- United States

- /

- Capital Markets

- /

- NasdaqGS:IBKR

Does Commission-Free Trading in Singapore Signal a New Growth Era for Interactive Brokers (IBKR)?

Reviewed by Sasha Jovanovic

- Interactive Brokers Group recently expanded its global offerings, launching the Karta Visa card and commission-free U.S. stock trading in Singapore as part of its ongoing international growth initiatives.

- This move highlights the company's focus on leveraging its proprietary technology and innovative products to continue boosting client acquisition and enhance its competitive position worldwide.

- We’ll explore how the rollout of commission-free trading in Singapore impacts Interactive Brokers' investment narrative and long-term international growth potential.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Interactive Brokers Group Investment Narrative Recap

To be a shareholder in Interactive Brokers Group, you have to believe in the global expansion thesis by betting on its technology-led platform for long-term account growth, while closely watching how new international product launches affect the company's ability to sustain client acquisition. The recent rollout of commission-free U.S. stock trading in Singapore aligns well with this narrative, but the immediate impact on trading volumes, the most important short-term catalyst, appears limited given broader global market factors at play, especially competition and volatility trends, remain the biggest risks.

Among the company's recent announcements, the August launch of IBKR Lite in Singapore, offering commission-free trading for U.S. stocks and ETFs, directly relates to the latest expansion news. This move supports Interactive Brokers' push for broader global client engagement, but also accentuates the need to monitor the pressures from intensifying competition in international markets, particularly as other brokers target the same investor base with similar offerings.

However, investors should also be aware that despite solid international growth moves, the online brokerage space remains highly competitive and...

Read the full narrative on Interactive Brokers Group (it's free!)

Interactive Brokers Group's outlook projects $5.9 billion in revenue and $740.3 million in earnings by 2028. This scenario assumes a 5.9% annual growth rate in revenue and a $42.3 million increase in earnings from the current $698.0 million.

Uncover how Interactive Brokers Group's forecasts yield a $76.82 fair value, a 18% upside to its current price.

Exploring Other Perspectives

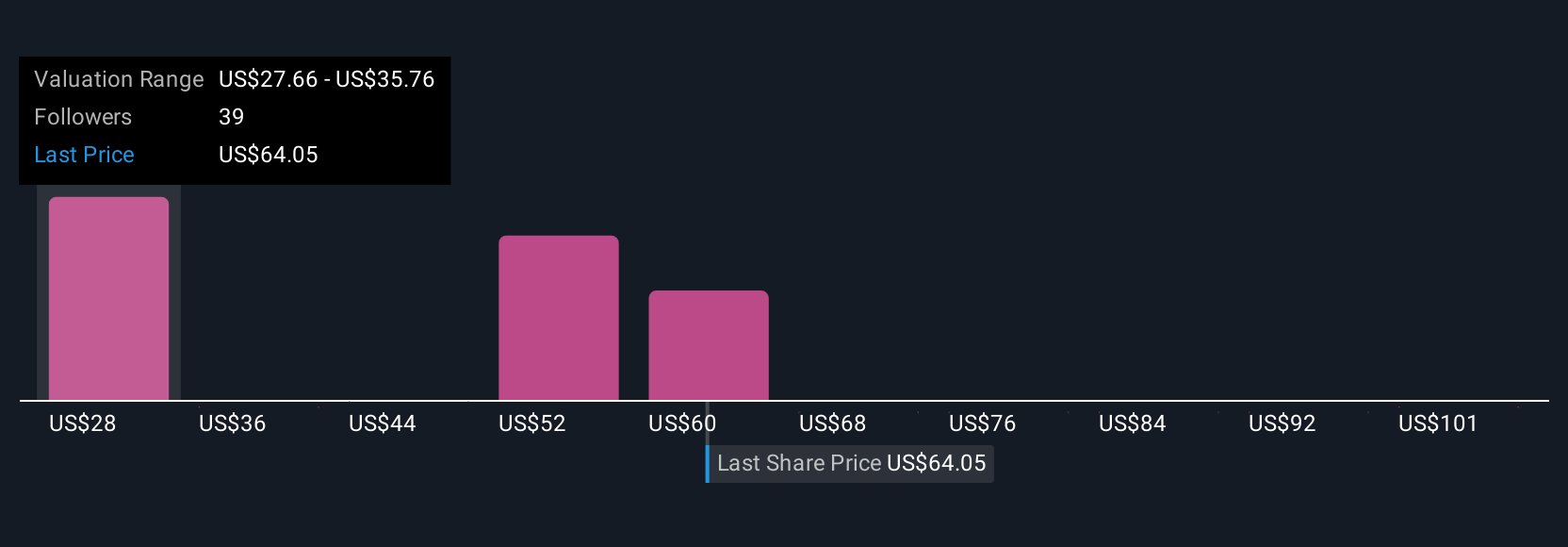

Retail investors in the Simply Wall St Community offer 11 fair value estimates for IBKR ranging from US$34.25 to US$77.11 per share, reflecting substantial variance in outlook. In light of expanding global competition, you may want to explore how others are assessing Interactive Brokers’ ability to maintain its market share and revenue growth.

Explore 11 other fair value estimates on Interactive Brokers Group - why the stock might be worth as much as 19% more than the current price!

Build Your Own Interactive Brokers Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Interactive Brokers Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Interactive Brokers Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Interactive Brokers Group's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IBKR

Interactive Brokers Group

Operates as an automated electronic broker in the United States and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026