- United States

- /

- Capital Markets

- /

- NasdaqGS:LPLA

LPL Financial Holdings (LPLA): Assessing Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

LPL Financial Holdings (LPLA) has seen steady gains over the past year, climbing around 15%, with the past month providing an additional 7% bump. Investors are keeping an eye on ongoing sector trends to gauge what is next.

See our latest analysis for LPL Financial Holdings.

LPL Financial Holdings’ recent 1-month share price return of nearly 7% has helped it notch a solid gain for the year, with 12-month total shareholder return running north of 15%. Despite a slight pullback in the past week, overall momentum is still trending positive. This points to resilient investor confidence as the sector evolves and growth prospects come into focus.

If you want to keep your options open, now’s the perfect time to discover fast growing stocks with high insider ownership.

With a strong run-up in recent months and share prices still sitting below analyst targets, the question now is whether LPL Financial Holdings is trading at a bargain or if the market has already accounted for its future growth potential.

Most Popular Narrative: 14.1% Undervalued

With the latest popular narrative setting LPL Financial Holdings' fair value at $420.93, the stock’s recent close at $361.40 suggests meaningful upside remains on the table. The narrative digs into structural trends and core financial drivers supporting the bulls and provides a clear catalyst investors are watching.

Strategic investments in proprietary technology platforms and automation are driving ongoing operational efficiencies. This has led to improved operating leverage and sustainable gains in net margins, as reflected in enhanced margin guidance and cost discipline initiatives that are ahead of schedule.

What’s fueling this optimism? The full narrative reveals ambitious projections for top and bottom line growth, and a profit multiple that’s not just high for the sector, but hints at confidence levels usually reserved for dominant industry players. Want the complete picture on just how aggressive these profit and revenue targets get? There’s a twist in the numbers that could surprise even seasoned investors. Get the full story before the market catches up.

Result: Fair Value of $420.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent earnings volatility from interest rate shifts and the complex integration of acquisitions could quickly challenge the optimistic outlook for LPL Financial Holdings.

Find out about the key risks to this LPL Financial Holdings narrative.

Another View: What About Valuation Multiples?

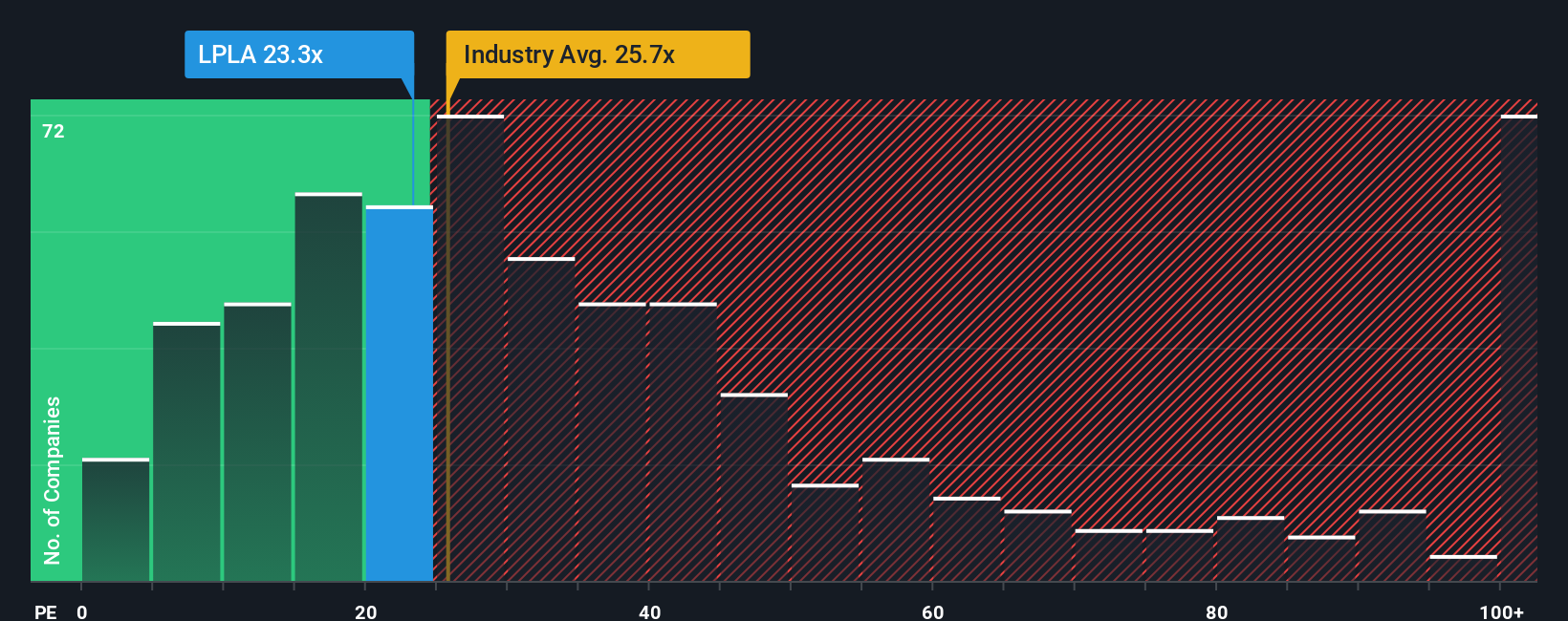

Looking at valuation through the lens of the price-to-earnings ratio tells a different story. LPL Financial Holdings trades at 34.7x earnings, which is much higher than both its peer average (21.2x) and the broader industry (24.9x). That is also above the level suggested by the fair ratio of 21.5x. This gap hints that the stock is priced for strong growth, but leaves less of a margin for error if expectations slip. Is the market too optimistic, or could the premium be justified by future results?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LPL Financial Holdings Narrative

If you have a different perspective or prefer to draw your own conclusions, you can quickly build your own narrative using the available data. It takes less than three minutes. Do it your way

A great starting point for your LPL Financial Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Act now to spot tomorrow’s winners by using the Simply Wall Street Screener to target unique opportunities other investors might overlook. Missing out could mean missing your next big gain.

- Catch high-yield opportunities by checking out these 18 dividend stocks with yields > 3%, which connects you with companies boasting sustainable dividend payouts above 3%.

- Ride the artificial intelligence wave by reviewing these 27 AI penny stocks, where innovators are reshaping industries with bold AI-driven solutions.

- Strengthen your portfolio with value buys, starting with these 896 undervalued stocks based on cash flows, which is based on real cash-flow fundamentals and growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LPLA

LPL Financial Holdings

Provides an integrated platform of brokerage and investment advisory services to independent financial advisors and financial advisors at institutions in the United States.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives