- United States

- /

- Diversified Financial

- /

- NasdaqGS:FLYW

Lawsuits Over Revenue Disclosures Might Change The Case For Investing In Flywire (FLYW)

Reviewed by Simply Wall St

- Earlier this year, multiple law firms filed class action lawsuits against Flywire Corporation following its disclosure of disappointing financial results, lowered revenue guidance, and restructuring plans that included a workforce reduction of about 10%.

- A unique aspect of these lawsuits is the accusation that Flywire understated the negative business impacts of international permit and visa restrictions, especially in key education markets such as Canada and Australia.

- We'll now examine how the legal scrutiny over Flywire's revenue disclosures could alter the company's previously positive investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Flywire Investment Narrative Recap

To be a Flywire shareholder, you need to believe in the company’s ability to grow cross-border payment volumes and expand beyond its core education markets, despite regulatory headwinds. The recent lawsuits and disappointing results have intensified focus on the risk that visa and permit restrictions in major geographies could hinder short-term revenue recovery, with the legal scrutiny making this the primary near-term catalyst and risk for the business.

Among recent announcements, Flywire’s full-year 2025 guidance, maintaining FX-neutral revenue growth expectations of 17%-23%, stands out for its relevance. This guidance remains under the microscope given emerging questions about the accuracy and transparency of prior revenue projections, particularly in markets now under legal and investor scrutiny.

In contrast, investors should be alert to the possibility that further regulatory shifts in international education markets could...

Read the full narrative on Flywire (it's free!)

Flywire's outlook anticipates $817.0 million in revenue and $102.1 million in earnings by 2028. Achieving this would require annual revenue growth of 14.8% and an increase in earnings of $95.3 million from the current $6.8 million.

Uncover how Flywire's forecasts yield a $14.55 fair value, a 10% upside to its current price.

Exploring Other Perspectives

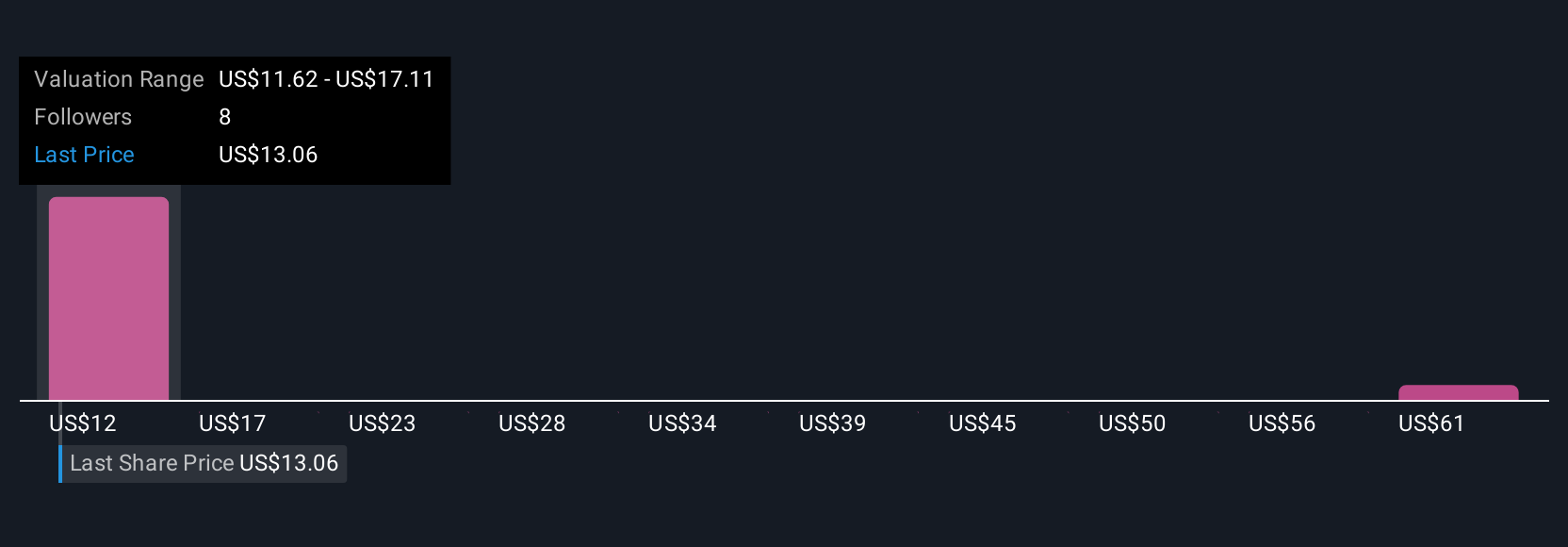

The Simply Wall St Community offered three distinct fair value estimates for Flywire, ranging from US$11.62 to US$66.49 per share. While investor opinions greatly differ, recent legal scrutiny over Flywire’s revenue disclosures highlights a key risk for anyone considering their own projections.

Explore 3 other fair value estimates on Flywire - why the stock might be worth 12% less than the current price!

Build Your Own Flywire Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Flywire research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Flywire research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Flywire's overall financial health at a glance.

No Opportunity In Flywire?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLYW

Flywire

Operates as a payments enablement and software company in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives