- United States

- /

- Capital Markets

- /

- NasdaqGM:FUTU

Is Futu Holdings’ (FUTU) Strong Q3 Earnings Performance Altering Its Investment Case?

Reviewed by Sasha Jovanovic

- Futu Holdings Limited recently reported earnings for the third quarter and nine months ended September 30, 2025, with revenue reaching HK$6.40 billion and net income at HK$3.23 billion for the quarter, both considerably higher than the prior year period.

- This surge in both revenue and profit, coupled with substantial increases in earnings per share, highlights the company’s strong business momentum over the past year.

- We'll explore how this outstanding earnings growth may shape Futu Holdings' investment narrative going forward.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Futu Holdings Investment Narrative Recap

For investors considering Futu Holdings, the core belief centers on the company’s ability to capitalize on global digital brokerage expansion and deliver sustainable client growth beyond its home base. The latest quarterly earnings, which saw revenue and profitability both roughly double year-over-year, reinforce the near-term catalyst of strong international account growth, while the most immediate risk remains the threat of new regulatory hurdles impacting expansion, especially with evolving requirements across core markets. The impact of these earnings results amplifies current growth trends but does not materially alter this risk profile.

Among Futu’s recent updates, the launch of ETF-based robo-advisory services in partnership with BlackRock stands out as most relevant, reflecting the company’s commitment to diversifying its product suite and deepening user engagement. This new service could bolster the platform’s appeal and help offset potential revenue headwinds in brokerage commissions, an important consideration given the sector’s ongoing pressure on fee structures.

However, despite these positive developments, investors should keep in mind the potential impact of heightened regulatory scrutiny in key jurisdictions...

Read the full narrative on Futu Holdings (it's free!)

Futu Holdings' outlook anticipates HK$26.3 billion in revenue and HK$12.9 billion in earnings by 2028. This scenario assumes annual revenue growth of 17.8% and an increase in earnings of HK$5.0 billion from the current HK$7.9 billion.

Uncover how Futu Holdings' forecasts yield a $225.69 fair value, a 32% upside to its current price.

Exploring Other Perspectives

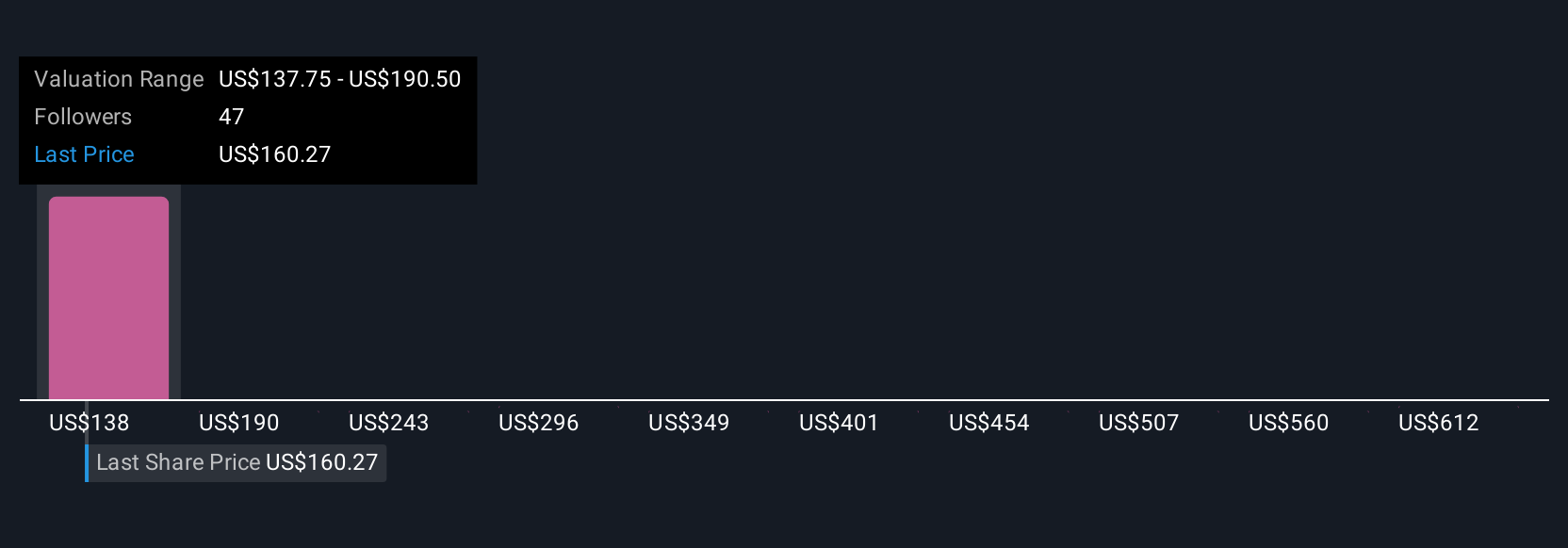

Ten private investors in the Simply Wall St Community estimate fair value for Futu Holdings across a wide span, from HK$142 to HK$388 per share. While many are drawn to Futu’s global expansion and rising client base, ongoing regulatory uncertainty casts a shadow that could influence the company’s trajectory, consider exploring these alternate viewpoints before making any decisions.

Explore 10 other fair value estimates on Futu Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Futu Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Futu Holdings research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Futu Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Futu Holdings' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FUTU

Futu Holdings

Provides digitalized securities brokerage and wealth management product distribution service in Hong Kong and internationally.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026