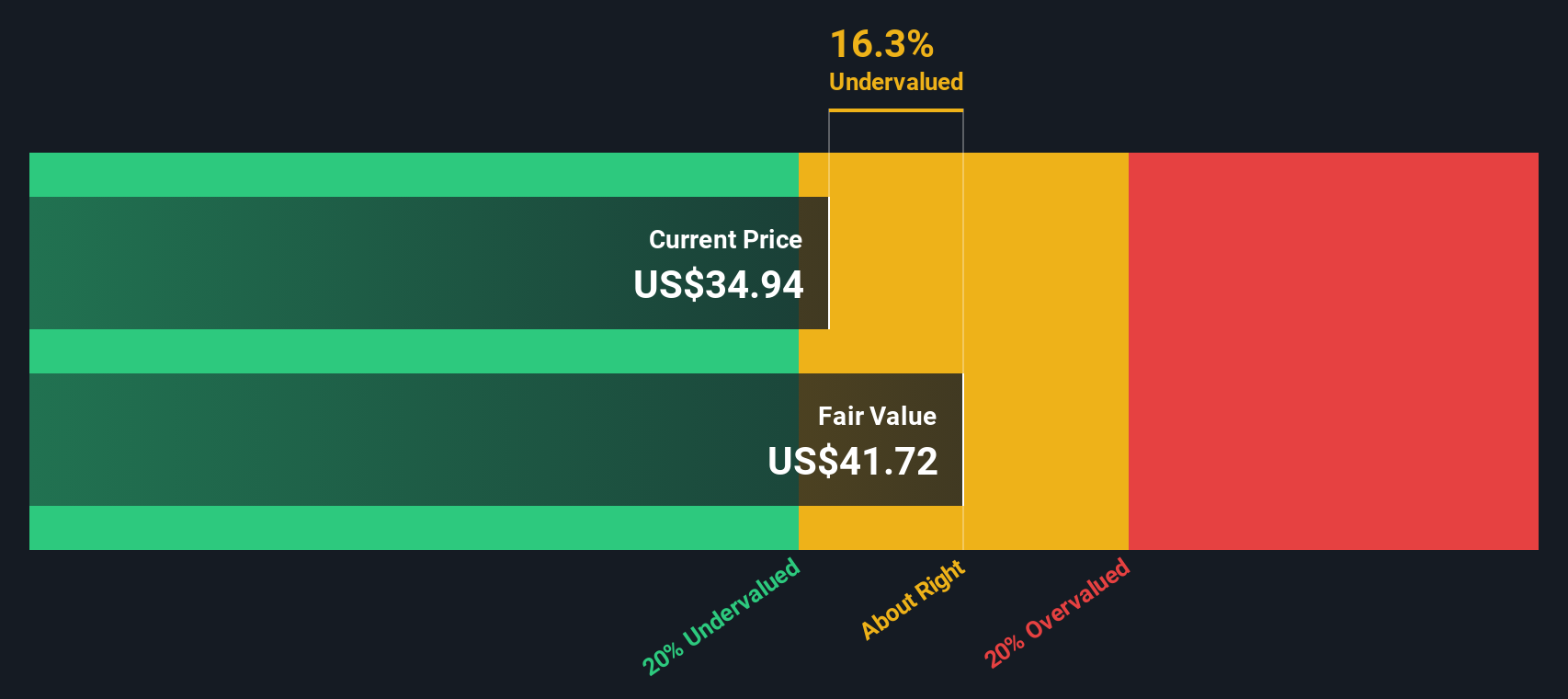

Taking a step back from analyst price targets, our DCF model also points to Marex Group being undervalued at current prices. If both methods agree, what might the market be missing about Marex Group’s risks or future prospects?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Marex Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Marex Group Narrative

If you see things differently or want to dig into the data on your own terms, you can craft your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Marex Group.

Looking for more investment ideas?

Smart investors are always on the lookout for that next compelling opportunity. Take the lead with these unique stock idea lists that could reveal your next winner, so don’t miss out:

- Unlock potential gains by tracking undervalued stocks based on cash flows. These companies trade below their true worth for sharp-eyed value seekers.

- Power up your portfolio with AI penny stocks, where innovators are pushing boundaries in artificial intelligence applications across industries.

- Tap into market trends and steady income with dividend stocks with yields > 3%, offering yields above 3% for investors who appreciate reliable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRX

Marex Group

A financial services platform provider company, provides liquidity, market access, and infrastructure services to clients in the energy, commodities, and financial markets in the United Kingdom, the United States, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives