- United States

- /

- Diversified Financial

- /

- OTCPK:FPAY

FlexShopper, Inc. (NASDAQ:FPAY) Might Not Be As Mispriced As It Looks After Plunging 31%

FlexShopper, Inc. (NASDAQ:FPAY) shareholders won't be pleased to see that the share price has had a very rough month, dropping 31% and undoing the prior period's positive performance. Looking at the bigger picture, even after this poor month the stock is up 26% in the last year.

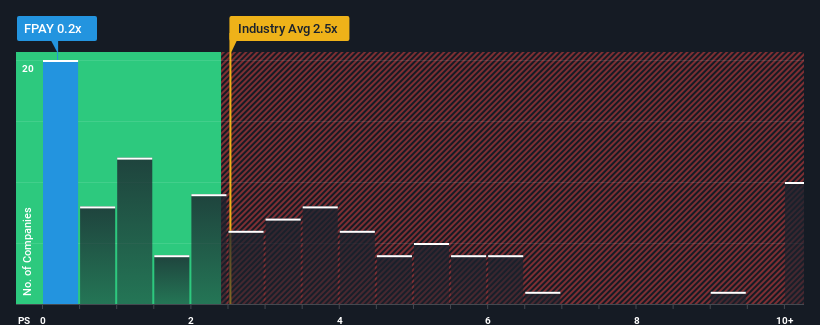

Since its price has dipped substantially, FlexShopper may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Diversified Financial industry in the United States have P/S ratios greater than 2.5x and even P/S higher than 5x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for FlexShopper

What Does FlexShopper's P/S Mean For Shareholders?

FlexShopper could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on FlexShopper will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For FlexShopper?

In order to justify its P/S ratio, FlexShopper would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a decent 3.5% gain to the company's revenues. The latest three year period has also seen a 15% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 26% as estimated by the two analysts watching the company. That's shaping up to be materially higher than the 1.4% growth forecast for the broader industry.

With this information, we find it odd that FlexShopper is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From FlexShopper's P/S?

Having almost fallen off a cliff, FlexShopper's share price has pulled its P/S way down as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To us, it seems FlexShopper currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Before you take the next step, you should know about the 1 warning sign for FlexShopper that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:FPAY

FlexShopper

A financial technology company, operates an e-commerce marketplace to shop electronics, home furnishings, and other durable goods on a lease-to-own (LTO) basis.

Low risk and slightly overvalued.

Market Insights

Community Narratives