- United States

- /

- Capital Markets

- /

- NasdaqGS:MKTX

MarketAxess (MKTX): Reassessing Valuation After a Year of Share Price Weakness and Slower Momentum

Reviewed by Simply Wall St

MarketAxess Holdings (MKTX) has been grinding lower this year, with the stock down about 29% year to date and roughly 33% over the past year, even as earnings and revenue continue to grow.

See our latest analysis for MarketAxess Holdings.

The latest leg down, including a 14.8% 90 day share price return and a 33.5% 1 year total shareholder return, signals fading momentum as investors reassess what they are willing to pay for the company’s consistent but steady growth.

If this kind of re rating has you rethinking your exposure to financial infrastructure names, it is a good moment to broaden your search and explore fast growing stocks with high insider ownership

With shares sliding despite solid double digit profit growth and a sizable gap to analyst targets, the key question now is whether MarketAxess is quietly drifting into undervalued territory or if the market already sees growth stalling from here.

Most Popular Narrative Narrative: 20.5% Undervalued

With MarketAxess closing at $159.71 against a narrative fair value near $201, the current gap frames an intriguing long term valuation story.

The analysts have a consensus price target of $218.833 for MarketAxess Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $274.0, and the most bearish reporting a price target of just $168.0.

Curious how a maturing, slower growing platform still earns a premium style earnings multiple and higher margins in this narrative? The long range revenue, profit and discount rate assumptions quietly reshape what fair value could mean here.

Result: Fair Value of $200.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained market share losses to rivals and slower adoption of new protocols could cap volumes, compress fees, and challenge the undervaluation thesis.

Find out about the key risks to this MarketAxess Holdings narrative.

Another Angle on Valuation

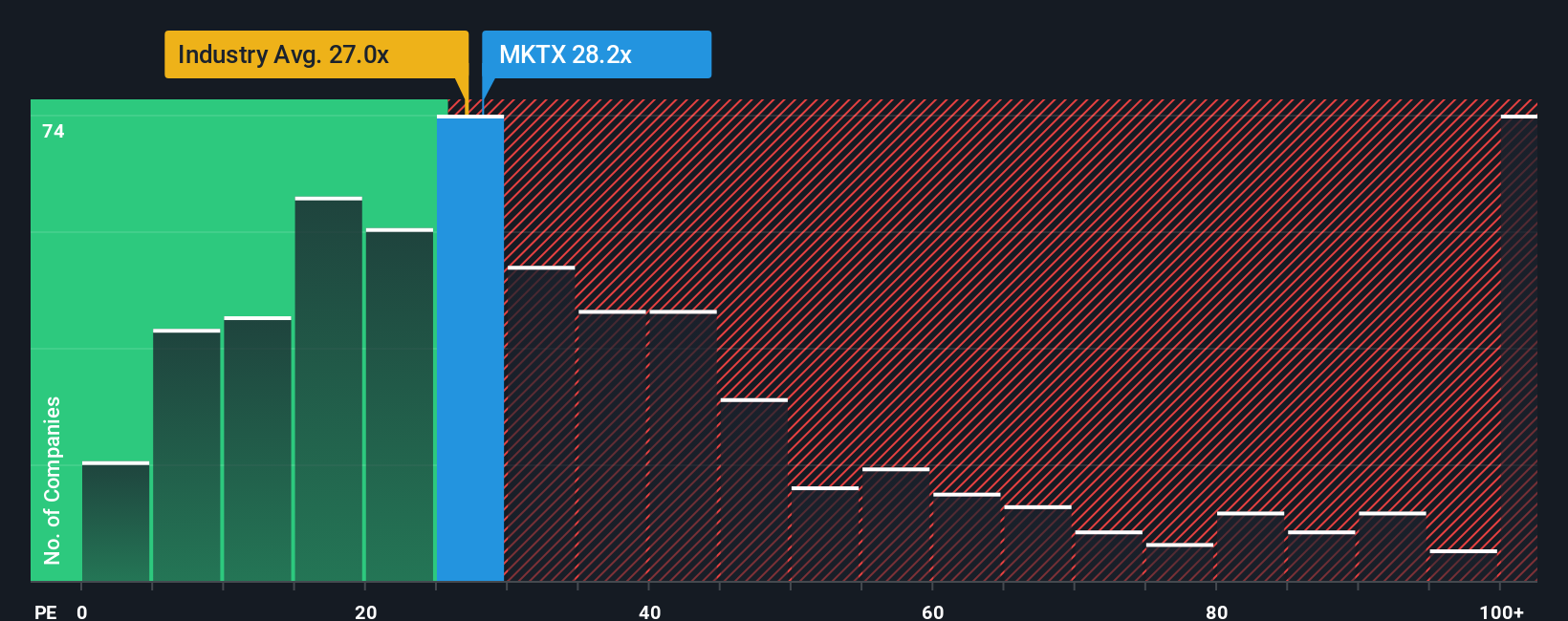

On traditional earnings metrics, MarketAxess looks far less forgiving. Its P/E ratio of 27 times earnings sits above the US Capital Markets industry at 23.8 times, peers at 26.3 times, and well ahead of a fair ratio of 14.8 times. This suggests meaningful derating risk if sentiment sours further.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MarketAxess Holdings Narrative

If you see things differently or want to dig into the numbers yourself, you can build a custom view in just a few minutes. Do it your way

A great starting point for your MarketAxess Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next moves with fresh stock ideas from our screeners so you are not leaving potential returns on the table.

- Explore potential mispricings by reviewing these 907 undervalued stocks based on cash flows, focusing on companies that generate strong cash flows yet still trade below what their fundamentals suggest.

- Seek exposure to innovation by targeting these 26 AI penny stocks built around real world applications and growing revenue engines.

- Support your income strategy by focusing on these 14 dividend stocks with yields > 3% that combine regular payouts with solid underlying businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MKTX

MarketAxess Holdings

Operates an electronic trading platform for institutional investor and broker-dealer firms in the United States, the United Kingdom, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026