- United States

- /

- Capital Markets

- /

- NasdaqGS:FOCS

Those who invested in Focus Financial Partners (NASDAQ:FOCS) three years ago are up 222%

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But in contrast you can make much more than 100% if the company does well. For instance the Focus Financial Partners Inc. (NASDAQ:FOCS) share price is 222% higher than it was three years ago. That sort of return is as solid as granite. Also pleasing for shareholders was the 30% gain in the last three months. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

So let's assess the underlying fundamentals over the last 3 years and see if they've moved in lock-step with shareholder returns.

View our latest analysis for Focus Financial Partners

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Focus Financial Partners became profitable within the last three years. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

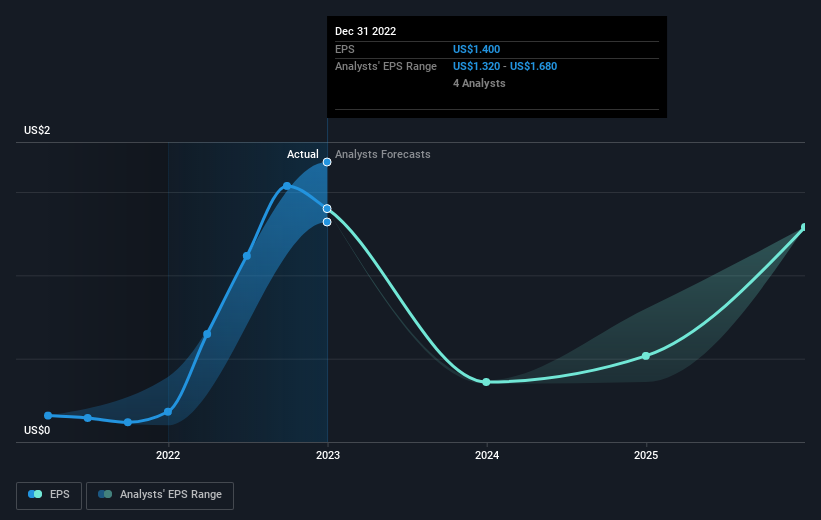

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Focus Financial Partners has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Focus Financial Partners' financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that Focus Financial Partners rewarded shareholders with a total shareholder return of 17% over the last year. But the three year TSR of 48% per year is even better. It's always interesting to track share price performance over the longer term. But to understand Focus Financial Partners better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Focus Financial Partners you should be aware of, and 2 of them are significant.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FOCS

Focus Financial Partners

Focus Financial Partners Inc. provides wealth management services to primarily ultra-high and high net worth individuals, families, and business entities.

High growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026