- United States

- /

- Diversified Financial

- /

- NasdaqGS:FLYW

Flywire (FLYW) Valuation in Focus After Legal Challenges and Disappointing Earnings Shake Investor Confidence

Reviewed by Kshitija Bhandaru

If you have been following Flywire (FLYW) lately, you know there has been a stir in the market that is hard to ignore. A wave of class action lawsuits has rolled in, with claims that Flywire misrepresented how sustainable its revenue growth really was and downplayed challenges like permit and visa restrictions. These legal actions, set against a backdrop of weaker-than-expected earnings and news of an operational shake-up, have triggered a selloff in the stock and put a spotlight on Flywire’s internal headwinds.

This run of news has weighed on Flywire’s share price over the past year. The stock is down 20% over that stretch, sharply underperforming the market. Short-term gains in the past month, up almost 3%, have been overshadowed by a year marked by volatility and sliding momentum, especially following the February financial update that nervous investors saw as a red flag. A string of recent events, from legal trouble to strategic pivots, shows a company in transition rather than one riding a wave of growth.

After a challenging year and all this fresh uncertainty, the question is straightforward: are investors looking at an undervalued opportunity with Flywire, or is the market pricing in more bumps ahead?

Most Popular Narrative: 9.7% Undervalued

According to the most widely referenced narrative, Flywire is currently valued below its fair value. Analysts see upside potential for the stock based on future earnings growth and expansion drivers.

Accelerated digital payments adoption, especially in core Millennial and Gen Z segments, combined with Flywire's success in onboarding nearly 200 new clients across multiple verticals (including rapid scaling in underpenetrated geographies and segments such as luxury travel and B2B), provides a sustained catalyst for total addressable market (TAM) expansion and revenue acceleration.

What is fueling this underappreciated valuation? This narrative relies on a multi-year growth forecast, ambitious profit targets, and a future earnings multiple that may appear optimistic. Interested in which aggressive assumptions analysts are using to justify that upside? Explore the core calculations and bold projections that support Flywire's fair value.

Result: Fair Value of $14.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, increasing regulatory scrutiny, particularly regarding education visas, and ongoing margin pressure could challenge Flywire's outlook and disrupt its growth trajectory.

Find out about the key risks to this Flywire narrative.Another View: Price Ratios Tell a Different Story

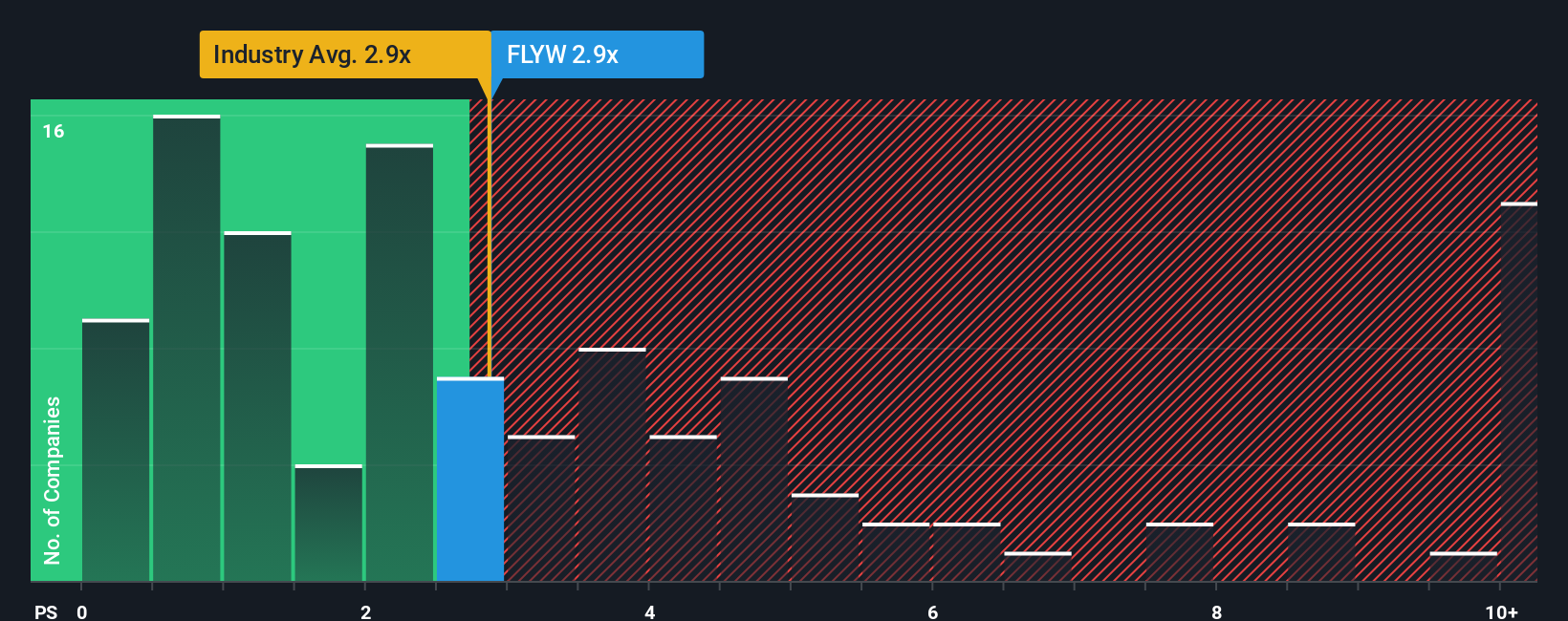

Looking at Flywire from a different angle, its current price ratios suggest the shares are not cheap compared to the industry average. This raises the question of whether optimism is getting ahead of fundamentals or if growth is being underestimated.

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Flywire to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Flywire Narrative

If these takes do not fit your outlook or you prefer digging into the numbers yourself, you can quickly build your own interpretation in just a few minutes. Do it your way

A great starting point for your Flywire research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Why stop at Flywire when there are powerful trends reshaping markets right now? Use these targeted ideas to spark your next winning move. Don’t let potential pass you by.

- Kickstart your search for breakout value by zeroing in on undervalued stocks based on cash flows that could be poised for an upside surprise.

- Take action on the artificial intelligence boom with AI penny stocks driving innovation in automation and data science across industries.

- Turbocharge your income strategy by focusing on dividend stocks with yields > 3% that reward you with robust yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLYW

Flywire

Operates as a payments enablement and software company in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives