- United States

- /

- Capital Markets

- /

- NasdaqGS:MKTX

MarketAxess Holdings (NASDAQ:MKTX) shareholders have endured a 42% loss from investing in the stock three years ago

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. Unfortunately, that's been the case for longer term MarketAxess Holdings Inc. (NASDAQ:MKTX) shareholders, since the share price is down 44% in the last three years, falling well short of the market return of around 22%. The falls have accelerated recently, with the share price down 12% in the last three months.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

Check out our latest analysis for MarketAxess Holdings

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

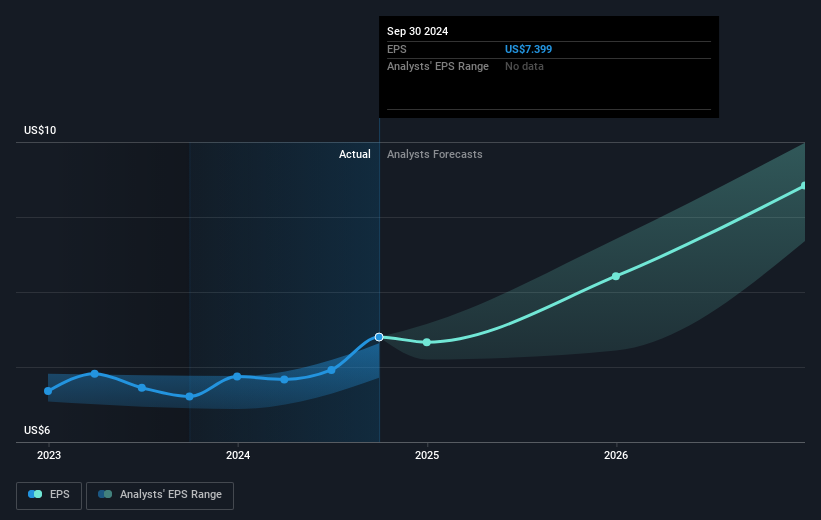

During the three years that the share price fell, MarketAxess Holdings' earnings per share (EPS) dropped by 0.2% each year. The share price decline of 18% is actually steeper than the EPS slippage. So it seems the market was too confident about the business, in the past.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that MarketAxess Holdings has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

A Different Perspective

Investors in MarketAxess Holdings had a tough year, with a total loss of 19% (including dividends), against a market gain of about 25%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 6% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with MarketAxess Holdings , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

If you're looking to trade MarketAxess Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MKTX

MarketAxess Holdings

Operates an electronic trading platform for institutional investor and broker-dealer firms in the United States, the United Kingdom, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives