- United States

- /

- Diversified Financial

- /

- NasdaqGS:JKHY

Jack Henry & Associates (JKHY): Valuation Check After Earnings Beat and Fresh Analyst Upgrades

Reviewed by Simply Wall St

Jack Henry & Associates (JKHY) just cleared a key hurdle by beating Wall Street expectations with its fiscal 2026 first quarter earnings, while also picking up fresh upgrades from Raymond James and Compass Point that highlight emerging growth drivers.

See our latest analysis for Jack Henry & Associates.

The upbeat quarter and analyst upgrades arrive after a solid run, with a 30 day share price return of 16.93 percent and a steadier 1 year total shareholder return of 3.56 percent suggesting momentum is quietly rebuilding.

If strong execution in bank tech has your attention, this is also a good moment to scan other financial innovators through fast growing stocks with high insider ownership.

Yet with the stock hovering near analyst targets after a sharp 30 day rally, but still trading below some intrinsic value estimates, are investors staring at an underappreciated compounder or a bank tech leader with future growth already priced in?

Most Popular Narrative Narrative: 2.8% Undervalued

With Jack Henry & Associates closing at $176.13 against a narrative fair value of $181.23, the story points to gentle upside, not euphoria.

The analysts have a consensus price target of $185.091 for Jack Henry & Associates based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $206.0, and the most bearish reporting a price target of just $173.0.

Want to see how steady mid single digit growth, margin creep, and a richer future earnings multiple add up to this fair value call? The key assumptions and tensions sit just below the headline numbers, and they are not what you might expect for a mature financial tech provider. Curious which forecasts carry the most weight in this narrative and how they stack up over the next few years? Read on and unpack the full valuation playbook behind these projections.

Result: Fair Value of $181.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating bank consolidation and intensifying fintech competition could limit core contract growth, pressure pricing, and undermine the modest valuation case.

Find out about the key risks to this Jack Henry & Associates narrative.

Another Lens on Valuation

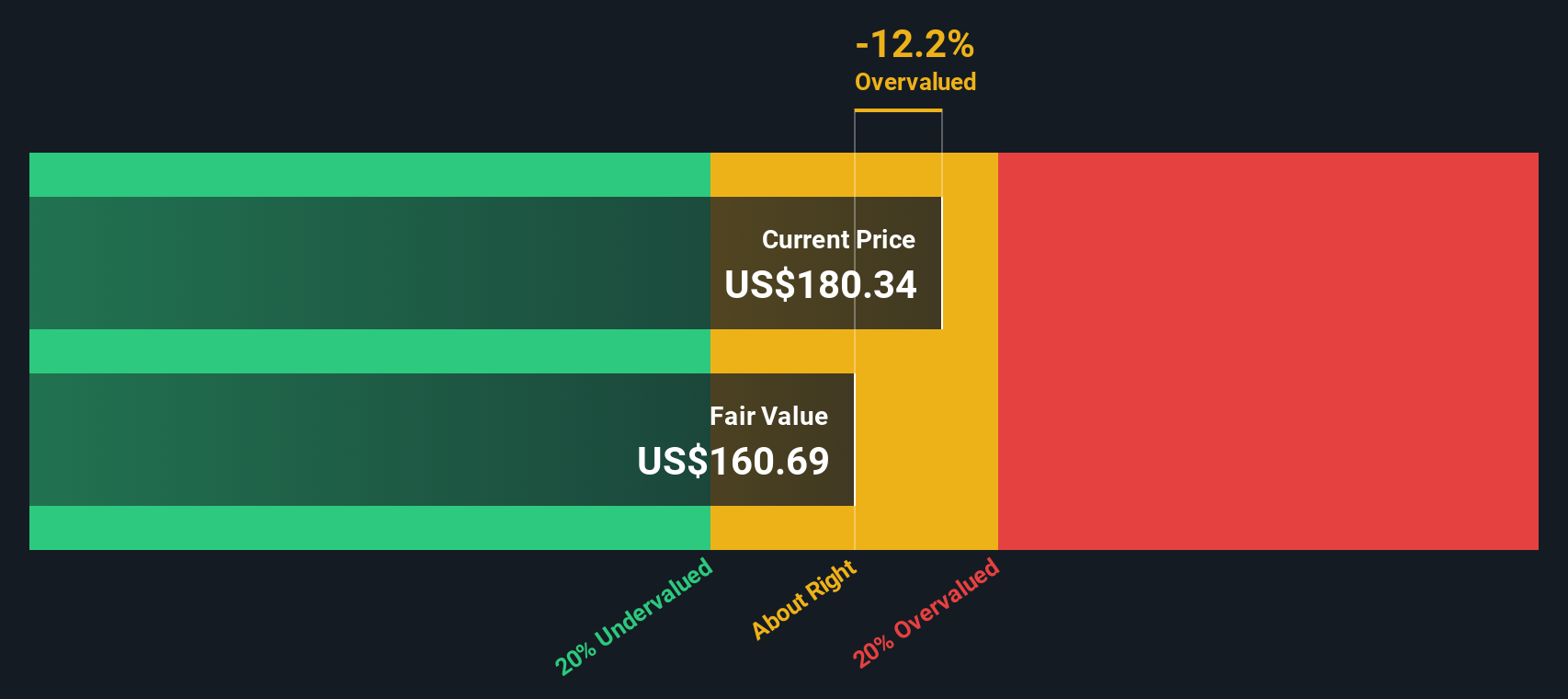

Our DCF model shows a sharper downside than the narrative fair value, with Jack Henry & Associates trading about 9 percent above an estimated fair value of $160.87. If cash flows are already priced for perfection, how much room is left for mistakes or surprises?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Jack Henry & Associates for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 918 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Jack Henry & Associates Narrative

If you see the data differently or prefer to dig into the numbers yourself, you can build a custom narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Jack Henry & Associates.

Looking for more investment ideas?

Turn this research into action by uncovering fresh opportunities on Simply Wall Street, or you risk missing the next wave of market shifting winners.

- Capture potential long-term compounding in companies priced below their fundamentals with these 918 undervalued stocks based on cash flows, which may offer attractive upside if the market re-rates them.

- Focus on breakthrough innovations that are reshaping industries by targeting next generation innovators through these 25 AI penny stocks, which is focused on artificial intelligence driven growth stories.

- Strengthen your income stream by pinpointing dependable payers via these 14 dividend stocks with yields > 3%, which aims to balance yield with solid underlying businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JKHY

Jack Henry & Associates

Operates as a financial technology company that connects people and financial institutions through technology solutions and payment processing services.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026