- United States

- /

- Capital Markets

- /

- NasdaqGS:IBKR

What Interactive Brokers Group (IBKR)'s Strong Q3 Earnings and AI Innovations Mean for Shareholders

Reviewed by Sasha Jovanovic

- Interactive Brokers Group recently released its third-quarter 2025 results, reporting net income of US$263 million and the launch of new AI-powered portfolio analytics and trading platform enhancements.

- The company also declared a quarterly cash dividend of US$0.08 per share and indicated surpassing four million customers and US$750 billion in client equity, marking substantial customer and asset growth.

- We'll examine how Interactive Brokers' strong earnings growth and technology rollouts influence its investment narrative and future business prospects.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Interactive Brokers Group Investment Narrative Recap

To be a shareholder in Interactive Brokers Group, investors need to believe in sustained global demand for diversified investing, new product rollouts, and the company’s ability to keep attracting clients in a competitive industry. The recent robust earnings and technology releases reinforce account growth as the short-term catalyst, while competitive pressures in international markets remain the largest risk to future revenue. This latest news supports the business narrative, but does not materially alter these central risks or drivers for now. The release of the AI-powered Ask IBKR tool stands out for its immediate relevance, as it aims to enhance client experience by providing intuitive, natural language access to portfolio data. This type of product innovation may support stronger client engagement, a key factor underpinning both account growth and trading volumes, which are central to Interactive Brokers’ performance outlook. In contrast, investors should be aware of how quickly intensifying competition in international markets could ...

Read the full narrative on Interactive Brokers Group (it's free!)

Interactive Brokers Group's outlook anticipates $5.9 billion in revenue and $740.3 million in earnings by 2028. This projection assumes a 5.9% annual revenue growth rate and reflects a $42.3 million increase in earnings from the current $698.0 million.

Uncover how Interactive Brokers Group's forecasts yield a $75.90 fair value, a 10% upside to its current price.

Exploring Other Perspectives

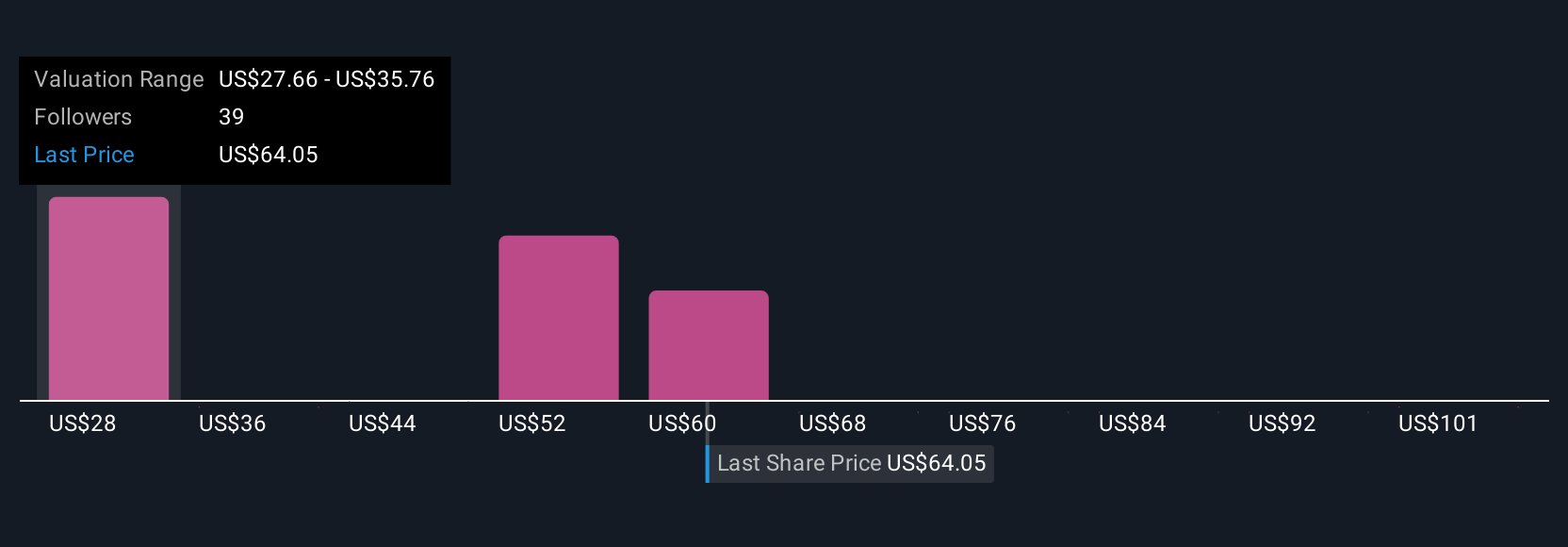

Ten fair value estimates from the Simply Wall St Community span US$27.29 to US$76.50, showing a broad mix of expectations. While new account momentum remains a key driver, this range highlights how your views on future client growth could shape your overall outlook.

Explore 10 other fair value estimates on Interactive Brokers Group - why the stock might be worth less than half the current price!

Build Your Own Interactive Brokers Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Interactive Brokers Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Interactive Brokers Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Interactive Brokers Group's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IBKR

Interactive Brokers Group

Operates as an automated electronic broker in the United States and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives