- United States

- /

- Entertainment

- /

- NasdaqGS:PLTK

High Insider Ownership Fuels Growth In These 3 Companies

Reviewed by Simply Wall St

As the major U.S. stock indices hit fresh records on optimism surrounding U.S.-China trade talks and robust earnings from tech giants, investors are increasingly attentive to companies with strong growth potential. In this environment, stocks with high insider ownership can offer unique insights into their prospects, as insiders' significant stakes often signal confidence in the company's future trajectory.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 92.9% |

| Prairie Operating (PROP) | 31.3% | 75.9% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11% | 30.4% |

| Celsius Holdings (CELH) | 10.8% | 31.6% |

| Atour Lifestyle Holdings (ATAT) | 18.3% | 23.7% |

| Astera Labs (ALAB) | 12.1% | 36.6% |

| AppLovin (APP) | 27.5% | 25.7% |

| Accelerant Holdings (ARX) | 24.9% | 66.5% |

We'll examine a selection from our screener results.

Marqeta (MQ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Marqeta, Inc. operates a cloud-based open API platform focused on card issuing and transaction processing services, with a market cap of approximately $2.12 billion.

Operations: The company generates revenue from its data processing segment, which amounts to $553.22 million.

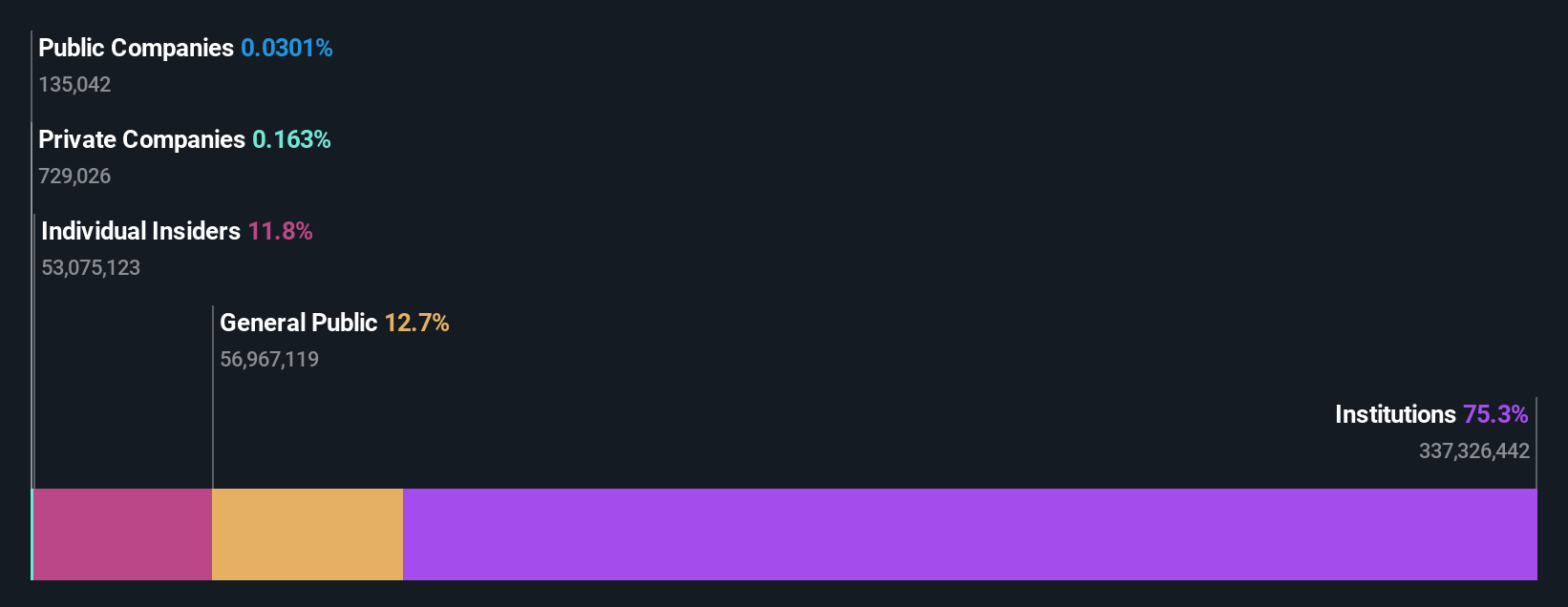

Insider Ownership: 11.8%

Marqeta has seen significant insider buying over the past three months, indicating confidence in its growth potential. Despite reporting a net loss for the second quarter of 2025, revenue increased to US$150.39 million from US$125.27 million a year ago. The company raised its earnings guidance for 2025, expecting revenue growth between 17% and 18%. Recent executive changes include Mike Milotich's appointment as CEO and Sarah Barkema's designation as Principal Accounting Officer.

- Click here to discover the nuances of Marqeta with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Marqeta is trading beyond its estimated value.

Playtika Holding (PLTK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Playtika Holding Corp. develops mobile games globally and has a market capitalization of approximately $1.38 billion.

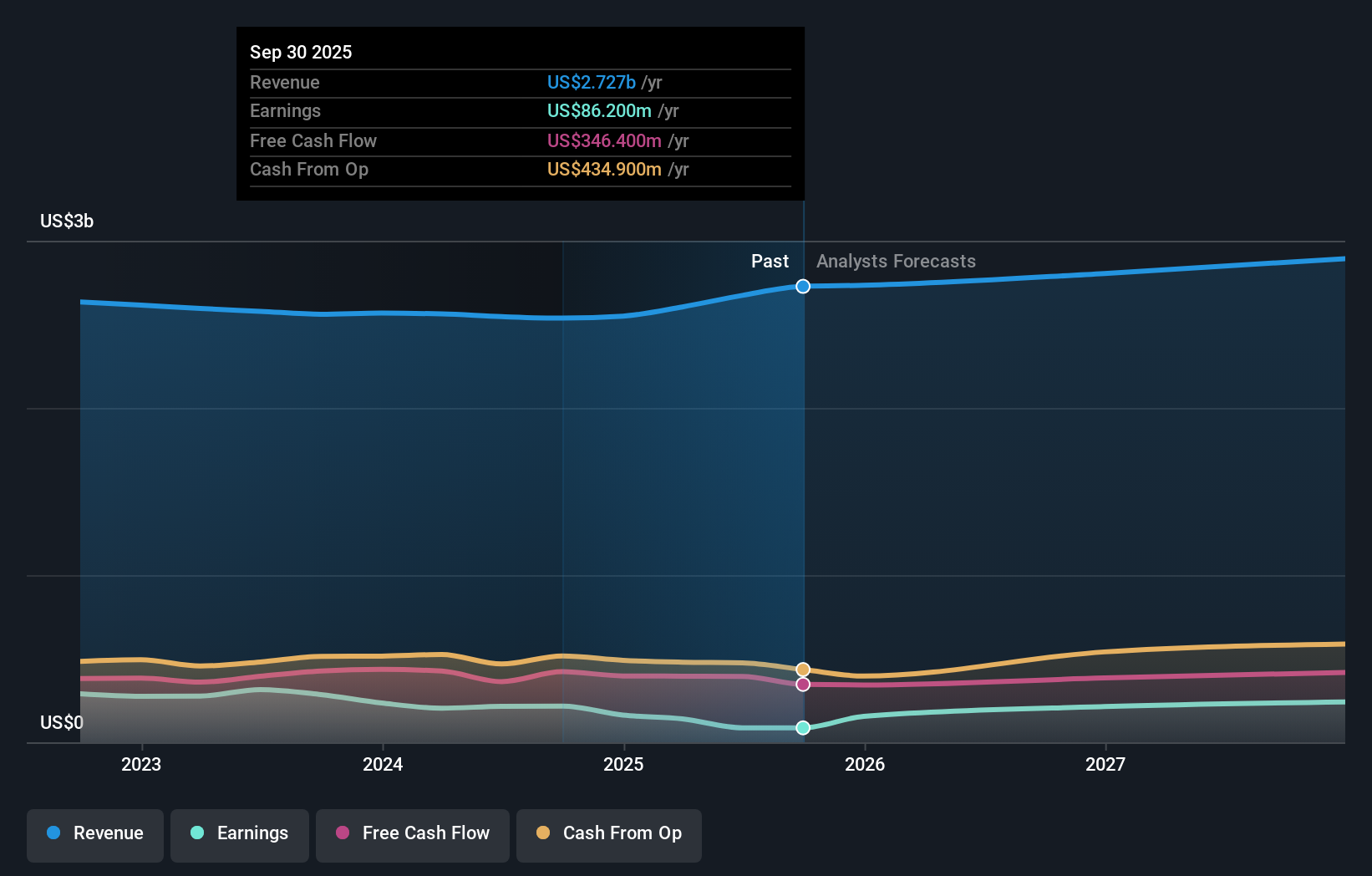

Operations: The company's revenue is primarily generated from its Computer Graphics segment, which amounts to $2.67 billion.

Insider Ownership: 26.4%

Playtika Holding, with substantial insider ownership, is trading significantly below its estimated fair value. Despite a forecasted revenue growth of only 3.4% annually, earnings are expected to grow substantially at 26.1% per year, outpacing the broader US market. Recent executive changes include Erez Hershkovitz's appointment as Chief Accounting Officer. However, the company's dividend sustainability is questionable due to low coverage by earnings and profit margins have decreased from last year’s levels.

- Unlock comprehensive insights into our analysis of Playtika Holding stock in this growth report.

- Our expertly prepared valuation report Playtika Holding implies its share price may be lower than expected.

BBB Foods (TBBB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: BBB Foods Inc. operates a chain of grocery retail stores in Mexico and has a market cap of $3.36 billion.

Operations: The company's revenue primarily comes from the sale, acquisition, and distribution of various products and consumer goods, totaling MX$67.08 billion.

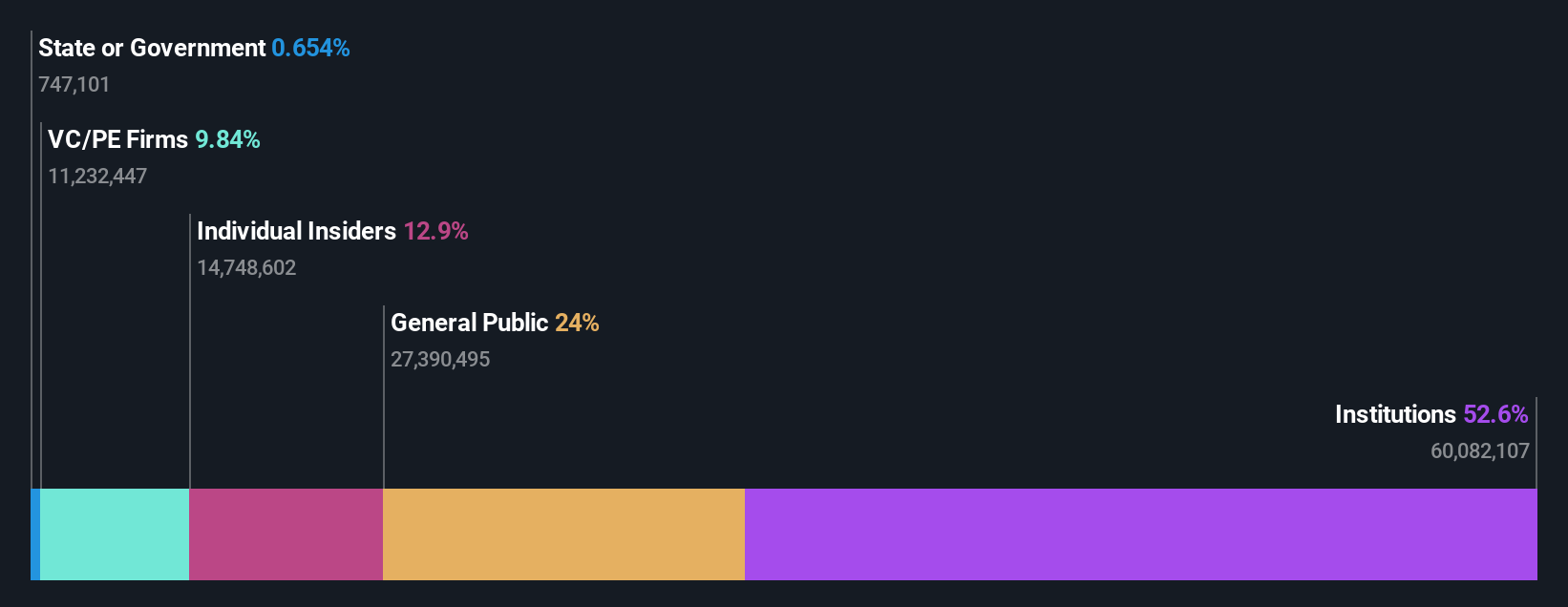

Insider Ownership: 12.7%

BBB Foods is trading 11.2% below its estimated fair value, with earnings having grown 57.5% annually over the past five years. Revenue is projected to increase by 21.7% per year, surpassing the US market's growth rate of 10.1%. The company is expected to become profitable within three years, reflecting above-average market growth expectations. Despite no recent insider trading activity, high insider ownership aligns management interests with shareholders'. Return on equity is forecasted at a modest 15.8%.

- Dive into the specifics of BBB Foods here with our thorough growth forecast report.

- According our valuation report, there's an indication that BBB Foods' share price might be on the expensive side.

Next Steps

- Access the full spectrum of 201 Fast Growing US Companies With High Insider Ownership by clicking on this link.

- Ready For A Different Approach? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLTK

Playtika Holding

Develops mobile games in the United States, Europe, the Middle East, Africa, the Asia Pacific, and internationally.

Moderate risk and good value.

Similar Companies

Market Insights

Community Narratives