- United States

- /

- Trade Distributors

- /

- NYSE:ZKH

Discover LexinFintech Holdings And 2 More Insider-Favored Growth Companies

Reviewed by Simply Wall St

As the U.S. stock market takes a breather following a series of gains for the S&P 500, investors remain attentive to insider ownership as a potential indicator of confidence in growth companies. In this environment, stocks with high insider ownership can be particularly appealing, as they suggest that those closest to the company are optimistic about its future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 25.3% | 39.1% |

| Duolingo (NasdaqGS:DUOL) | 14.3% | 39.9% |

| AST SpaceMobile (NasdaqGS:ASTS) | 13.4% | 64.6% |

| FTC Solar (NasdaqCM:FTCI) | 27.9% | 61.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.1% | 65.1% |

| Astera Labs (NasdaqGS:ALAB) | 15.2% | 44.6% |

| BBB Foods (NYSE:TBBB) | 16.2% | 30.2% |

| Enovix (NasdaqGS:ENVX) | 12.1% | 58.4% |

| Upstart Holdings (NasdaqGS:UPST) | 12.5% | 102.6% |

| Ryan Specialty Holdings (NYSE:RYAN) | 15.6% | 91% |

We're going to check out a few of the best picks from our screener tool.

LexinFintech Holdings (NasdaqGS:LX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LexinFintech Holdings Ltd., along with its subsidiaries, offers online consumer finance services in the People's Republic of China and has a market cap of approximately $1.47 billion.

Operations: The company generates revenue of CN¥14.20 billion from its online retailer segment in the People's Republic of China.

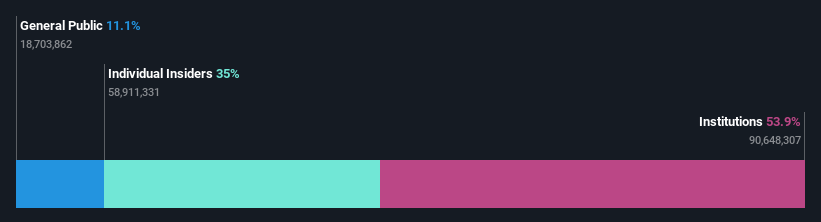

Insider Ownership: 35%

Earnings Growth Forecast: 34.8% p.a.

LexinFintech Holdings demonstrates strong insider ownership, with earnings forecasted to grow significantly at 34.8% annually, outpacing the broader US market. Despite this growth potential, revenue is expected to increase at a more modest 5.9% per year, lagging behind market averages. Recent executive changes include the retirement of President Jared Yi Wu, who remains on the board as a senior advisor. The company has reported substantial net income growth and announced dividend increases amidst a volatile share price environment.

- Get an in-depth perspective on LexinFintech Holdings' performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility LexinFintech Holdings' shares may be trading at a discount.

loanDepot (NYSE:LDI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: loanDepot, Inc. operates in the United States by originating, financing, selling, and servicing residential mortgage loans with a market cap of approximately $405.79 million.

Operations: The company's revenue is primarily derived from the originating, financing, and selling of mortgage loans, totaling $1.09 billion.

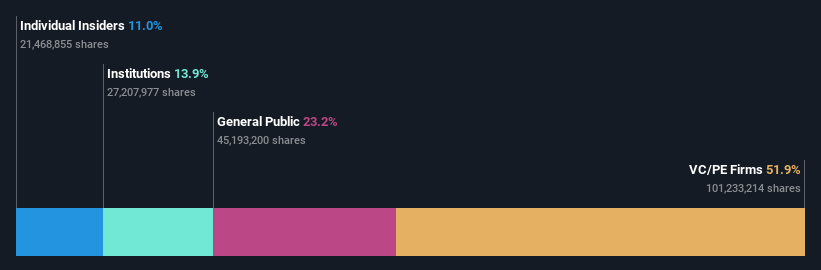

Insider Ownership: 12.3%

Earnings Growth Forecast: 112.5% p.a.

loanDepot, with substantial insider ownership, is navigating leadership changes as founder Anthony Hsieh returns to an executive role. Despite a recent net loss of US$21.9 million for Q1 2025, the company is expected to achieve profitability within three years and forecasts revenue growth at 15.5% annually, surpassing the US market average. However, return on equity remains low at 8.3%. The stock trades at a favorable value compared to peers amidst these developments.

- Take a closer look at loanDepot's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that loanDepot is trading behind its estimated value.

ZKH Group (NYSE:ZKH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ZKH Group Limited operates a trading and service platform for maintenance, repair, and operating (MRO) products in China, including spare parts and office supplies, with a market cap of approximately $485.05 million.

Operations: The company's revenue primarily comes from its Business-To-Business Trading and Services of Industrial Products segment, which generated CN¥8.76 billion.

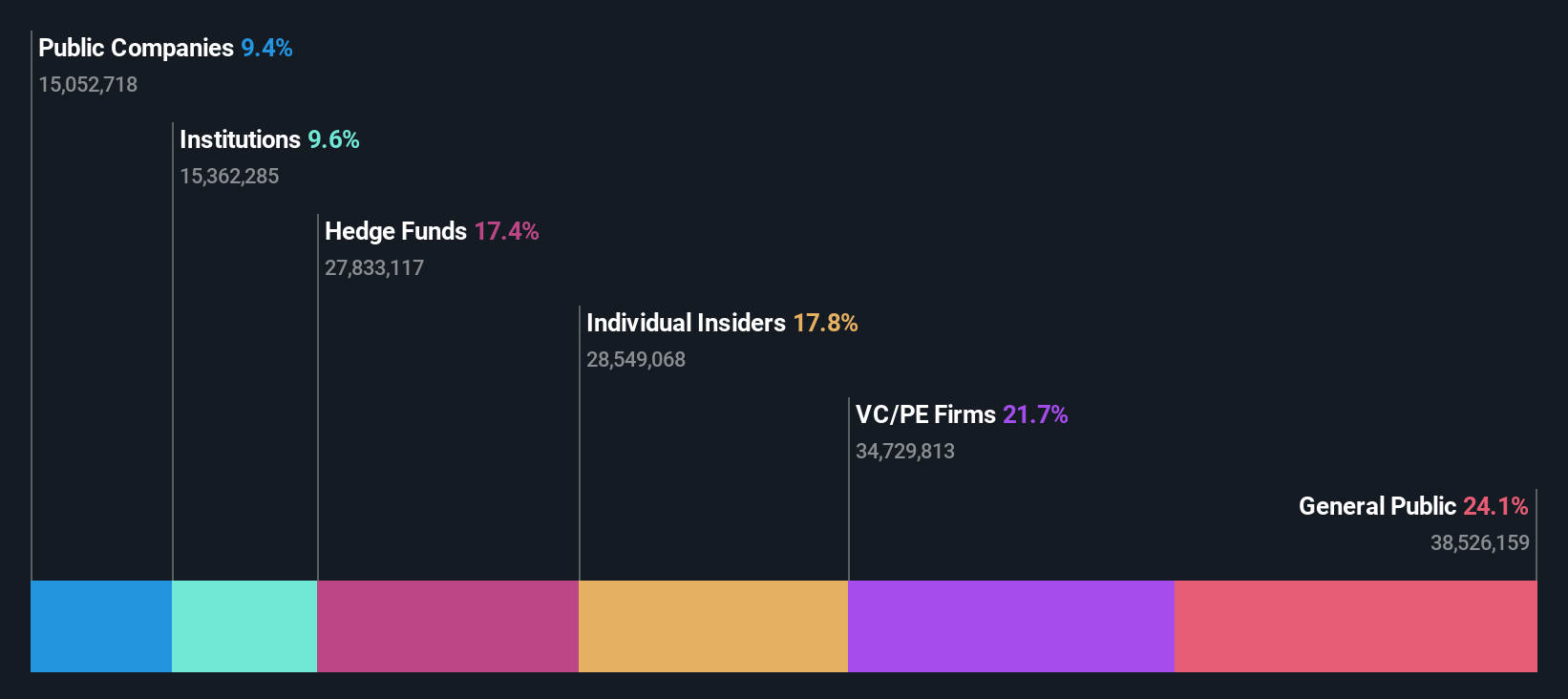

Insider Ownership: 17.7%

Earnings Growth Forecast: 102.3% p.a.

ZKH Group, benefiting from high insider ownership, reported reduced net losses for Q1 2025 with revenue at CNY 1.94 billion. The company is forecast to achieve profitability within three years and expects earnings growth of over 100% annually. Trading significantly below estimated fair value, ZKH's revenue growth outpaces the US market average at 10.7% per year. Analysts anticipate a potential stock price increase of 40.7%, though return on equity remains modestly low at 8.4%.

- Click to explore a detailed breakdown of our findings in ZKH Group's earnings growth report.

- Our comprehensive valuation report raises the possibility that ZKH Group is priced lower than what may be justified by its financials.

Seize The Opportunity

- Click here to access our complete index of 191 Fast Growing US Companies With High Insider Ownership.

- Searching for a Fresh Perspective? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if ZKH Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZKH

ZKH Group

Develops and operates a maintenance, repair, and operating (MRO) products trading and service platform that offers spare parts, chemicals, manufacturing parts, general consumables, and office supplies in the People’s Republic of China.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives