- United States

- /

- Diversified Financial

- /

- NasdaqCM:IMXI

We Ran A Stock Scan For Earnings Growth And International Money Express (NASDAQ:IMXI) Passed With Ease

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like International Money Express (NASDAQ:IMXI), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide International Money Express with the means to add long-term value to shareholders.

Check out our latest analysis for International Money Express

How Quickly Is International Money Express Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Shareholders will be happy to know that International Money Express' EPS has grown 18% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming. It's also worth noting that the EPS growth has been assisted by share buybacks, indicating the company is in a position to return capital to shareholders.

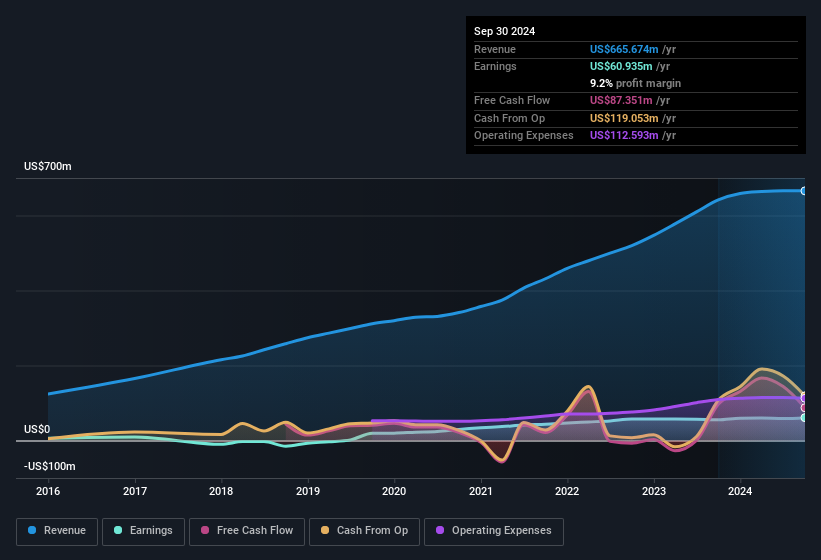

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of International Money Express' revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. EBIT margins for International Money Express remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 3.8% to US$666m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for International Money Express' future EPS 100% free.

Are International Money Express Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. International Money Express followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. Indeed, they hold US$38m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. As a percentage, this totals to 5.6% of the shares on issue for the business, an appreciable amount considering the market cap.

Should You Add International Money Express To Your Watchlist?

You can't deny that International Money Express has grown its earnings per share at a very impressive rate. That's attractive. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. Now, you could try to make up your mind on International Money Express by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

Although International Money Express certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:IMXI

International Money Express

Operates as an omnichannel money remittance services company in the United States, Latin America, Mexico, Central and South America, the Caribbean, Africa, and Asia.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives