- United States

- /

- Capital Markets

- /

- NasdaqCM:FRHC

Freedom Bank Georgia Launch Could Be a Game Changer for Freedom Holding (FRHC)

Reviewed by Sasha Jovanovic

- Freedom Holding Corp. recently launched Freedom Bank Georgia as a subsidiary of Freedom Bank Kazakhstan, advancing its expansion across Central Asia, the Caucasus, and Europe.

- This move coincided with The Motley Fool adding Freedom Holding to its TMF Moneyball Portfolio, drawing attention to the company's focus on financial technology and regional integration.

- We’ll explore how Freedom Holding’s continued push into digital banking influences its evolving investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Freedom Holding's Investment Narrative?

To be comfortable holding Freedom Holding Corp. stock today, you need conviction in the continued integration of financial technology across Central Asia, the Caucasus, and Europe, regions where the group is actively expanding its banking and brokerage operations. The company’s recent launch of Freedom Bank Georgia, coming just as the stock was added to the TMF Moneyball Portfolio, adds another leg to its ambition of building a cross-border financial ecosystem. In the short term, this move could strengthen Freedom’s growth narrative and address current concerns about slowing earnings and thin profit margins by signaling commitment to core financial services, rather than just adjacent sectors like telecommunications. However, the company’s high valuation multiples, coupled with a history of delayed SEC filings and tightening profit margins, continue to shape its key risks. This expansion into Georgia could shift attention slightly toward operational execution and integration challenges in new markets, while any material uplift in financial performance will take time to show up in the numbers. For now, recent share price moves suggest the news has not triggered a dramatic rerating, but the conversation around future catalysts and risks is evolving.

But with ongoing compliance concerns, investors should not overlook the impact of regulatory risks.

Exploring Other Perspectives

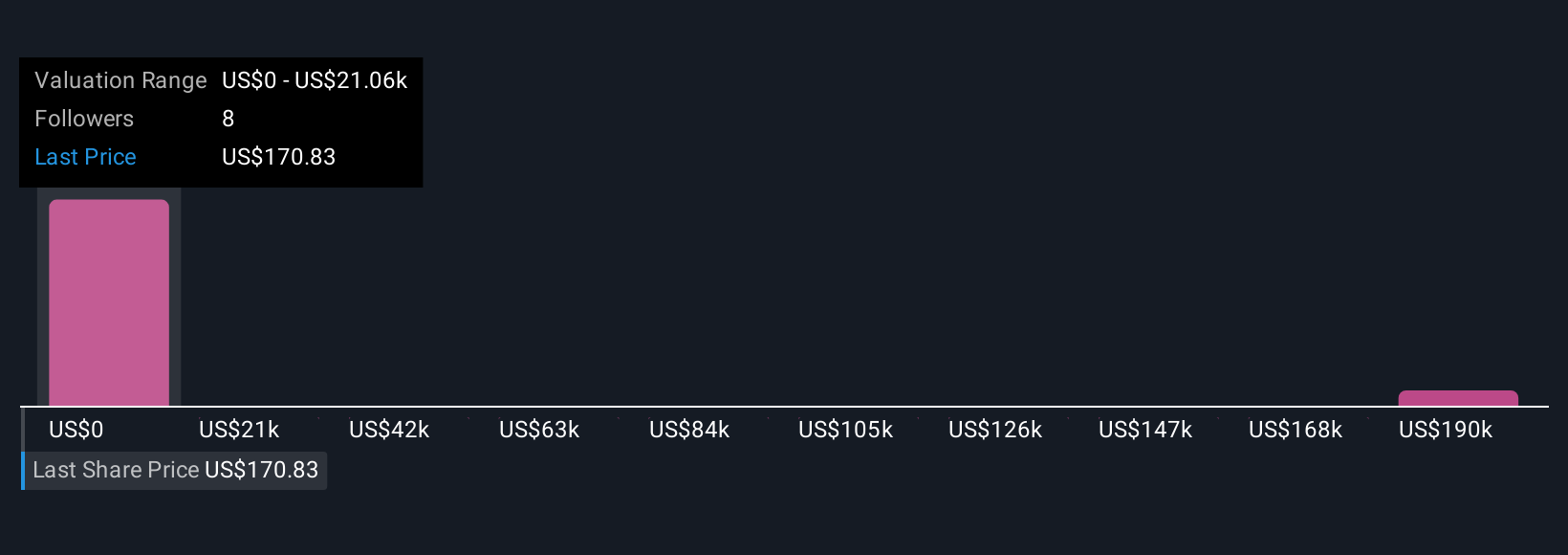

Explore 7 other fair value estimates on Freedom Holding - why the stock might be worth just $21059!

Build Your Own Freedom Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Freedom Holding research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free Freedom Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Freedom Holding's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:FRHC

Freedom Holding

Through its subsidiaries, provides securities brokerage, securities dealing, market making, investment research, investment counseling, retail and commercial banking, and insurance products.

Questionable track record with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives