- United States

- /

- Diversified Financial

- /

- NasdaqGS:FLYW

Should Quasar Expeditions’ Partnership Signal a New Chapter for Flywire (FLYW) in Luxury Travel Payments?

Reviewed by Sasha Jovanovic

- Quasar Expeditions recently announced it has chosen Flywire Corporation as its exclusive payments partner to enhance payment processes for its global clientele, integrating Flywire into its booking system for streamlined transactions and reconciliation.

- This move strengthens Flywire's foothold in the fast-growing luxury ocean travel sector and showcases the company's ability to address complex, international payment needs with transparent pricing and robust platform integration.

- With Flywire's tailored payment solution addressing luxury travel complexities, we'll explore how this client win could influence its investment outlook.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Flywire Investment Narrative Recap

Flywire’s growth narrative centers on expanding its global reach and diversifying beyond its core education business into high-growth verticals like luxury travel. While the Quasar Expeditions partnership highlights Flywire’s traction in ocean-based experiences and could accelerate growth in travel, its effect on upcoming financial catalysts appears incremental rather than game-changing. The biggest near-term risk remains pressure on overall net margins due to an increasing revenue mix from lower-margin verticals such as travel, a trend that this news may reinforce.

One related announcement is Flywire’s recent inclusion in Virtuoso’s luxury travel portfolio, which likewise targets affluent clients and global trip providers. Both partnerships solidify Flywire’s standing in the upscale travel segment and support the catalyst of accelerated digital payments adoption and increased client onboarding within underpenetrated geographies and segments. These moves demonstrate continued progress toward revenue diversification and reinforce the theme of expanding total addressable market.

On the other hand, investors should not ignore how persistent margin pressure, especially from a faster-growing travel vertical, could weigh on bottom-line results if left unaddressed...

Read the full narrative on Flywire (it's free!)

Flywire's narrative projects $817.0 million revenue and $102.1 million earnings by 2028. This requires 14.8% yearly revenue growth and a $95.3 million earnings increase from $6.8 million currently.

Uncover how Flywire's forecasts yield a $14.55 fair value, a 7% upside to its current price.

Exploring Other Perspectives

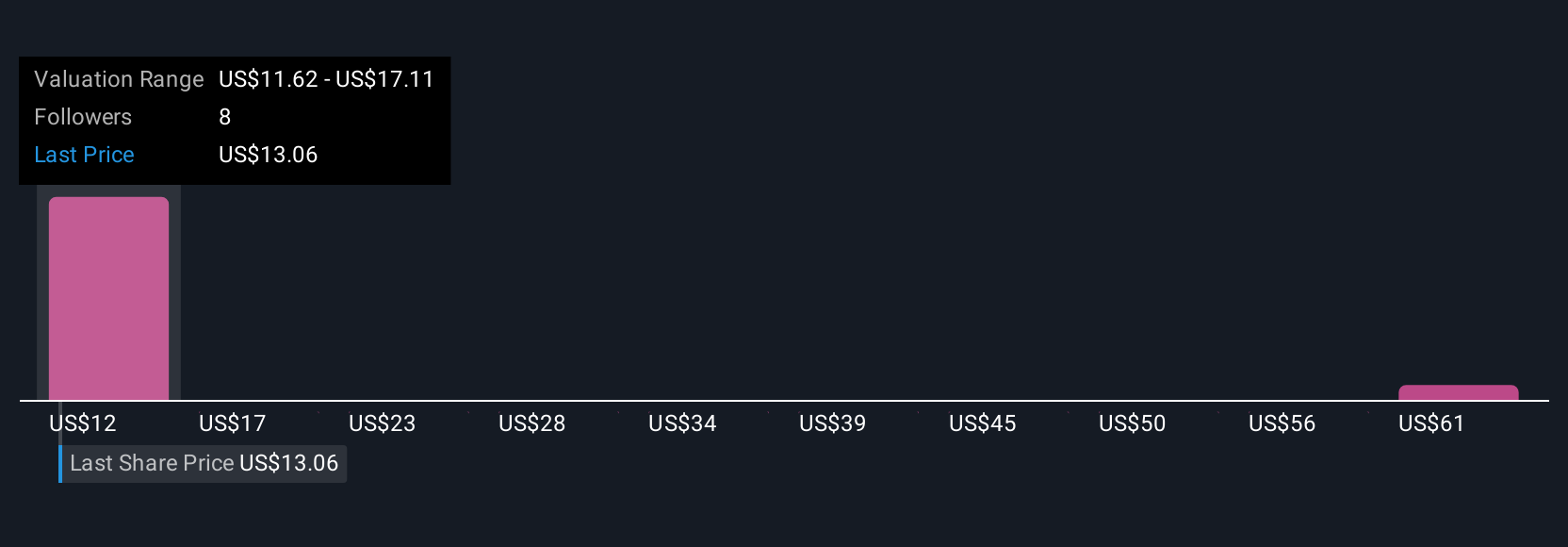

Three members of the Simply Wall St Community estimate Flywire’s fair value between US$11.62 and US$66.49, reflecting widely divergent outlooks. As revenue diversification gains pace, increasing reliance on lower-margin segments like travel may influence longer-term profitability, so compare several viewpoints to build your own picture.

Explore 3 other fair value estimates on Flywire - why the stock might be worth 14% less than the current price!

Build Your Own Flywire Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Flywire research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Flywire research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Flywire's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 32 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLYW

Flywire

Operates as a payments enablement and software company in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives