- United States

- /

- Capital Markets

- /

- NasdaqGS:LPLA

LPL Financial (LPLA) Is Up 10.9% After Beating Q3 Adjusted Earnings and Acquiring Commonwealth

Reviewed by Sasha Jovanovic

- LPL Financial Holdings Inc. reported third quarter 2025 earnings showing US$4.55 billion in revenue, with adjusted earnings exceeding analyst estimates, and highlighted recent M&A activity including the completed acquisition of Commonwealth Financial Network.

- An interesting insight is that, despite reporting a net loss due to acquisition-related accounting costs, the company delivered strong adjusted earnings growth and continued expanding advisory assets, signaling progress in its ongoing transformation and business momentum.

- We'll explore how LPL Financial’s outperformance in adjusted earnings and successful integration of acquired firms may impact its investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

LPL Financial Holdings Investment Narrative Recap

Investors in LPL Financial Holdings need to believe that large-scale advisor and asset growth, underpinned by robust M&A execution and operational scale, will drive long-term earnings and margin improvement. The recent acquisition of Commonwealth Financial Network enhances LPL’s competitive positioning, but the most immediate catalyst, successful integration and asset retention, remains critical, while execution risk from ongoing M&A continues to be the biggest watchpoint. The recent earnings surprise and asset growth reinforce the bullish narrative, but the impact on risks around integration is still material.

Among the recent announcements, the completed onboarding of Edge Wealth Advisory Group is most relevant, as it underscores LPL’s advisor recruitment momentum and can be seen as evidence of continued interest from experienced independent teams. These advisor additions directly influence organic growth and margin stabilization, both key short-term catalysts, especially as LPL manages ambitious integration and retention targets from its latest acquisitions.

However, investors should also pay attention to how ongoing acquisition integration risk could affect future margin performance if execution does not go to plan...

Read the full narrative on LPL Financial Holdings (it's free!)

LPL Financial Holdings' narrative projects $23.0 billion revenue and $1.9 billion earnings by 2028. This requires 18.7% yearly revenue growth and an increase in earnings of $0.8 billion from $1.1 billion today.

Uncover how LPL Financial Holdings' forecasts yield a $420.93 fair value, a 12% upside to its current price.

Exploring Other Perspectives

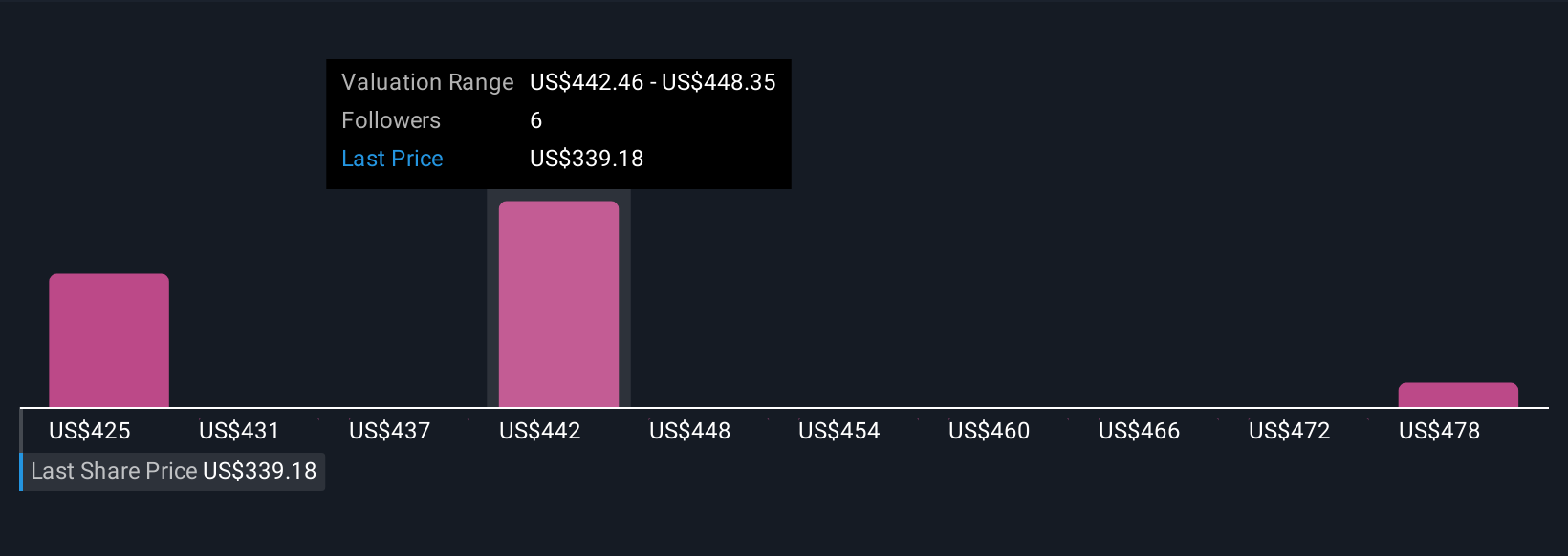

Across three separate fair value estimates from the Simply Wall St Community, expectations for LPL Financial range widely from US$326 to US$484 per share. Given the recent acceleration in advisor recruitment, these differing outlooks reflect how varied assumptions can influence your view on LPL’s path forward.

Explore 3 other fair value estimates on LPL Financial Holdings - why the stock might be worth as much as 28% more than the current price!

Build Your Own LPL Financial Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LPL Financial Holdings research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free LPL Financial Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LPL Financial Holdings' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LPLA

LPL Financial Holdings

Provides an integrated platform of brokerage and investment advisory services to independent financial advisors and financial advisors at institutions in the United States.

High growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives