- United States

- /

- Capital Markets

- /

- NasdaqGS:HOOD

Why Robinhood (HOOD) Is Up 22.1% After S&P 500 Debut and Global Expansion Moves

Reviewed by Sasha Jovanovic

- In September 2025, Robinhood Markets was added to the S&P 500 and surpassed 4 billion event contracts traded in its prediction markets, while launching new banking services and expanding tokenized asset offerings in Europe.

- The company's active discussions for regulatory-compliant international expansion and leadership in tokenization signal an accelerated shift toward becoming a global, full-service financial hub.

- We’ll examine how Robinhood’s surge in prediction market activity may influence its broader investment narrative and future growth outlook.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Robinhood Markets Investment Narrative Recap

To be a Robinhood Markets shareholder today, you need to believe the company can extend its momentum as a tech-forward global financial hub, powered by user growth, product innovation, and expansion into regulated markets like prediction trading and tokenized assets. The recent surge in prediction market contracts has reinforced Robinhood’s growth story, but the most important near-term catalyst remains continued user engagement and volume growth; however, the biggest immediate risk is the stock's heady valuation and sensitivity to any slowdown in growth. While the news event adds excitement to Robinhood’s narrative, its impact on catalysts and risks appears modest for now.

Among recent developments, Robinhood’s inclusion in the S&P 500 is most relevant, as it validates the platform’s expanding institutional acceptance and could further support liquidity and investor confidence. For existing and potential shareholders, this milestone amplifies attention on Robinhood’s ability to sustain high engagement and revenue per user, critical factors if valuation multiples are to remain at current levels.

Still, investors should consider that despite strong momentum, Robinhood’s elevated share price brings heightened risk if future trading volumes or user growth trends disappoint...

Read the full narrative on Robinhood Markets (it's free!)

Robinhood Markets' outlook anticipates $5.3 billion in revenue and $1.8 billion in earnings by 2028. This implies 14.0% annual revenue growth, with earnings remaining flat compared to the current level of $1.8 billion.

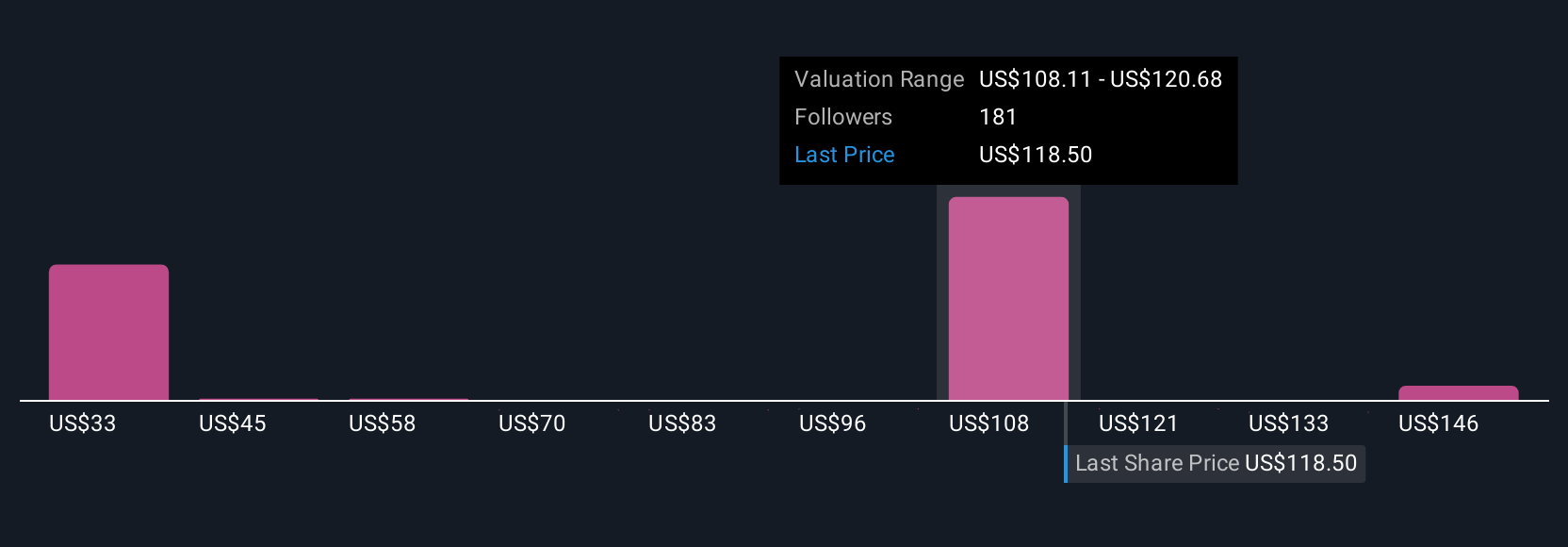

Uncover how Robinhood Markets' forecasts yield a $118.80 fair value, a 20% downside to its current price.

Exploring Other Perspectives

Forty-one Simply Wall St Community investors estimate Robinhood’s fair value from US$38.99 up to US$158.37 per share. With the current price well above most targets, any moderation in user or transaction growth could have outsize effects on sentiment and future returns, explore these perspectives for a full picture.

Explore 41 other fair value estimates on Robinhood Markets - why the stock might be worth less than half the current price!

Build Your Own Robinhood Markets Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Robinhood Markets research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Robinhood Markets research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Robinhood Markets' overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOOD

Robinhood Markets

Operates financial services platform in the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives