- United States

- /

- Capital Markets

- /

- NasdaqGS:HOOD

Is Robinhood a Smart Bet After Shares Soared 537% and Following Earnings Beat?

Reviewed by Bailey Pemberton

If you’re following Robinhood Markets, you already know the ride has been nothing short of remarkable lately. Maybe you’re wondering if now’s the moment to jump in, or if it’s time to take some profits off the table. Either way, deciding what to do next requires more than just a glance at the share price, and what a share price it’s been. Since the start of the year, Robinhood’s stock has soared 277.0%, including a stunning 537.5% gain over the past 12 months, and an eye-popping 1,313.2% return in the last three years. Even in just the past month, shares have climbed an impressive 46.8%, showing a pace that’s hard to ignore.

Much of this momentum appears tied to broader market enthusiasm, with investors piling into companies that sit at the crossroads of technology and finance. As retail investor engagement remains robust, Robinhood continues to capture attention and speculative interest as a gateway to the markets. With so much action around the stock, you might expect Robinhood to look undervalued by some traditional yardsticks. But according to our valuation score, based on six key checks, Robinhood is actually undervalued in 0 out of 6 criteria, placing its value score at 0.

Of course, valuation isn’t always black and white. In the next section, we’ll break down the specific methods analysts use to gauge whether Robinhood’s current market price makes sense. And just when you think you’ve seen every angle, stick around for an even smarter way to put valuations in context at the end of the article.

Robinhood Markets scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Robinhood Markets Excess Returns Analysis

The Excess Returns model is designed to evaluate whether a company is truly creating value for its shareholders by earning more on its invested capital than the cost of that capital. In Robinhood’s case, this model centers on its return on equity, projected growth in earnings, and how much more the company may generate above the minimum required by investors.

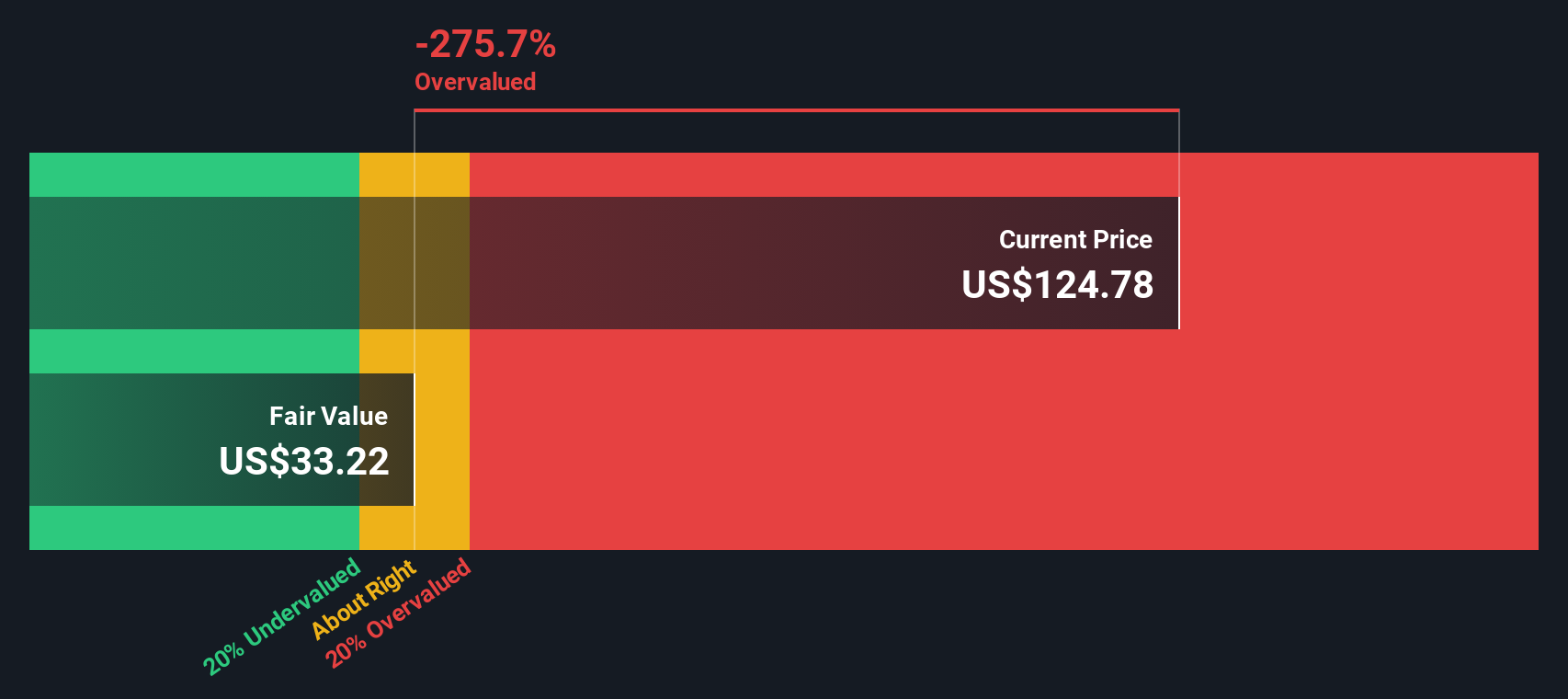

Based on the latest analysis, Robinhood has a Book Value of $9.09 per share and a Stable EPS of $2.50, as estimated from seven analysts’ return on equity projections. The Cost of Equity is $1.04 per share, with an Excess Return of $1.46 per share. Notably, Robinhood’s Average Return on Equity stands at a robust 20.02%, with a Stable Book Value projected at $12.47, supported by four analysts’ forecasts.

However, the intrinsic discount calculated using this approach is -270.7%. This means the stock is currently trading far above the model’s fair value estimate. This suggests that even though Robinhood’s growth and profitability look appealing on paper, the current share price expects far more than what excess returns alone can justify.

Result: OVERVALUED

Our Excess Returns analysis suggests Robinhood Markets may be overvalued by 270.7%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Robinhood Markets Price vs Earnings

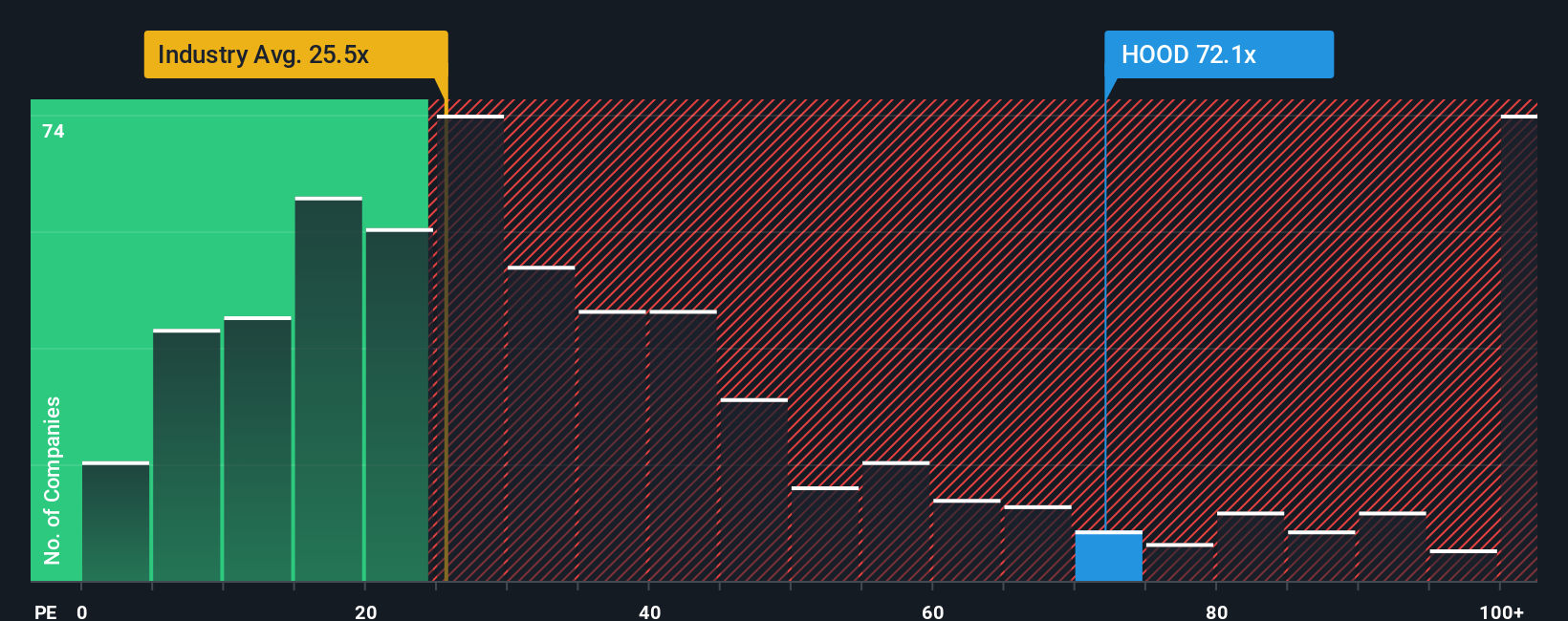

For profitable companies like Robinhood Markets, the price-to-earnings (PE) ratio is a widely used and sensible valuation metric because it links a company’s stock price directly to its current profitability. The PE ratio helps investors determine how much they are paying for each dollar of earnings, making it a quick way to assess if a stock is expensive or cheap relative to its actual bottom line.

What counts as a “fair” PE ratio, though, isn’t set in stone. It can swing higher for businesses with exceptional growth prospects or lower for more cyclical, slower-growing, or riskier firms. Currently, Robinhood trades at a PE ratio of 73.89x, which stands out next to the Capital Markets industry average of 27.07x and the peer average of 24.33x. This sizable gap suggests the market expects substantially stronger growth and profitability from Robinhood going forward.

Rather than relying solely on these broad comparisons, Simply Wall St’s “Fair Ratio” goes a step further. This proprietary measure calculates what a sensible PE multiple should be for Robinhood by weighing not just earnings growth and risk, but profit margins, industry dynamics, and the company’s market cap. In this case, Robinhood’s Fair Ratio is assessed at 23.48x, which is much lower than its current PE ratio. Since the actual PE is well above both the Fair Ratio and peer benchmarks, the numbers point to the stock being significantly overvalued using this method.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Robinhood Markets Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is more than just numbers; it’s your perspective on a company’s future, bundled into a story that explains why you believe a stock might be worth more or less than what traditional analyses suggest.

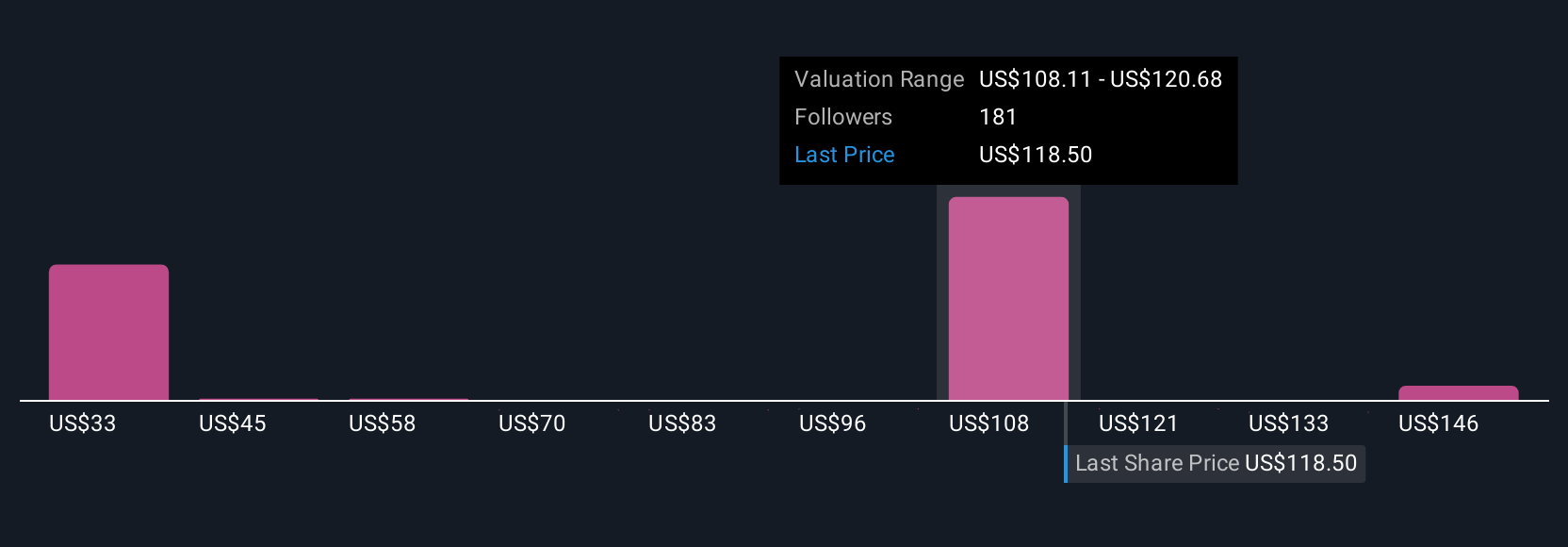

Narratives make it easy to link the story behind a stock, such as Robinhood’s leadership in financial technology or the risks from rising competition, directly to your own forecast for its future revenue, earnings, and margins. This produces a personalized fair value. On Simply Wall St’s Community page, a platform used by millions, anyone can create, share, and compare Narratives, making advanced investing accessible to all.

By comparing the Fair Value from your Narrative with Robinhood’s actual share price, you can decide if now is a buying or selling opportunity. Because Narratives are updated automatically when new information, like news or earnings, emerges, they help you quickly adapt your view as events unfold.

For example, some investors believe Robinhood could be worth $160 if growth outpaces expectations, while others see more risk and set their fair value as low as $50. This highlights how Narratives can capture every unique perspective on the market’s future.

Do you think there's more to the story for Robinhood Markets? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOOD

Robinhood Markets

Operates financial services platform in the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives