- United States

- /

- Capital Markets

- /

- NasdaqGS:IBKR

Can Interactive Brokers’ 40% Rally in 2025 Still Be Justified?

Reviewed by Bailey Pemberton

- Ever wondered if Interactive Brokers Group is a hidden gem or if the market already has it figured out? You are not alone, and today we are diving into what lies beneath the surface of its current share price.

- The stock is up a hefty 40.7% so far this year, and has soared 381.2% over the past five years, even though there has been a -7.6% slip in the last month.

- Recent headlines have spotlighted Interactive Brokers Group’s growing influence as more investors flock to online trading platforms. The firm’s expansion into new global markets is drawing attention. Positive sentiment from analysts and increased trading volumes seem to be fueling optimism despite short-term volatility.

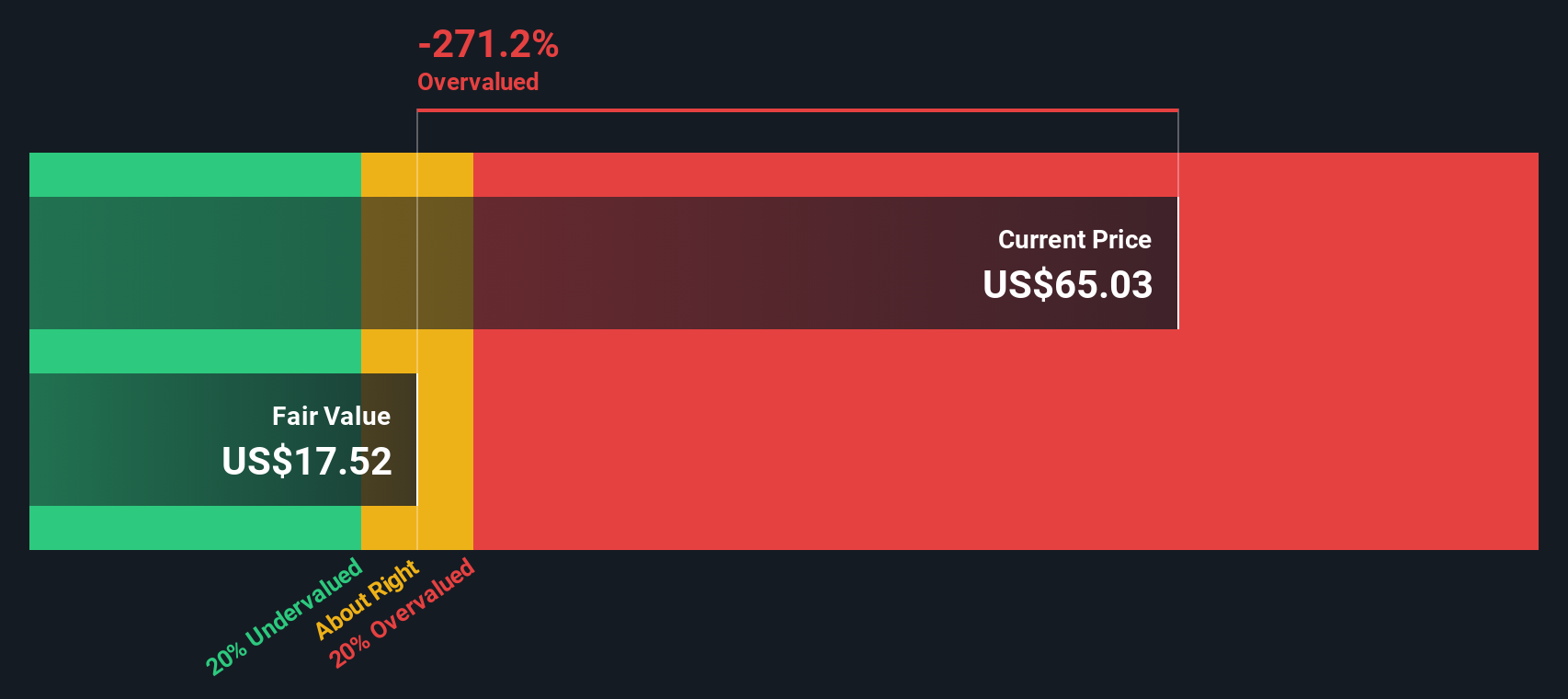

- On our valuation checks, Interactive Brokers Group scores a 1 out of 6, meaning it passes just one measure of undervaluation. Let us unpack the main ways investors assess valuation and by the end, we will show you an approach that could give you an even clearer signal.

Interactive Brokers Group scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Interactive Brokers Group Excess Returns Analysis

The Excess Returns valuation model focuses on how efficiently a company puts its equity capital to work, and how much return it generates above its cost of equity. This method helps assess whether the business is consistently creating value for shareholders by earning returns that exceed the minimum required by investors.

For Interactive Brokers Group, the numbers are as follows:

- Book Value: $11.47 per share

- Stable EPS: $2.33 per share

(Source: Weighted future Return on Equity estimates from 4 analysts.) - Cost of Equity: $1.20 per share

- Excess Return: $1.13 per share

- Average Return on Equity: 16.98%

- Stable Book Value: $13.72 per share

(Source: Weighted future Book Value estimates from 2 analysts.)

The Excess Returns model calculates an intrinsic value for Interactive Brokers Group of $34.38 per share. This estimate suggests the stock is currently 86.7% overvalued compared to its trading price. In other words, the market price is much higher than what this model projects based on the company’s fundamentals.

Result: OVERVALUED

Our Excess Returns analysis suggests Interactive Brokers Group may be overvalued by 86.7%. Discover 926 undervalued stocks or create your own screener to find better value opportunities.

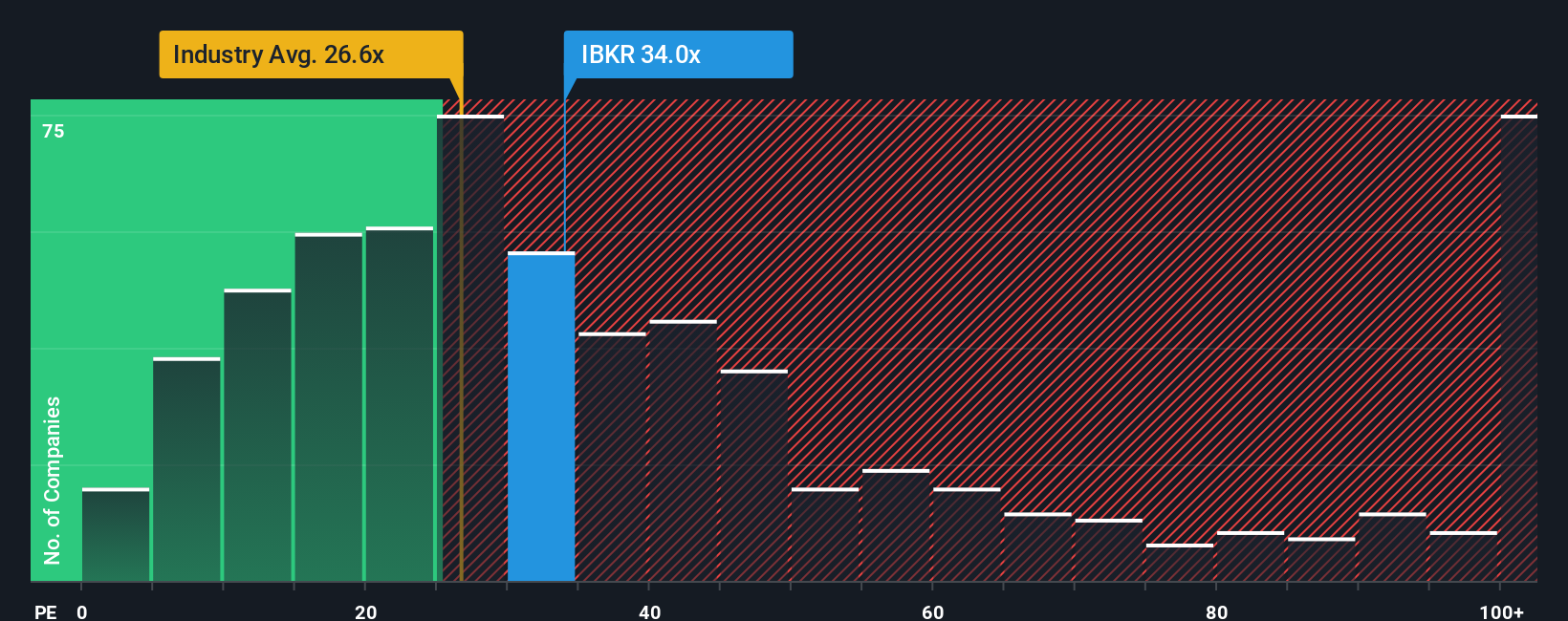

Approach 2: Interactive Brokers Group Price vs Earnings

For profitable companies like Interactive Brokers Group, the price-to-earnings (PE) ratio is a widely used and meaningful valuation tool. It quickly shows how much investors are willing to pay for each dollar of the company's earnings. Generally, companies with greater growth prospects or lower risk tend to justify higher PE ratios, while slower-growing or riskier firms command lower multiples.

Currently, Interactive Brokers Group trades at a PE ratio of 31.2x. This is higher than both the average PE for the Capital Markets industry, which sits at 23.5x, and its peer group average of 26.7x. On the surface, this might suggest an expensive stock, but headline multiples do not tell the full story.

To add more context, Simply Wall St calculates a “Fair Ratio” for each company. For Interactive Brokers Group, the Fair Ratio is 21.1x. Unlike basic peer or industry comparisons, this metric factors in the company’s unique earnings growth, profit margins, industry conditions, market capitalization, and risks. In this way, the Fair Ratio offers a more personalized and informative benchmark for valuation.

Since Interactive Brokers Group’s actual PE of 31.2x is significantly higher than its Fair Ratio of 21.1x, the stock appears overvalued on this basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1434 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Interactive Brokers Group Narrative

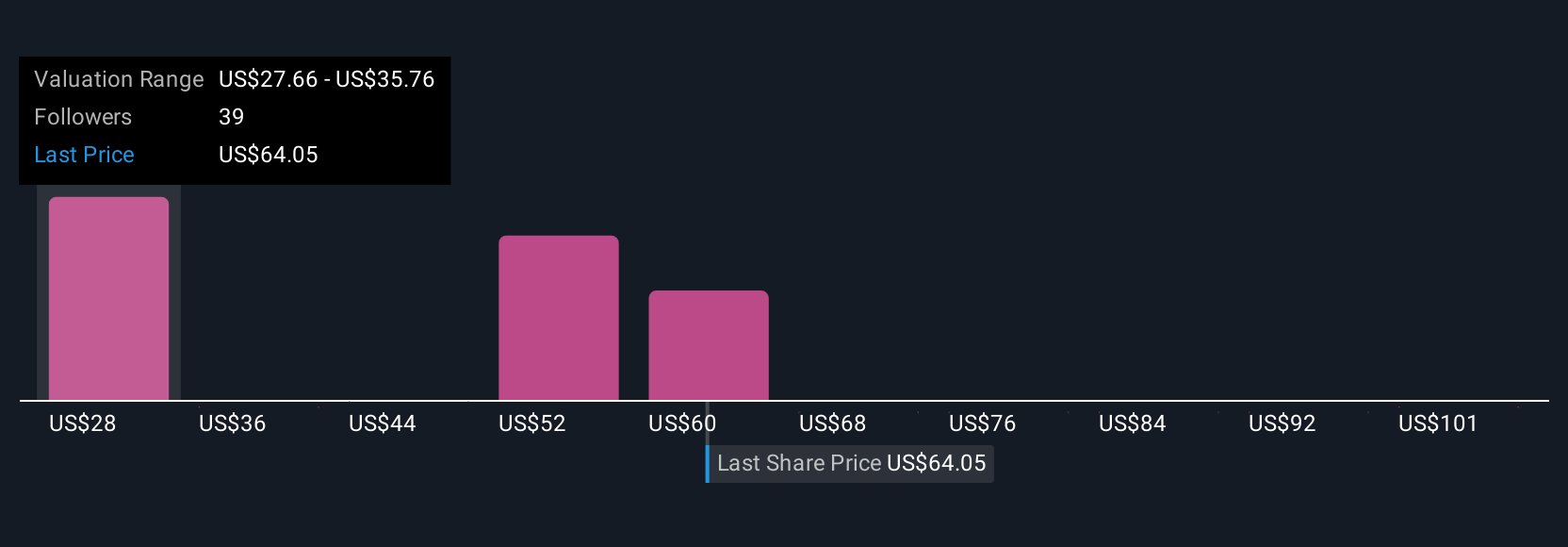

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, intuitive tool that lets you connect the story you believe about a company, including its future prospects, risks, momentum, or challenges, to your own financial estimates such as future revenue, earnings, and profit margins. This ultimately results in your personal fair value for the stock.

By linking a company’s unique story with a financial forecast and then to a fair value, Narratives go far beyond static ratios or analyst targets. Narratives make investing more personal and a lot more dynamic because they update automatically when new news or results come in, helping you stay on top of major changes.

On Simply Wall St, millions of investors are using Narratives via the Community page to share, test, and refine their views on companies. Narratives make it easy to compare fair value against the current share price so you can decide whether now may be the right time to buy, sell, or hold based on your expectations and assumptions.

For example, with Interactive Brokers Group, one investor might forecast rapid global growth with high profit margins and arrive at a fair value of $288.0. Another might see more risks and lower earnings, leading to a fair value of $140.0. This approach helps both investors make decisions grounded in their own beliefs about the company's future.

Do you think there's more to the story for Interactive Brokers Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IBKR

Interactive Brokers Group

Operates as an automated electronic broker in the United States and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success