- United States

- /

- Consumer Finance

- /

- NasdaqGS:KSPI

Does Kaspi Offer a Buying Opportunity After Recent 31% Share Price Slide?

Reviewed by Bailey Pemberton

So, you’re eyeing Kaspi.kz and wondering whether the current stock price is an opportunity or just a value trap. It’s not an easy call, especially when the numbers are playing tricks. Over the past year, the share price has slumped by 31.1%, and year-to-date it’s down 25.1%. Even the last 30 days saw a further drop of 13.5%. Those red numbers can shake anyone’s confidence. But here’s what makes this interesting: go back three years, and Kaspi.kz has delivered a total return of 49.8%. This shows that the market has seen promise here before.

Some of that tumble is due to recent headlines out of Kazakhstan. News about regulatory changes and shifts in the competitive landscape have pushed investors into “wait and see” mode. While these stories have fueled uncertainty, they have also opened up the classic debate: is the stock now getting too cheap for its own good?

That is exactly what we’re digging into today. Kaspi.kz currently boasts a value score of 6 out of 6 on our undervaluation checks, a rare sweep that suggests the shares might be seriously undervalued by standard measures. But before you make any big decisions, let’s break down what those scores mean. Plus, I’ll share an even more reliable angle on valuation at the end that most investors miss entirely.

Why Kaspi.kz is lagging behind its peers

Approach 1: Kaspi.kz Excess Returns Analysis

The Excess Returns model takes a different view from traditional fair value calculations. Instead of focusing on future free cash flows, it looks at how much capital Kaspi.kz has invested and how much profit it can generate over and above the cost of that capital. This is particularly useful for companies with high profitability and efficient capital usage.

For Kaspi.kz, the figures are impressive. The company has a book value of $10,244.26 per share and is expected to generate stable earnings per share of $8,510.64, based on weighted future Return on Equity estimates from four analysts. The cost of equity is $1,664.38 per share, which means the excess return, or the profit produced beyond that cost, totals $6,846.27 per share. Kaspi.kz’s return on equity averages a hefty 51.60%, pointing to highly productive use of shareholders’ money. The stable book value is forecast at $16,492.31 per share, as projected by three analysts.

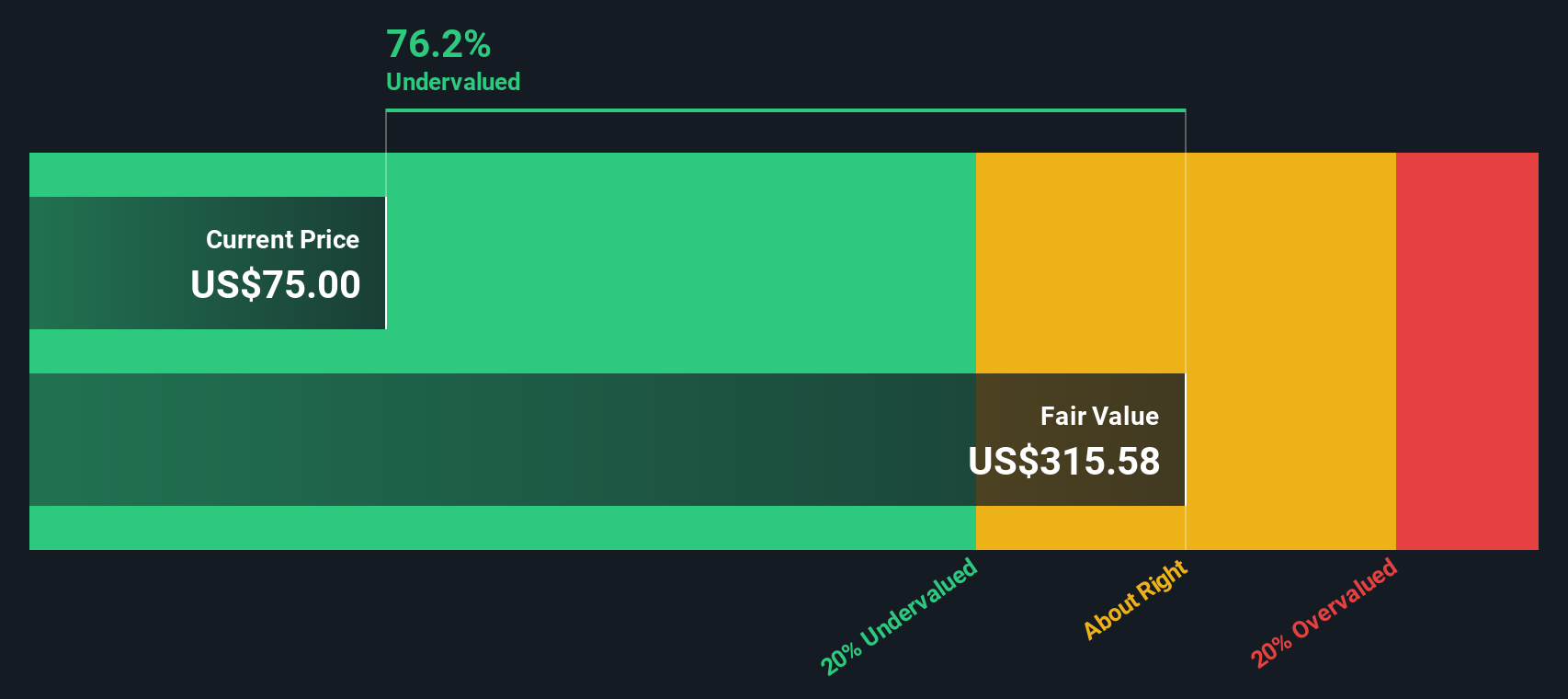

With these strong return metrics and a deep cushion of excess profitability, the Excess Returns model estimates Kaspi.kz is trading at a 64.8% discount to its intrinsic value. That is substantial undervaluation by this approach.

Result: UNDERVALUED

Our Excess Returns analysis suggests Kaspi.kz is undervalued by 64.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

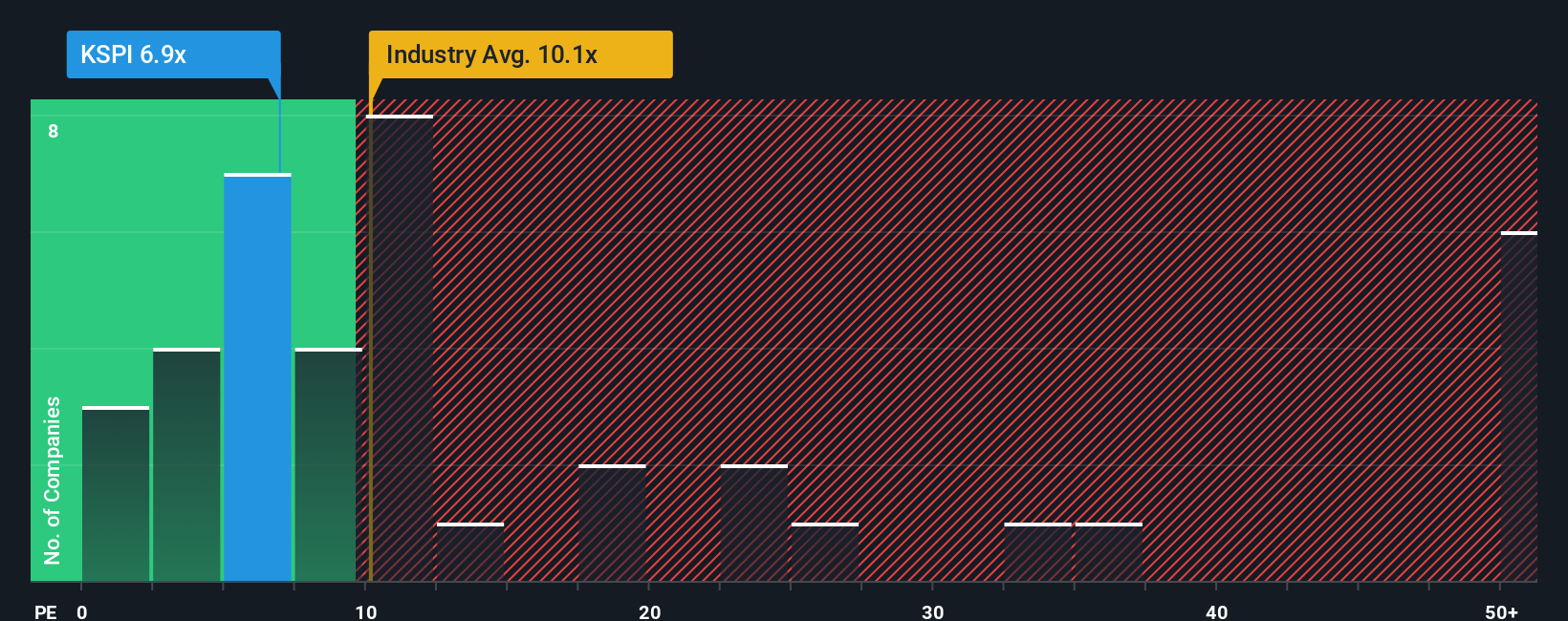

Approach 2: Kaspi.kz Price vs Earnings

For consistently profitable companies like Kaspi.kz, the price-to-earnings (PE) ratio is a popular and meaningful valuation measure. The PE ratio simply compares the market price to the company’s earnings, making it easy to see how much investors are willing to pay for each dollar of profits. What counts as a “normal” or “fair” PE can vary, though, depending on how quickly a business is expected to grow and what kind of risks are involved. Higher growth and lower risk usually command a higher PE.

Kaspi.kz is currently trading on a PE ratio of 7.0x, which is well below the global Consumer Finance industry average of 10.5x and the peer average of 65.3x. On the surface, this sounds like a bargain. However, simple comparisons can mislead, as they ignore the differences in each company’s profit margins, risk, size, and future prospects.

That is why Simply Wall St’s Fair Ratio is useful. The Fair Ratio, calculated at 17.9x for Kaspi.kz, reflects how the market should price its earnings, based on an in-depth look at its growth, profitability, business risks, industry, and market cap. This approach is more holistic than just lining up multiples side by side. Since Kaspi.kz’s current PE of 7.0x is significantly below its Fair Ratio, the shares appear undervalued using this lens.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kaspi.kz Narrative

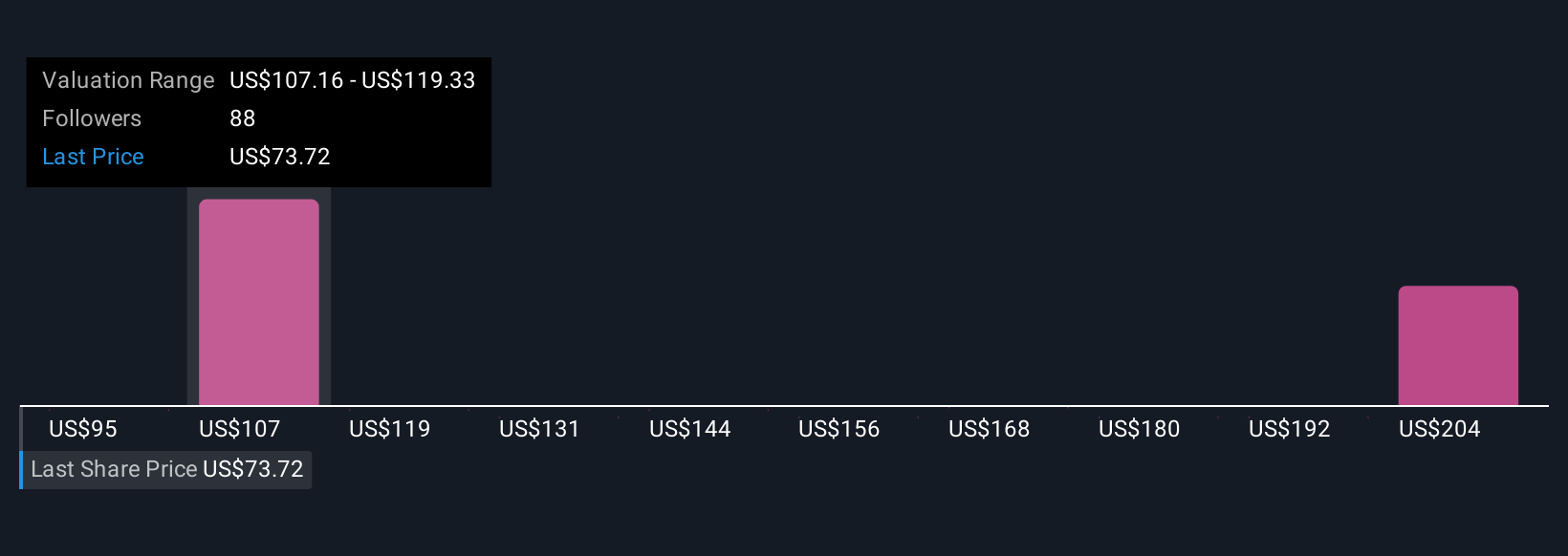

Earlier, we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is simply the story or perspective you have about a company, built on your own expectations for fair value and estimates of future revenue, earnings, and margins. This approach helps you connect the dots between what the business does, how it might perform, and what you believe the shares are worth.

Narratives help turn complex financial analysis into a practical decision tool by linking a company’s story to a forecast, and then to an explicit fair value. On Simply Wall St’s Community page, millions of investors use Narratives to quickly model their beliefs, compare them with others, and see what’s driving bullish or bearish sentiment right now.

Because Narratives update dynamically as new news or results come in, you can easily track whether your assumptions still stack up and decide if the Fair Value now makes the current Price a buy or a sell. For example, some on the platform see Kaspi.kz unlocking rapid growth if deposit products and new markets take off, valuing shares as high as KZT130.73, while others are more cautious about regulatory risks and set their targets closer to KZT86.54. With Narratives, you have all those perspectives and the tools to define your own at your fingertips.

Do you think there's more to the story for Kaspi.kz? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kaspi.kz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KSPI

Kaspi.kz

Provides payments, marketplace, and fintech solutions for consumers and merchants in Kazakhstan, Azerbaijan, and Ukraine.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives