- United States

- /

- Diversified Financial

- /

- NasdaqGS:MQ

The Bull Case For Marqeta (MQ) Could Change Following Leadership Scrutiny After Legal Probe Into Disclosure Practices

Reviewed by Sasha Jovanovic

- Recently, Marqeta faced an investigation by Kaskela Law LLC over potential breach of fiduciary duty claims related to alleged misleading statements about regulatory challenges and guidance cuts for the fourth quarter of 2024.

- This development has heightened scrutiny on the company's governance practices and transparency, sparking concerns among long-term investors about leadership accountability.

- We'll examine how heightened regulatory and legal scrutiny could influence Marqeta's investment narrative and its outlook going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Marqeta Investment Narrative Recap

To be a shareholder in Marqeta, you have to be confident in the company’s ability to sustain growth in global digital payments and defend its competitive edge despite heavy reliance on a few large clients and periods of regulatory pressure. The recent investigation into alleged misleading statements around regulatory challenges and the resulting sharp stock decline place legal and governance risks at the center of attention in the near term, but the material impact on customer retention and product innovation, Marqeta’s key catalysts, remains to be seen.

Among recent company announcements, the appointment of Mike Milotich as permanent CEO is most relevant to the current situation. Effective leadership continuity could be crucial as Marqeta addresses scrutiny related to transparency and governance, with investors likely evaluating if leadership stability helps bolster confidence in the company’s investment potential during a turbulent period.

Yet, against these developments, what some investors may be missing is the risk posed by...

Read the full narrative on Marqeta (it's free!)

Marqeta's outlook anticipates $900.6 million in revenue and $47.9 million in earnings by 2028. This scenario is based on analysts' assumptions of 17.6% annual revenue growth and an increase in earnings of $112.6 million from the current -$64.7 million.

Uncover how Marqeta's forecasts yield a $7.02 fair value, a 37% upside to its current price.

Exploring Other Perspectives

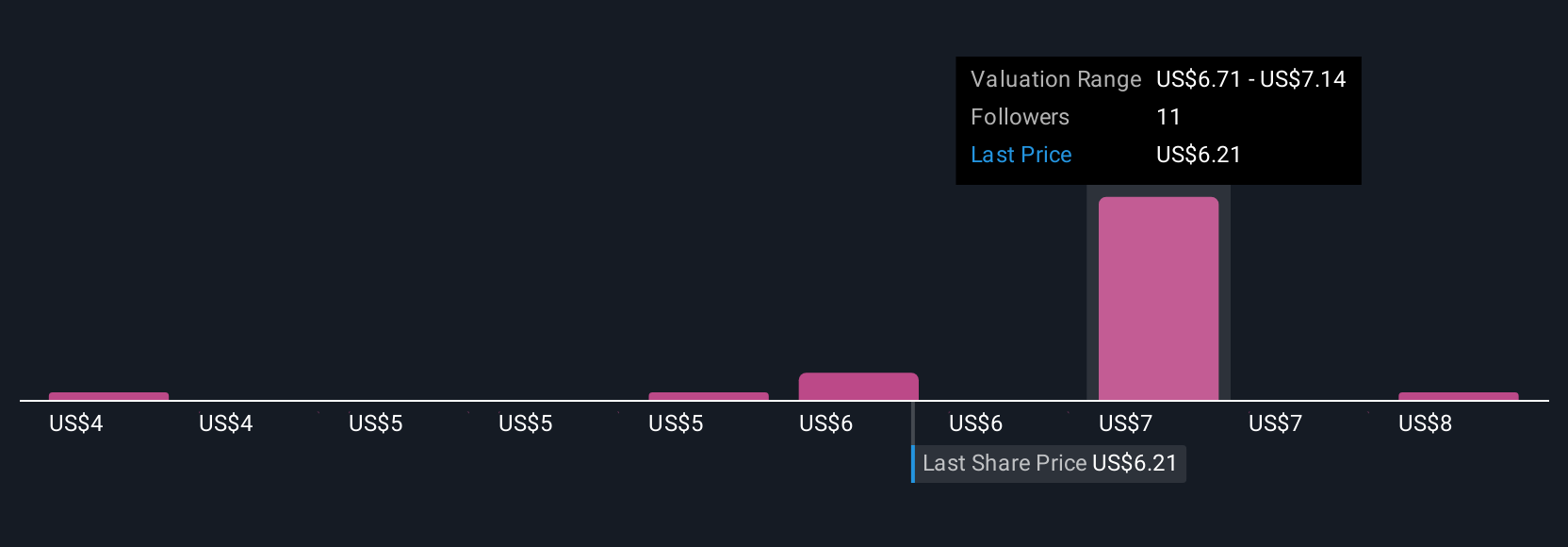

Six members of the Simply Wall St Community recently valued Marqeta between US$3.70 and US$8.00 per share, reflecting significant variation in individual outlooks. With regulatory scrutiny and customer concentration now at the forefront, you owe it to yourself to explore these perspectives and understand all sides of the company's future.

Explore 6 other fair value estimates on Marqeta - why the stock might be worth as much as 57% more than the current price!

Build Your Own Marqeta Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marqeta research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Marqeta research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marqeta's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MQ

Marqeta

Operates a cloud-based open API platform for card issuing and transaction processing services.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives