- United States

- /

- Capital Markets

- /

- NasdaqGS:MORN

Did the SS&C Alliance and Widespread Client Migration Just Reshape Morningstar's (MORN) Investment Narrative?

Reviewed by Simply Wall St

- On August 21, 2025, SS&C Technologies announced strong progress in its partnership with Morningstar, with more than 400 wealth management firms moving from Morningstar Office to the SS&C Black Diamond platform and receiving extensive onboarding support and integrated Morningstar tools.

- This coordinated migration of clients marks a significant transformation for Morningstar's wealth management technology business, highlighting shifts in market positioning and service integration.

- We'll explore how this widespread client transition through the SS&C alliance reshapes Morningstar's investment narrative and competitive landscape.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Morningstar's Investment Narrative?

For shareholders, the core rationale behind investing in Morningstar centers around the belief in the company’s ability to grow its financial data and research offerings, protect its strong profit margins, and benefit from expanding client partnerships. The latest news of 400 wealth management firms transitioning to the SS&C Black Diamond platform is meaningful, as it signals a shift in Morningstar’s wealth management technology approach, reallocating resources from its legacy Office platform to deeper integration of its data and advisory tools through powerful industry alliances. While this partnership highlights adaptability and could accelerate adoption of its advisory suite, it also introduces short-term risks tied to client migration execution and the competitive threat of ceding control over the end-client platform experience. Prior to this development, the biggest catalysts were ongoing earnings growth, consistent buybacks, dividends, and new product innovation, but execution risks related to partner dependence and change management now rise higher on the radar. Recent share price softness may reflect both macro concerns and the uncertainty surrounding this shift, meaning the impact of this transition is likely to be more than just a technical footnote in the quarters ahead.

However, one risk that stands out is the reliance on third-party partners for client platform delivery.

Exploring Other Perspectives

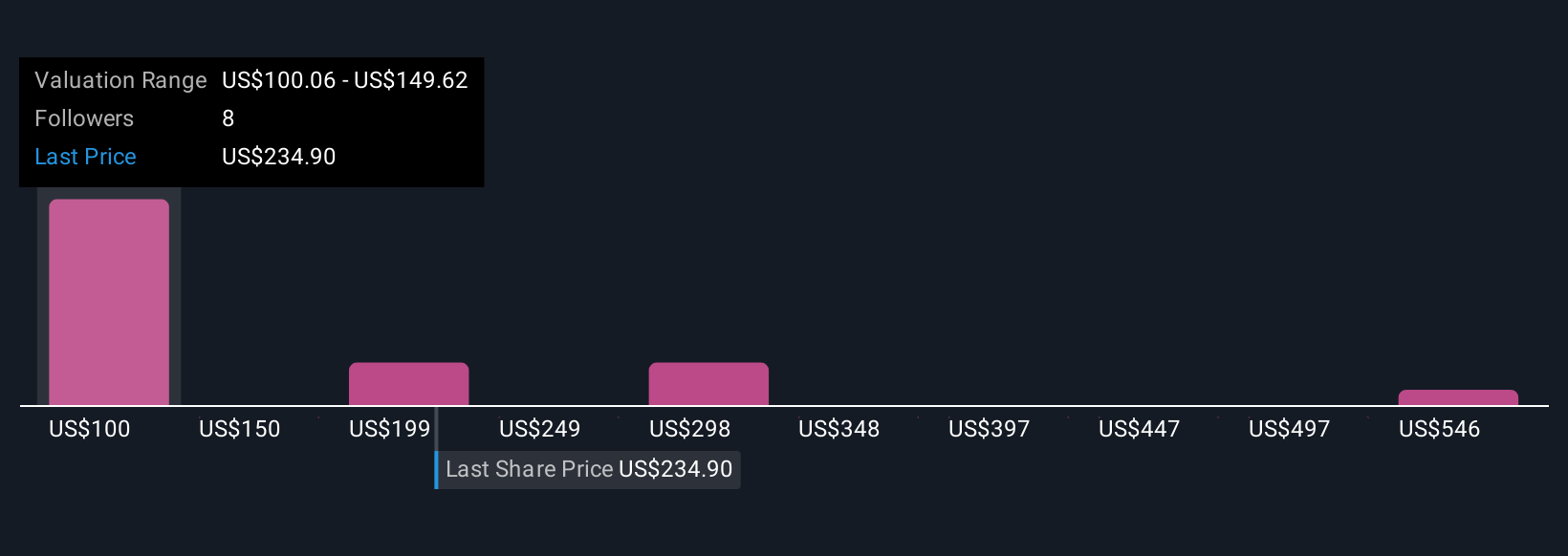

Explore 4 other fair value estimates on Morningstar - why the stock might be worth less than half the current price!

Build Your Own Morningstar Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Morningstar research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Morningstar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Morningstar's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 28 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MORN

Morningstar

Provides independent investment insights in the United States, Asia, Australia, Canada, Continental Europe, the United Kingdom, and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives